The EUR/USD has recovered impressively to turn flat on the session after being down more than 100 pips earlier in the day when it was hammered on the back of very weak PMI data. But the turnaround has now been completed, and more gains could be on the way as we head towards a busy next week.

Sentiment improved towards risk assets after Ukraine and Russia signed a UN-backed deal to allow the export of millions of tonnes of grain from blockaded Black Sea ports. This has the potential to not only avert the threat of a major global food crisis but reduce inflationary pressures too. The fact that Russian gas flows have re-started after maintenance works ended in Nord Stream 1 pipeline is further good news.

Part of the reason why the EUR/USD recovered had nothing to do with the euro, but everything to do with the US dollar. The greenback fell across the board as bond yields plunged on rising concerns over an economic slowdown that in the eyes of the market would bring forward rate cuts from the Fed. For indeed, the euro remained on the backfoot against most other major currencies, including the pound and yen.

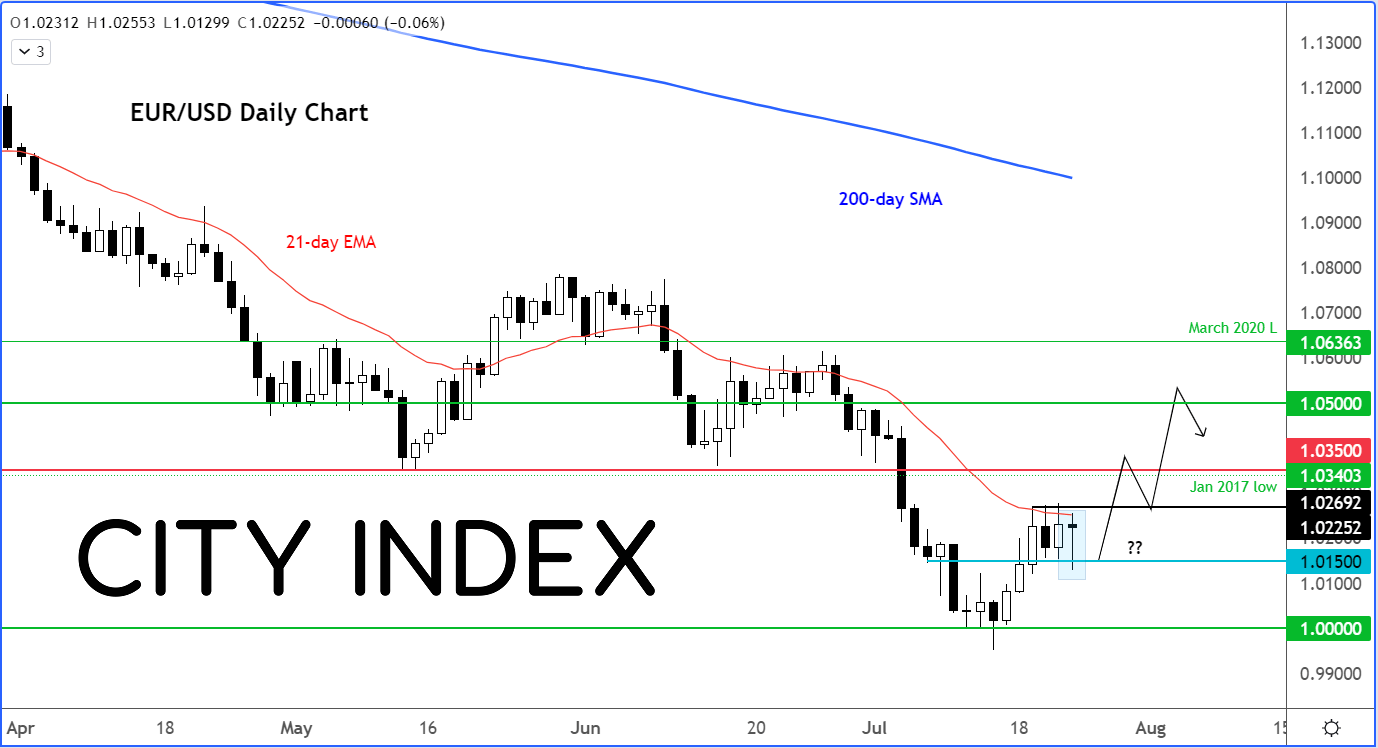

I still think that the EUR/USD is due for a correction towards at least 1.0350, with the potential to retest the 1.05 handle also cannot be ruled out, given the recent bullish price action, including today’s somewhat impressive recovery. However, all bets are off if rates break below the 1.0150 support level first. In that scenario, another retest of parity would then become likely.

The EUR/USD will face another testing week, with macro events (and company news) to take into account from both sides of the Atlantic. The macro highlights include:

- FOMC rate decision (Wednesday) - Inflation remains very hot in the US. Annual CPI accelerated to a 4-decade high of 9.1% in June, beating analysts’ expectations for the fourth time. The Fed has been front-loading aggressive rate hikes to control prices, even at a cost of economic growth. Expect another 75-basis point hike.

- US Advance GDP (Thursday) - With inflation continuing to eat into consumers’ disposable incomes and profit margins of businesses, there is a growing feeling that the Fed’s aggressive tightening will see the US fall into a recession. Is the US already in a technical recession? Output fell 1.6% in Q1 in an annual format. Another negative print means technical recession.

- Eurozone CPI and GDP (Friday) - The ECB finally started its fight against inflation with a 50-basis point rate hike, with President Lagarde warning that inflation could accelerate further and that future rate decisions will be data-dependant. CPI and GDP are obviously very important in that regard, which should bring the euro in sharp focus.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade