EUR/USD edges higher ahead of ECB Lagarde & Powell speeches

EUR/USD is rising after three days of declines as the rally in the USD shows signs of running out of steam and after German PPI cooled by less than expected. Speeches from both Fed Chair Powell and ECB President Christine Lagarde are in focus later today.

German PPI cooled to 4.1% YoY in April, down from 6.7%, but ahead of forecasts of 4%. It is worth remembering that eurozone CPI rose in April to 7% YoY from 6.9%, suggesting that prices pressures remain sticky.

The euro has come under pressure this week despite ECB policymakers sticking to their hawkish stance.

Attention will now turn to ECB President Christine Lagarde, who is due to speak. At the press conference following the ECB rate decision, Lagarde was clear that inflation was still too high and more hikes were needed to tame inflation. More hawkish commentary could help the EUR higher.

Prior to her speech, the ECB’s Economic Bulletin will be released, which could garner plenty of attention, particularly in light of the upward revision to growth and inflation forecasts from the EU Commission.

The USD has powered higher this week, lifted by hopes of a debt ceiling agreement, potentially by early next week, and by hawkish commentary from Fed speakers. Data has also been broadly encouraging with jobless claims, NY Empire & Philly Fed manufacturing beating forecasts.

Fed Chair Powell is due to speak later. A hawkish-sounding Powell could lift the USD higher.

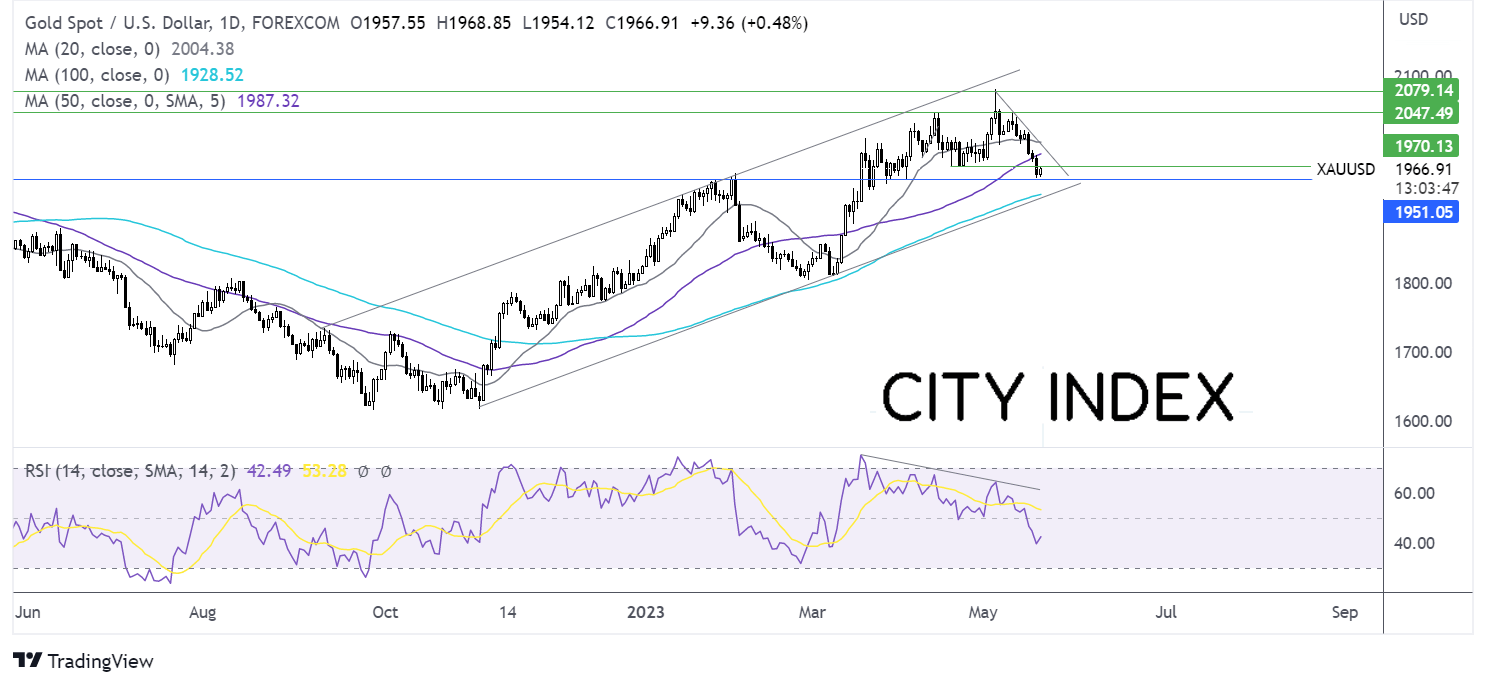

EUR/USD outlook – technical analysis

EUR/USD closed below the 100 sma, which proved to be a key support in March, before finding support on the 2-week falling trendline at 1.0760. The RSI keeps sellers hopeful of further downside.

Sellers need a break below 1.0760, the weekly low and the falling trendline support to open the door to 1.07.

However, should 1.0760 hold, buyers could look to retake the 1.08 round number and the 100 sma at 1.0810 in order to bring the 50 sma and multi-month rising trendline back into focus at 1.0895.

Gold awaits clues from Powell after steep losses

Kids are holding steady after steep falls across the week. The Metal is on track to lose around 2.4% this week weighed down by the improved market mood as a dent ceiling agreement looks increasingly likely and by hawkish fed commentary.

Both US President Biden and house speaker Kevin McCarthy have expressed optimism that a deal to lift the £31.4 trillion debt ceiling can be achieved. This would mean that the US would avoid a potential recession. Relief has lifted the USD across the weak and boosted risk assets, pulling gold lower. Gold fell to a low of $1952, a 6-week nadir.

Data has been upbeat this week and commentary from Fed speakers has been hawkish. Dallas Fed President Lorrie Logan said that data doesn’t support pausing rate hikes in June. Meanwhile, Fed governor Jefferson added that inflation is still too high.

Attention will be on Fed Chair Jerome Powell when he speaks later. Hawkish comments from Powell could fuel June rate hike bets. Currently, the market is pricing in a 37% probability of a rate hike in June, up from 15% a week ago..

Hawkish Powell comments could lift the USD further and pull USD-denominated, non-yielding gold.

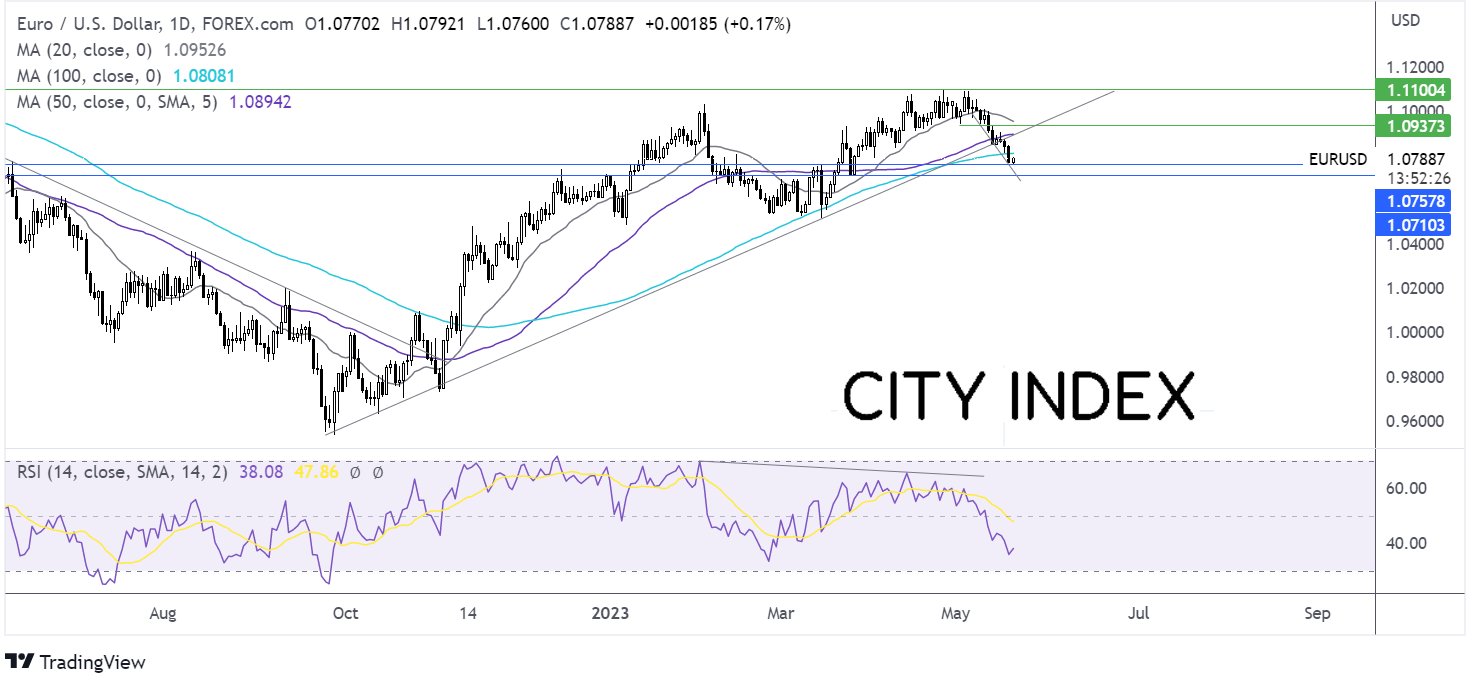

Gold outlook technical analysis

Gold closed below the 50 sma, falling to a low of 1952. Sellers will need a break below this support to extend the bearish short-term trend. A break below here exposes the 100 sma and the multi-month rising trendline support at 1930. A break below here would be significant, helping break Gold out of its multi-month rising channel.

On the flip side, should 1952 hold, immediate resistance can be seen at 1965, the late April low, and 1987 the 50 sma. A rise above 2000 the 20 sma could negate the near-term downtrend.