Short-term technical outlook on NZD/JPY (Mon, 13 May)

click to enlarge chart

Key elements

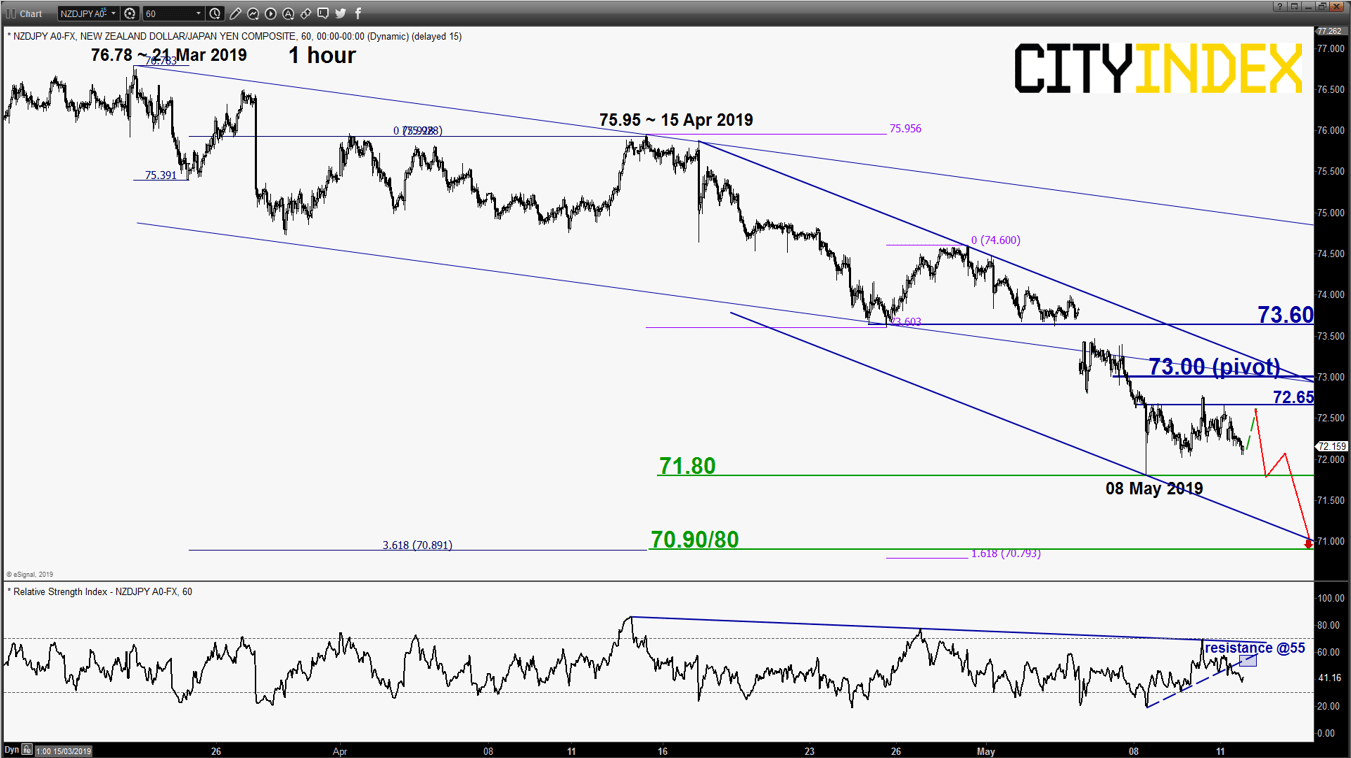

- The minor downtrend of the NZD/JPY cross pair in place since 21 Mar 2019 high has started to accelerate to the downside through the bearish break and gapped downed from its lower boundary of the descending channel on 06 May 2019.

- From its 15 Apr 2019 minor swing high of 75.95, it has evolved within a steeper minor descending channel with its key short-term resistance now at 73.00 which is defined by the intersection of the steeper descending channel resistance and pull-back of the former descending channel support from 21 Mar 2019 high.

- The hourly RSI oscillator has started to inch upwards and still has potential room for further upside before it reaches a corresponding resistance at the 55 level. This observation suggests that price action of the cross pair may see a minor bounce to retest 72.65.

- The next significant near-term support rests at 70.90/80 which is defined by the lower boundary of the steeper descending channel from 15 Apr 2019 high and a Fibonacci expansion cluster.

Key Levels (1 to 3 days)

Intermediate resistance: 72.65

Pivot (key resistance): 73.00

Support: 71.80 & 70.90/80

Next resistance: 73.60

Conclusion

The NZD/JPY may shape a minor bounce first towards 72.65 with a maximum limit set at the 73.00 key short-term pivotal resistance before another potential impulsive downleg materialises to retest 08 May 2019 low of 71.80 follow by 70.90/80 next.

However, an hourly close above 73.00 negates the bearish tone for a further corrective rebound towards the next resistance at 73.60 (gapped down formed on 06 May 2019 & former minor swing low area of 25 Apr 2019).

Latest market news

Today 07:49 AM

Today 04:24 AM

Yesterday 10:48 PM