Last week’s ECB meeting resulted in a noticeable pick up in intraday volatility in the EURUSD. Despite this, the EURUSD has remained encapsulated between key daily support and resistance levels, implying traders have elected to avoid the short-term noise and await the outcome of tomorrow mornings FOMC meeting.

Which prompts the questions what is the market expecting from tomorrows FOMC meeting and is there a trade opportunity in the EURUSD post the FOMC?

Tomorrow morning the FOMC is expected to cut the federal funds target range by 25bp to 1.75-2.00%, an outcome already fully priced by the market. For this reason, the focus will be on the accompanying statement, updated forecasts and on the dots of FOMC members’ projection of the funds rate as at end-2019, 2020, 2021 and 2022.

In terms of updated forecasts, the main changes are likely to see GDP forecasts for 2020 lowered modestly in response to the escalation in the trade war. The forecast for the unemployment rate is expected to remain unchanged, and a small rise in inflation projections for 2020 is possible.

The dot plots are likely to affirm that a substantial minority of FOMC members expect a third cut in 2019 before one hike each in 2020 and 2021 (or 2021 and 2022), that takes the feds funds rate back to 2.25-2.5%. The accompanying statement is likely to be mostly unchanged.

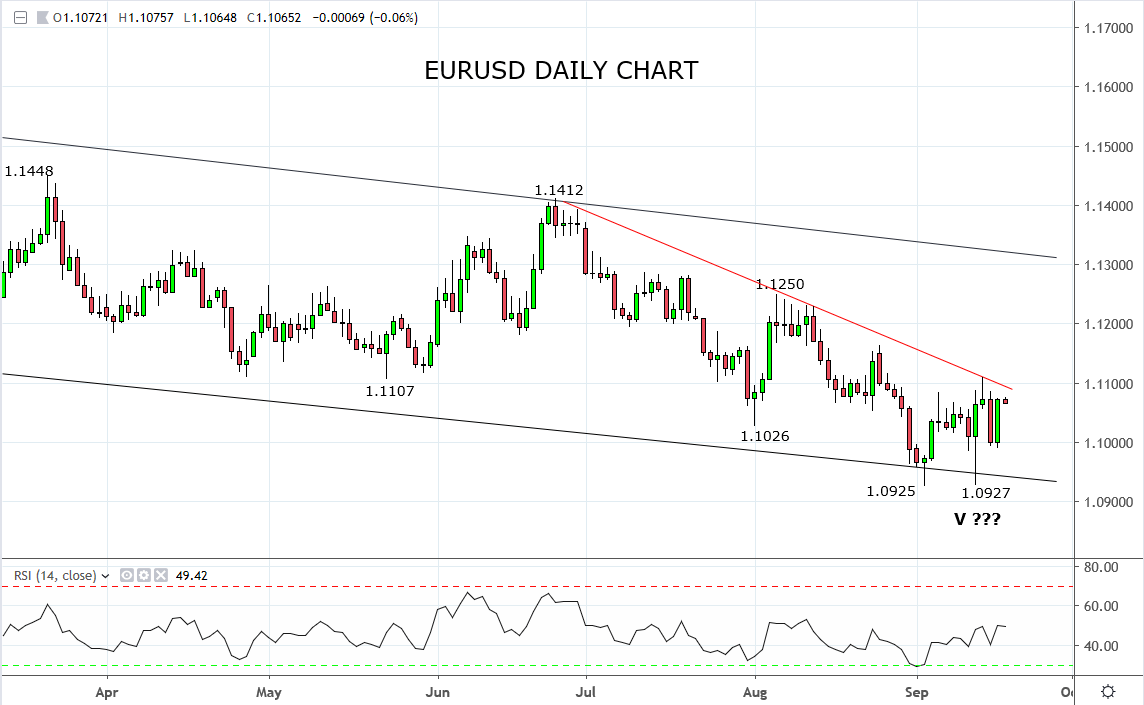

Turning to the charts, post last week’s ECB meeting the EURUSD was able to finish the week above key support 1.0925 area (double low), yet still below resistance 1.1100/20 coming from a series of daily lows in April and May and the downtrend line from the June 1.1412 high.

A break and close above 1.1100/20 post the FOMC would go a long way towards confirming that a medium-term low is in place at the recent 1.0925 double low and that a broader rally has commenced, initially towards 1.1250/1.1300.

Conversely, a break and close below 1.0925 would allow the EURUSD to probe towards the next area of downside support 1.0820/00.

Source Tradingview. The figures stated are as of the 18th of September 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.