ExxonMobil (XOM): Risk Breaking Below March's Low

Pressure has been mounting on ExxonMobil's share price, after the U.S. oil giant posted historical quarterly losses in late July. Furthermore, the company warned that low energy prices could wipe 20% of oil and natural gas reserves off its books. To make thing worse, ExxonMobil was kicked out the Dow Jones Industrial Average in late August.

Meanwhile, the relationship between ExxonMobil's management and its shareholders appears to be uncertain, as major shareholder BlackRock said previously it voted against the company's board of directors for failing to make progress on tackling the climate crisis and "effective corporate governance is lacking".

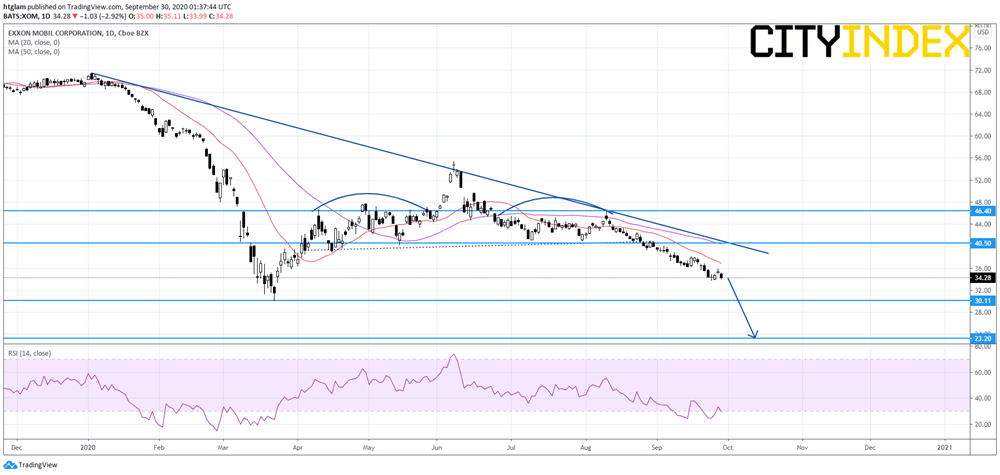

On a daily chart, ExxonMobil (XOM) is capped by a long-term bearish trend line drawn from January. In fact, it has formed a head and shoulders pattern, with the neckline broken. The level at $40.50 might be considered as the nearest resistance, while the 1st and 2nd support are expected to be located at $30.11 and $23.20 respectively. Alternatively, a break above $40.50 would suggest that the next resistance at $46.40 may be challenged.