- Potential US Treasury default poses short-term downside risks to EUR/USD outlook

- But resolution in debt ceiling talks should spur rally in all risk-sensitive assets

- Disinflation and weaker economy in months ahead mean Fed might have to cut rates sooner, supporting our bullish longer-term EUR/USD outlook

The key short-term risk facing the EUR/USD outlook and many other FX pairs is the potential for a default by US Treasury, which could send risk assets plunging across the board. This also implies that in the event of a likely resolution in the US debt-ceiling talks, i.e., kicking the can further down the road, risk assets should be able to sigh relief.

That’s precisely what the market is betting on right now – that the two sides will strike a compromise. For, had it been otherwise, there is no chance the markets would be THIS stable.

Indeed, the EUR/USD has managed to hold its own relatively well at the start of this week, finding mild support around 1.0850 area. The apparent strength seems even more remarkable given the renewed weakness we have observed in Eurozone (and Chinese) data, while the hawkish Fed commentary continues unabated. But the calm could be due to many traders just sitting on their hands until there’s a breakthrough in the debt ceiling talks.

Regardless of the short-term direction of the US dollar, owing to the uncertainty caused by the debt ceiling talks, the slightly longer-term view remains bearish. Later in the year, we are likely to see signs of disinflation and a weaker economy, because of the cumulative impact of the past rate hikes and sustained period of high inflation. The Fed might have to cut rates sooner than it currently envisages.

EUR/USD shrugs of weaker Eurozone and Chinese data

We have seen some rather negative data emerge from the Eurozone and China, suggesting that the recovery from the start of the year is starting to fade and consumers and business struggle with the cost-of-living crisis.

Form the Eurozone, industrial production came in at -4.1% m/m compared to a smaller fall expected on Monday. There was more negative news out Tuesday as German ZEW Economic Sentiment survey printed -10.7 vs. -5.4 expected. While Eurozone GDP was in line with the expectations at +0.1% q/q, not many people would have paid much attention to it anyway, even if it had surprised, for it is backward-looking. The latest data comes after a disappointing last week when we saw weaker-than-expected German industrial production (-3.4% m/m vs. -1.6% expected) and Sentix Investor Confidence (-13.1 vs. -8.0 eyed).

Regardless of the short-term direction of the US dollar, owing to the uncertainty caused by the debt ceiling talks, the slightly longer-term view remains bearish. Later in the year, we are likely to see signs of disinflation and a weaker US economy, because of the cumulative impact of the past rate hikes and sustained period of high inflation. The Fed, therefore, might have to cut rates sooner than it currently envisages.

US debt ceiling talks set to resume

The ongoing stalemate in the US debt ceiling talks is meant to be negative for risk-sensitive currency pairs, as too should be the disappointing economic data from China. Yet, the EUR/USD is holding its own above the long-term bullish trend line and key support around 1.0850 – at least for now anyway.

With the euro shrugging off bearish news, this is a sign of strength. The potential for a resolution in the US debt ceiling stalemate could fuel a rally in EUR/USD and other risk assets.

Talks on this matter are set to resume between Joe Biden, House Speaker Steve McCarthy and several Congressional leaders later today.

US retail sales disappoint

April retail sales, released a few moments ago, were expected to show a 0.8% m/m rise after falling 0.6% in March.

However, they came in softer, causing the dollar to initially drop. On the headline front, sales were up 0.4% m/m, missing expectations of a 0.8% rise. On the core front, sales rose 0.4%, below expectations of 0.5%.

Weaker sales further diminish the already-minority view that the Fed could hike rates again in June – not that the Fed has stopped with its hawkish rhetoric. FOMC official Thomas Barkin has said he saw no barriers to hiking rates again in June.

However, we think that the Fed has reached a peak in terms of interest rates, so Barkin’s comments are likely to – as they have – fall on deaf ears.

EUR/USD outlook: Technical analysis

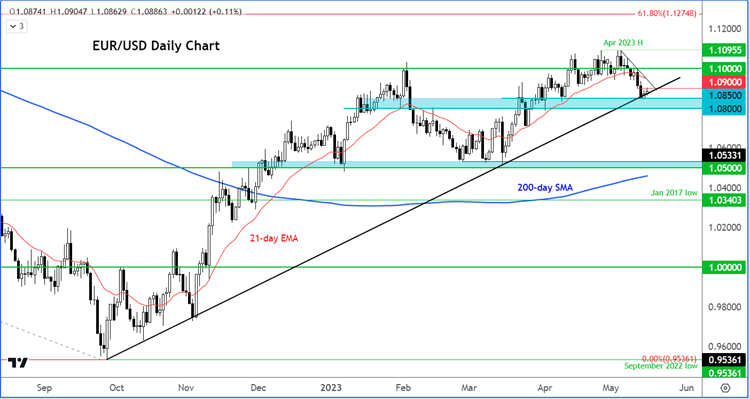

The EUR/USD printed a small bullish candle around 1.0850 area on Monday despite negative news from the Eurozone. The rebound means the longer-term bullish trend line has been defended – at least for now, anyway.

Bullish traders need to see the breakdown of some key resistance levels here, starting with 1.0900, in order to support the short-term EUR/USD outlook.

Bearish speculators will want the EUR/USD to remain offered around key resistance levels, leading to a potential drop below 1.0850. A closing break below this level could pave the way for a deeper retracement towards 1.0700 or even lower.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade