Just in time to celebrate today’s Labour Day public holidays in countries including France, Germany and Italy, the sagging EURUSD staged a brave rally to close the session back above 1.1200. The recovery in the EURUSD, primarily the result of a cluster of Eurozone economic data overnight that either beat expectations or confirmed some stabilisation.

The key data highlights were the flash Eurozone advanced Q1 GDP which printed at 0.4% QoQ and boosted the YoY growth rate to 1.2%. German harmonised CPI was 0.5ppt higher than consensus at 1.0% for April, taking the YoY rate to a relatively punch 2.1%. Topping the session off was better than expected German, and Eurozone unemployment data as the Eurozone unemployment rate fell to 7.7%, its lowest rate since October 2008.

Also aiding sentiment was the Spanish elections held over the weekend. Current Prime Minister and former economics professor Pedro Sanchez’s Socialist Party increased the number of seats it holds in parliament. While falling short of a majority, the result hailed as a victory over the populist right and a victory for the EU.

As we highlighted in yesterday’s note “USD – pausing or failing?” the market has built a significant long U.S. dollar position against a handful of core currencies. Due to the persistently weak Eurozone data of late, the EUR has been one of the market’s favourites to short against the U.S. dollar.

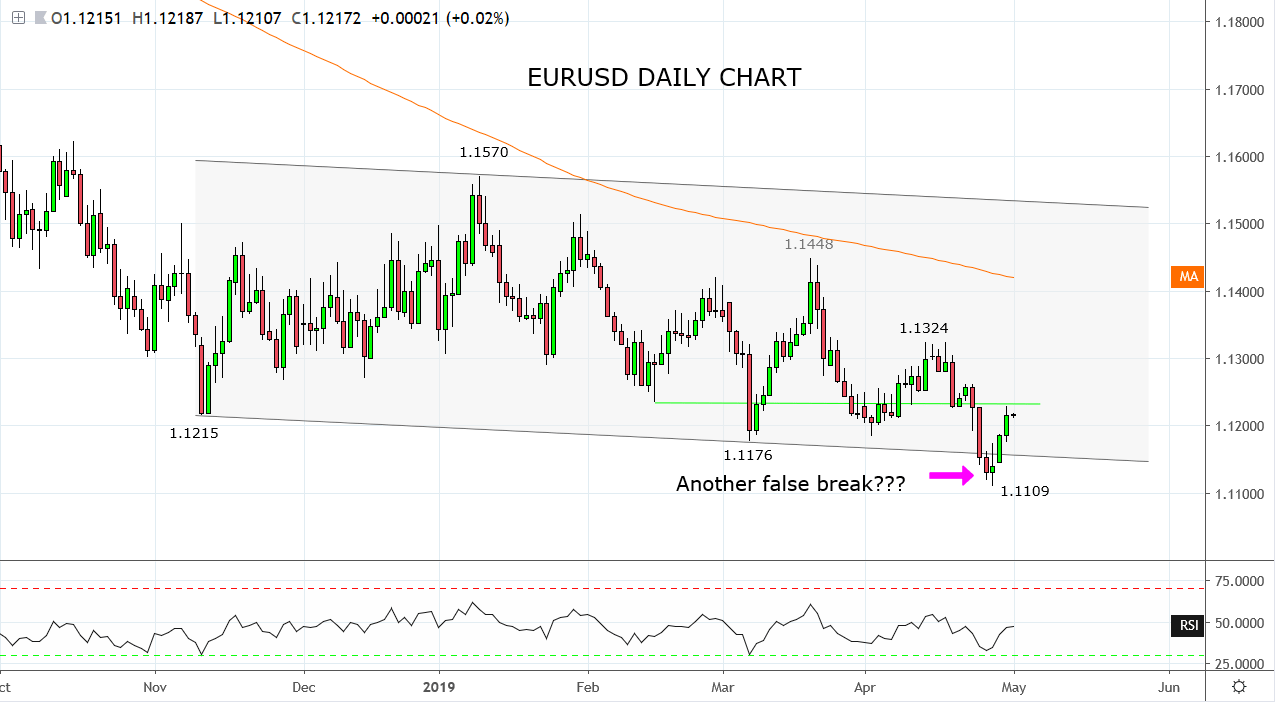

The funds and traders that sit short the EURUSD will not welcome the sudden emergence of firmer Eurozone data or the fact that last weeks move to 1.1109 is starting to resemble yet another false break. However, with U.S ISM manufacturing PMI, FOMC and employment data still to be released this week, they are unlikely to give up on EURUSD shorts just yet.

Much like we are watching the price action in the U.S. dollar index, the DXY as it tests horizontal support 97.70/50, the equivalent level for the EURUSD is 1.1230/50. Should the EURUSD break and register a daily close above resistance 1.1230/50 it is likely to be the trigger for a short covering rally in the EURUSD back towards 1.1400 and a deeper pullback in the DXY.

Source Tradingview. The figures stated are as of the 1st of May 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.