No official reason has been given (which is usually the case) but we suspect the 80% loss this year may have something to do with it. And the fact that the highly indebted property company’s problems are far from over simply make it less appealing to such a premier benchmark index.

Who will replace Evergrande in the Hang Seng?

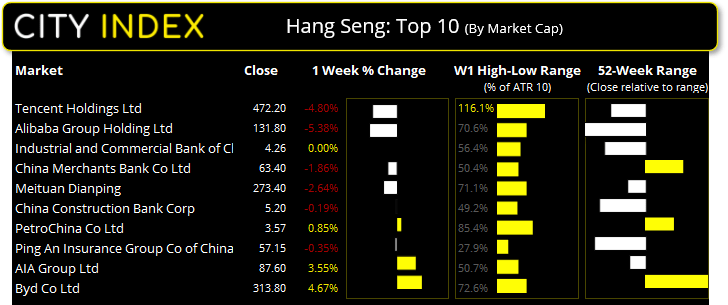

Interestingly, two new technology companies will be added, despite concerns that a regulatory crackdown on the technology sector could also dampen investors appetite for such companies. And the two new additions set to be e-commerce company JD.com and videogame company NetEase. The change swill take effect from Monday 6th December. Logically should chart these two companies, yet from a technical perspective something more interesting has caught our eye from a

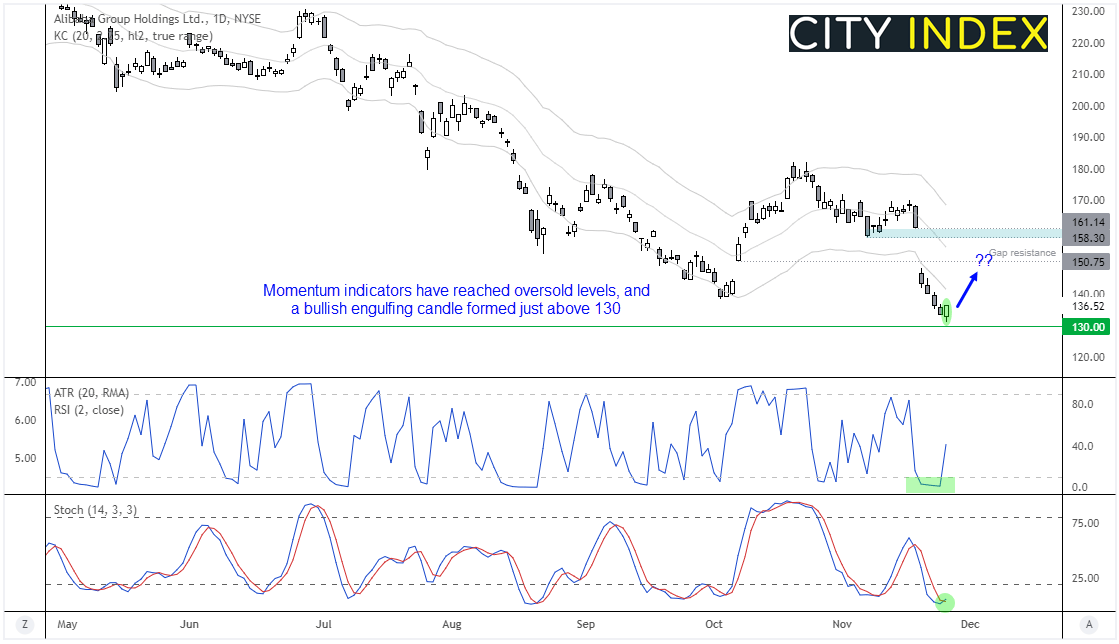

Alibaba set to bounce?

Alibaba (BABA) fell to its lowest level since early 2019 since the company announced a profit warning last Friday, citing weak demand from Chinese consumers. The stock has fallen -17.2% so far this month and is down nearly -60% from tis record high. Yet there are technical reasons to suspect it could be due a bounce and let mean reversion take over.

Alibaba formed a bullish engulfing candle yesterday, the RSI (2) reached an extremely oversold level by Tuesday and a stochastic buy signal formed by yesterday’s close. Furthermore, prices held just above the round number 130, so it appears a technical correction is due and that could help alleviate some selling pressure on the Hang Seng.

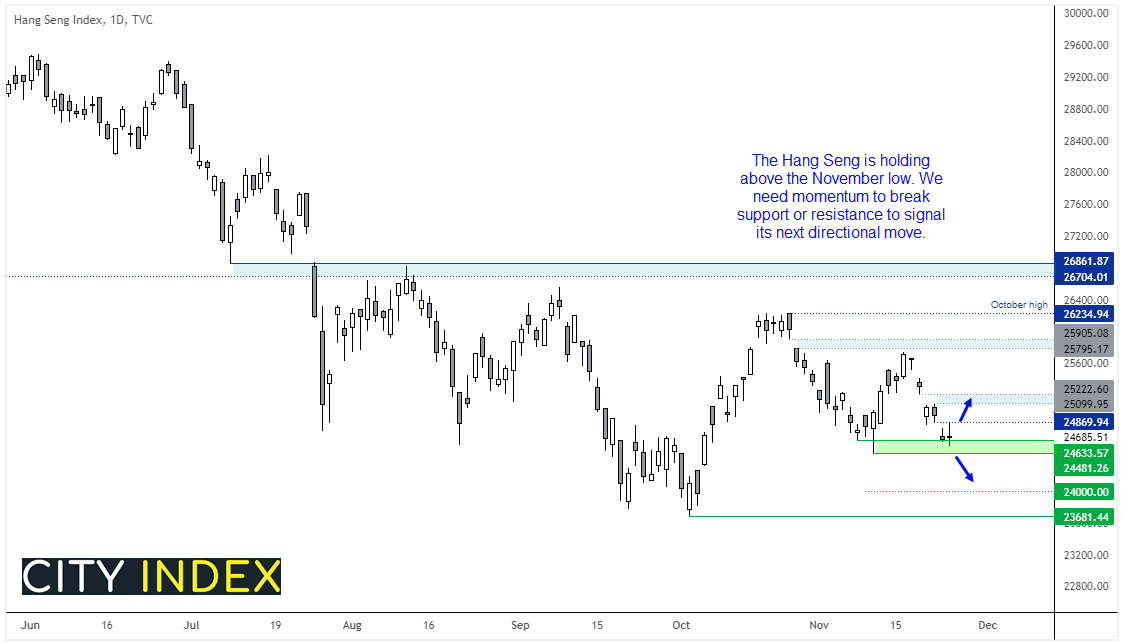

The Hang Seng 50 clings onto the November low

The Hang Seng (HSI) is holding above the November low, but only just. The lower high on November 16th is a concerns to a bullish case, as is the weaker Hong Kong dollar (HKD/USD) which is under pressure form a very strong US dollar. The index is at a pivotal level, where a break above Monday’s low (24,869) is required to confirm a bounce as long as prices hold above 24,481. Yet if prices break below 24,480 then 24k becomes the next target for bears, ahead of the October low at 23,681.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade