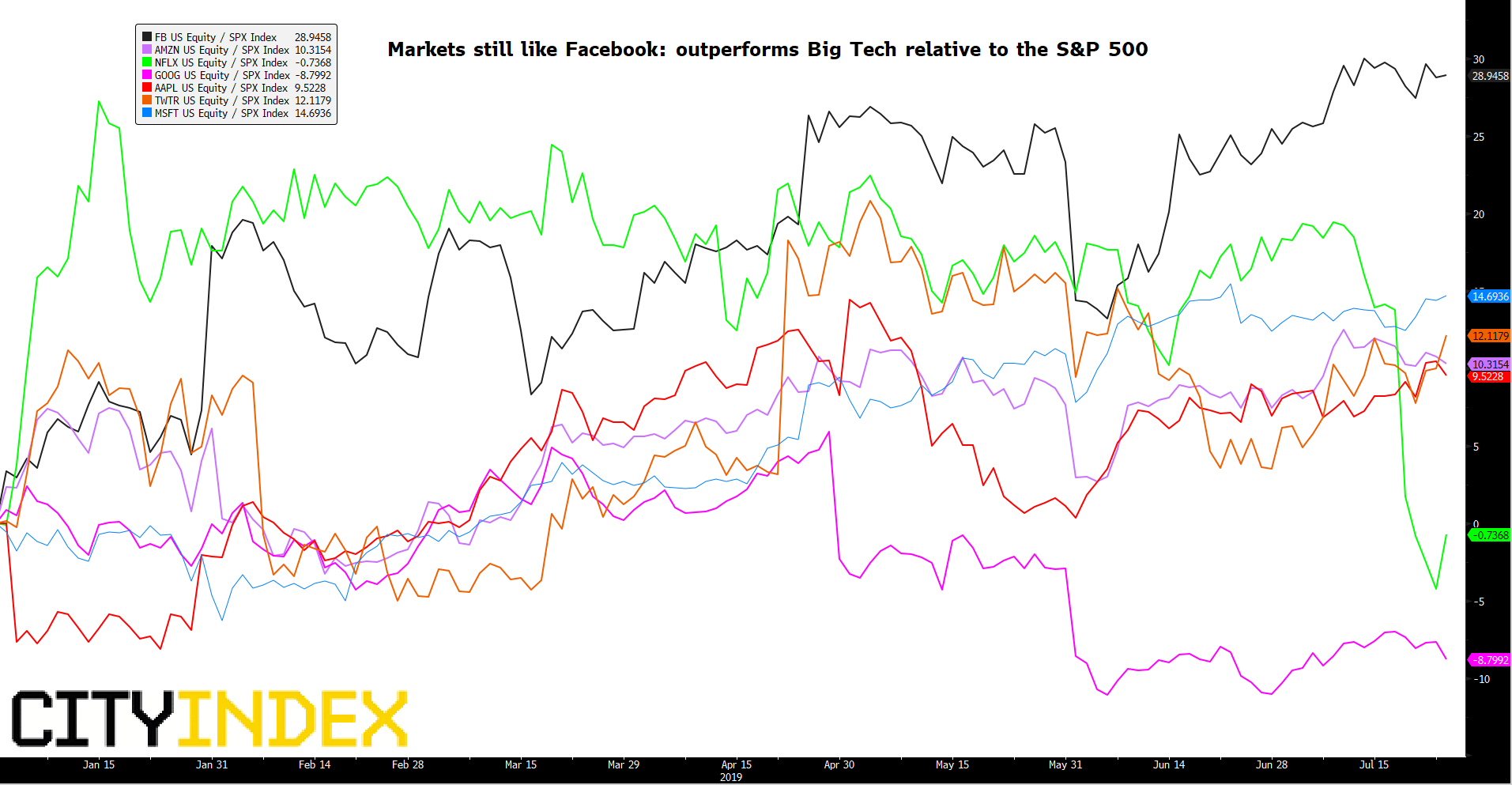

Facebook shares have slowly erased a fall of around 2.5% earlier on Wednesday, in reaction to a $5bn fine. Even beforehand, the drop barely bothered the stock’s 28% outperformance relative to the S&P 500 in 2019.

Normalised chart: FB AMZN NFLX GOOG AAPL TWTR MSFT [24/07/2019 19:52:46]

Source: Bloomberg/City Index/FOREX.com

Investors are not dismissing the Federal Trade Commission’s $5bn fine, nor an announcement of a Department of Justice probe. Yet price action articulates the perceived threat level for Facebook as relatively low. The basic rationale for a neutral-to-negative assessment of immediate risks is outlined below.

- Facebook’s FTC settlement is in-line with $3bn-$5bn expectation. A level of uncertainty has been cleared. The FTC is set to mandate privacy rule changes and behavioural changes that disrupt Facebook’s business, may yet be on the horizon. But the FTC would be over-reaching if it demanded such as remedies in its suit

- The Justice Department’s investigation into whether Big Tech is thwarting competition is a serious development. It will therefore be exacting and take years to conclude. The DoJ doesn’t throw around the term ‘monopoly’ as lightly as you or I might. There is a high burden of proof to validate the charge, lest the case to blows up in the DoJ’s face. The probe can therefore be filed under ‘concerning, though not imminent’

The main focus thereby remains Facebook’s Q2 performance, a year after the social media leader shocked investors with some of its worst results ever. The shares haven’t fully come back from that disappointment. Yet the let-down has lowered expectations which is an implied benefit. Expected growth rates are now fairly modest compared to the breakneck clip of yore.

Key expectations (consensus data from Bloomberg)

- Daily active users: 1.57 billion vs. 1.56 billion in Q1 and 1.47 billion in Q2 2019

- Monthly active users: 2.42 billion vs. 2.38 billion in Q1 and 2.32 billion in Q2 2019

- Adjusted EPS: $2.25 vs. $1.74 last year

- Revenue: $16.49bn vs. $13.23bn last year

- Gross margin: 80.9% vs. 83.27% last year

- 3Q adjusted EPS guidance: $2.19

- 3Q revenue guidance: $17.04bn

What to watch

The key overarching theme right now is Stories. The obvious economic impact of higher advertising inventory is widely thought to be negative for pricing, especially combined with clear cautions from Facebook over the last few years about the dampening impact on financials from investments in technology to improve privacy and security. As the group’s transition towards a ‘more private’ social network deepens, that too may weigh on growth and key metrics. The group is now combining apps, ramping Instagram monetisation and launching paid messages, moves which will take time to bed down. Libra will be of interest, though the crypto gambit is at such an early stage, any further commentary should be largely neutral. Executive views on potential FTC remedies, if offered may be more market-moving.

Likely stock reaction

Call option positions expiring at the end of the week outnumber puts 2-to-1, according to Bloomberg data, a signal that a majority of traders expect the shares to rise. Exact positioning notches the expected gain at 7.3% immediately after results. That compares with an average move over the last eight quarters of 7.1%. There were two falls and six climbs over that stretch.

For a look at the wider context ahead of earnings from other giant U.S. technology companies, see our Big Tech earnings preview from last week.