…Will other indices follow?

Although US index futures extended their advance after Thursday’s massive rally on the back of that cooler-than-expected US inflation report, the UK’s FTSE has not shown the same type of optimism. That’s despite some positive news from China easing some of its COVID restrictions.

Growth worries hold back UK stocks

The FTSE’s struggles suggest UK investors are more worried about a deteriorating domestic, Eurozone and global economies, than are hopeful about the US and other central banks easing rate hikes.

The weakening US CPI data certainly points to the Fed stepping down on their aggressive hiking stance, but inflation still needs to come down a lot more before they even discuss pausing hikes. It is important not to pin all your hopes on just one inflation report. There are many other risks that could derail the rally.

In the UK, quarterly GDP fell by a less-than-forecast 0.2%, while construction output and industrial production both topped expectations, even if they hardly grew. But the monthly GDP disappointed with a bigger fall of 0.6% on month.

Eurozone heading into recession: EC

In Eurozone, CPI reached a new record high of 10.7% in October – higher than the UK’s own double-digit inflation. Soaring prices are choking the UK and Eurozone economies. The European Commission now thinks Eurozone inflation will average 8.5% this year and 6.1% in 2023, both sharply higher that the predictions made in July.

“Amid elevated uncertainty, high energy price pressures, erosion of households’ purchasing power, a weaker external environment and tighter financing conditions are expected to tip the EU, the euro area and most member states into recession,” the Commission said.

In the UK, the soft GDP data and soaring inflation means the BoE is expected to keep hiking interest rates, which should intensify the squeeze on the consumer. Lack of growth in the Eurozone and elsewhere are also not good news for UK’s multi-national corporations. With the dollar falling, the GBP/USD has recovered further, which is going to hurt foreign earnings when converted back to GBP.

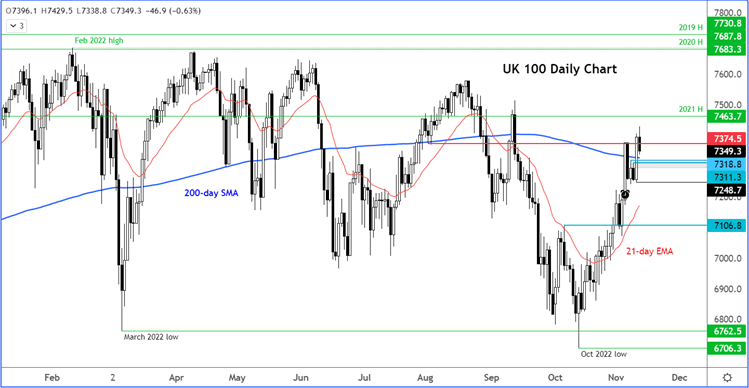

FTSE needs to go below 200 MA for bears to pounce

All that said, the FTSE is holding its own very well given all the macro risks mentioned. It will need to go back below the broken 200-day average and support around 7310-7320 before things start to look bearish again. A move below Thursday’s low at 7248 is the line in the sand now. If we break that level, then things will look bearish again and the technical outlook will then match a darkening economic outlook.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade