FTSE rises after large losses last week

The FTSE is rebounding after steep losses last week. The UK index tumbled 4.1% last week, dropping to a three-and-a-half-month low as recession fears grew.

The FTSE came under pressure after the BoE raised interest rates by 25 basis points and indicated that there were more hikes to come as inflation is set to rise to 11% in the coming month.

In addition to surging inflation, economic growth has stalled, and the outlook is deteriorating further as the coat of living crisis ramps up.

Higher interest rates, supply issues, and falling real wages are reflected in weaker sentiment.

Today data revealed that house prices rose 0.3% to a record high. However, this was a significant slowdown in growth. Rising interest rates are cooling the housing market, bringing house builders lower.

Instead, leading the index higher are the heavyweight Banks after the BoE stops the mortgage market affordability test. Separately banks are also the sector that stands to benefit from rising interest rates lifting ne5t interest income.

Where next for FTSE?

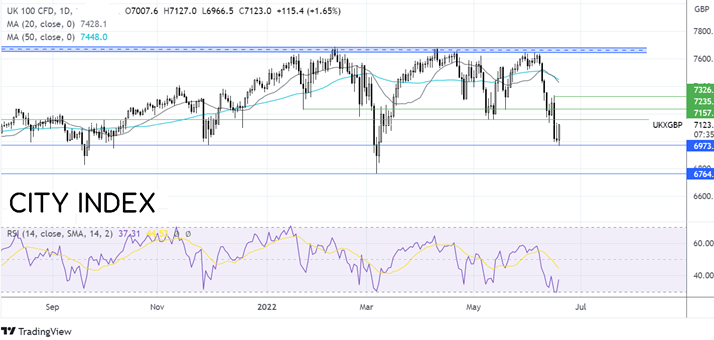

The FTSE ran into resistance at7650 at the start of the month and rebounded lower. The price fell below its 20 & 50 sma, tumbling to support at 6966, the November 30 low.

Today the index is rebounding and heads towards resistance at 7150, the May low. A move over here opens the door to 7225, the May 19 low. However, it would take a move over 7325, the June 16 high, to create a higher high.

However, the trend is still bearish, as highlighted by the RSI remaining in bearish territory and the 20 sma crossing below the 50 sma. Sellers need a move below 6966 in order to extend the bearish trend towards 6830, the September low, and 6762, the 2022 low.