Short-term technical outlook on Russell 2000/US Small Cap Index (Tues 23 Apr)

click to enlarge charts

Key technical elements

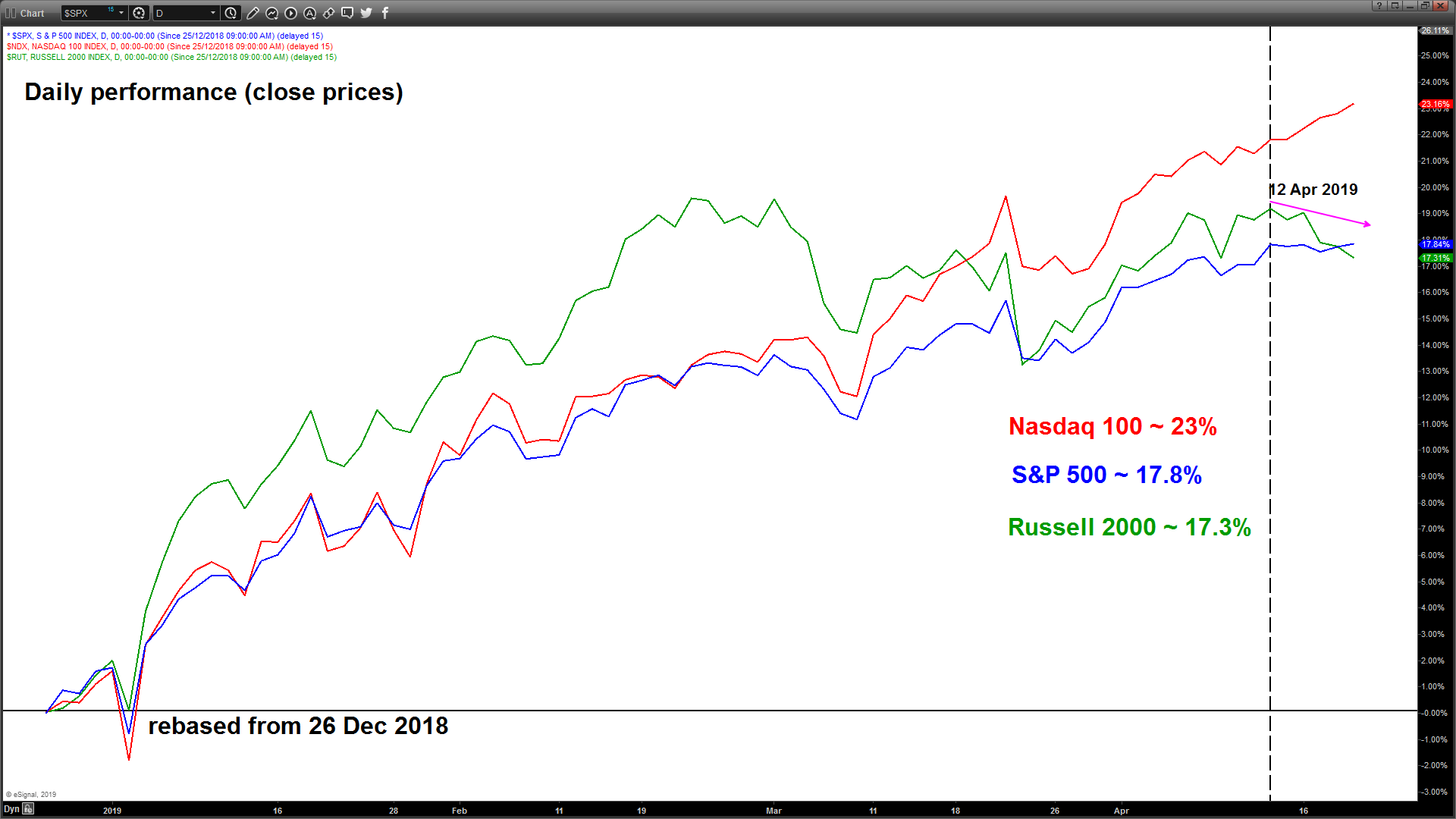

- Since 12 Apr 2019, the US Small Cap Index (proxy for the Russell 2000 futures) has started to see its initial rally from 26 Dec 2019 fizzled out that make it the underperformer against the other benchmark indices; the Nasdaq 100 and S&P 500.

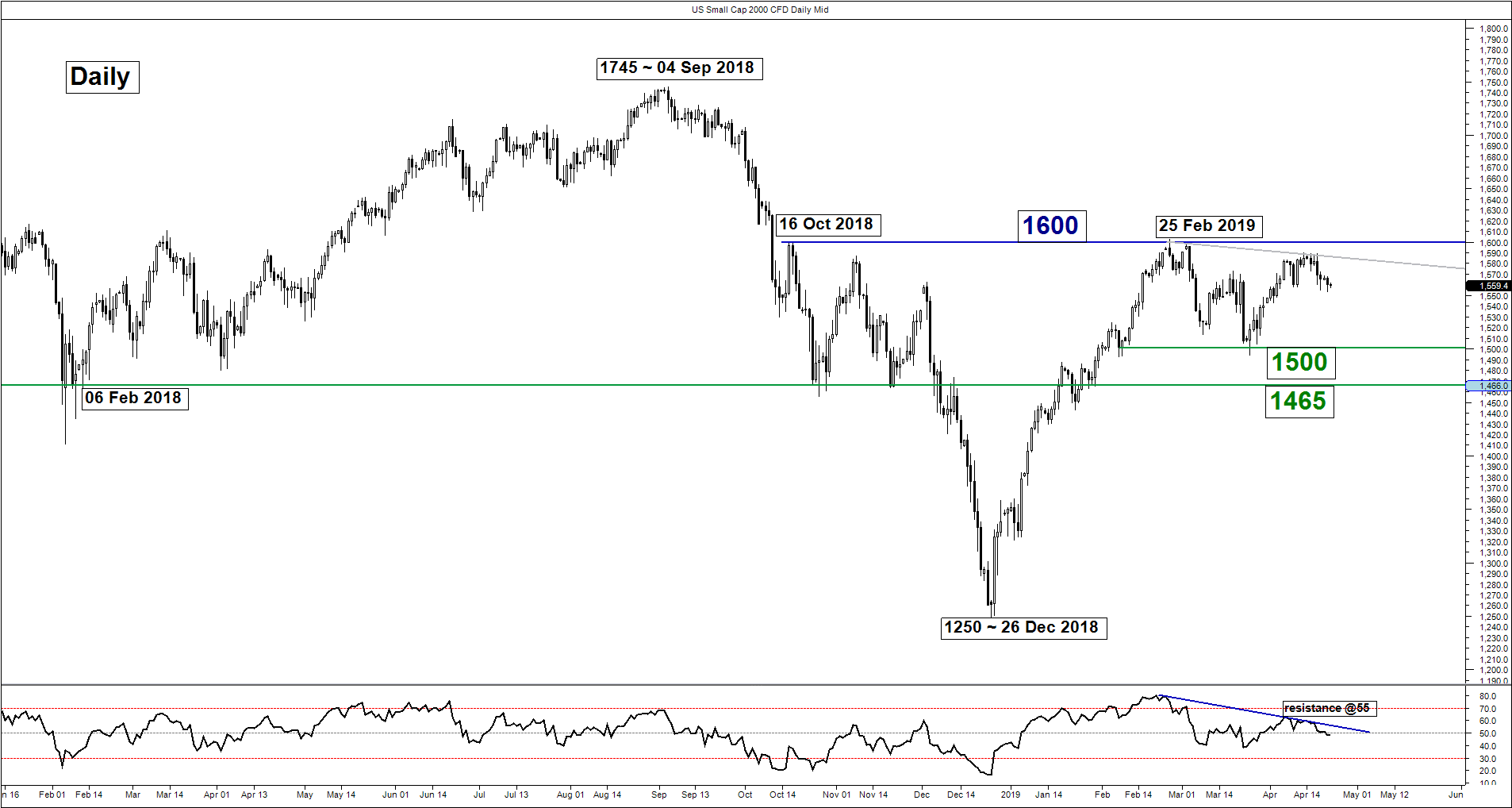

- The Index has started to evolve into a medium-term descending range configuration in place since 25 Feb 2019 high with its upper boundary/resistance set at 1590/1600.

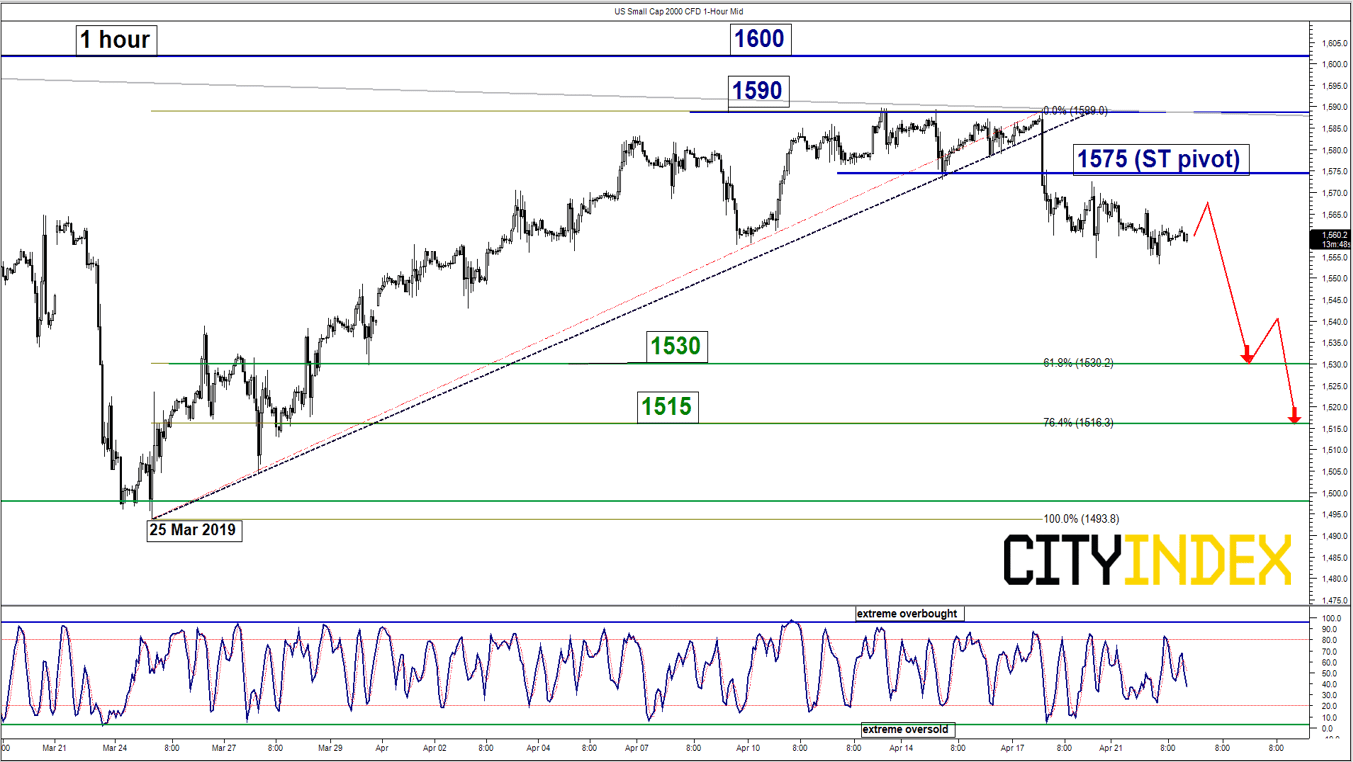

- The Index has broken below a minor ascending trendline support from 25 Mar 2019 low and its key short-term resistance now stands at 1575 (the former minor swing low of 16 Apr 2019 & 61.8% Fibonacci retracement of the recent bearish reaction from the medium-term descending range resistance to yesterday, 22 Apr U.S. session low of 1553).

- Momentum indicators remain negative as the daily RSI oscillator is being capped by the corresponding descending resistance at the 55 level and the shorter-term hourly Stochastic has started in inch down from its overbought zone.

- The next significant near-term supports rest at 1530 and 1515 (61.8% & 76.4% Fibonacci retracement of the prior push up from 25 Mar 2019 low to 17 Apr 2019 high).

Key Levels (1 to 3 days)

Pivot (key resistance): 1575

Supports: 1530 & 1515

Next resistance: 1590/1600

Conclusion

If the 1575 key short-term pivotal resistance is not surpassed, the US Small Cap Index may see a further push down to target the next supports 1530 and 1515 in the first step.

However, a break above 1575 negates the bearish tone for a squeeze up to retest the medium-term descending range resistance zone at 1590/1600.

Charts are from City Index Advantage TraderPro & eSignal