The most anticipated event in financial markets since the G20 meeting in Osaka is likely to see the FOMC announce its first rate cut in over a decade this Thursday morning at 4.00am AEST.

In the lead-up, the discussion has centred not on whether the FOMC would cut rates. Instead, it has been a revolving debate on the merits of a 25bp cut vs a 50 bp cut. Just one week ago following dovish comments from New York Fed President Williams the market had priced in almost a 70% chance of a 50bp cut.

Following clarification of Williams dovish comments and some robust economic data in the second half of last week including durable goods and Q2 GDP, the odds of a 50bp cut are now back to 20%. The market appears comfortable with the idea the FOMC will deliver a 25bp cut on Thursday morning and indicate it is open to additional rate cuts pending developments abroad.

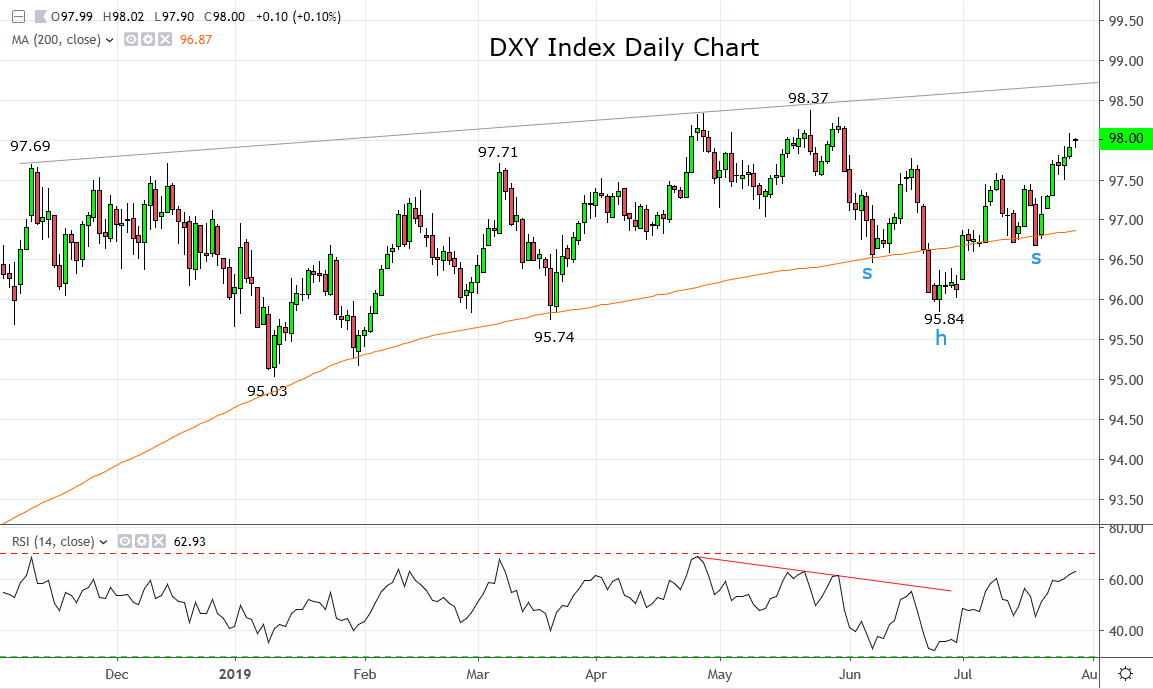

What does this mean for the U.S. dollar?

With the market still pricing in 20% chance of a 50bp move at this week’s meeting and a cumulative 92bp of cuts over the next 12 months, the onus is on Fed Chairman Powell not to stray too far from the dovish path the market has mapped out.

Should Powell place too much emphasis on recent positives surround the underlying economy, including employment, inflation and growth data, the risks are it provides a boost to the U.S dollar.

This is likely to test the resolve of the Trump administration who according to reports in the Wall Street Journal last week decided against the use of intervention to weaken the U.S. dollar.

As the saying goes where there is smoke, there is usually fire, and in the event, the U.S dollar rallies post the FOMC, a well-timed tweet from the U.S. President designed to limit dollar strength should not come as a surprise.

Source Tradingview. The figures stated are as of the 29th of July 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.