EUR/USD struggles below 1.10 ahead of ECB’s Lagarde

- USD strength continues from Friday

- Christine Lagarde to speak

- EUR/USD looks to support at 1.0930

EUR/USD continues to struggle below 1.10 after falling on Friday as the USD continues with its recovery.

The Greenback advanced on Friday despite retail sales falling 1%, instead encouraged by a tick higher in the University of Michigan’s Consumer Sentiment report, which rose to 63.5 from 62 and as the one-year inflation outlook also rose to 4.6% up from 3.6%. Core retail sales also showed resilience.

According to the CME Fedwatch tool, the market is pricing in an 83% probability that the Fed will hike rates by 25 bps at the May meeting.

The EUR rose 0.9% against the USD last week, supported by hawkish ECB commentary, which now has the market pricing in a 46% probability of a 50 basis point rate hike in May.

There is no high-impacting eurozone data due today. Instead, attention will be on ECB President Christine Lagarde, who is due to speak. Investors will be watching carefully for clues about the ECB’S next move.

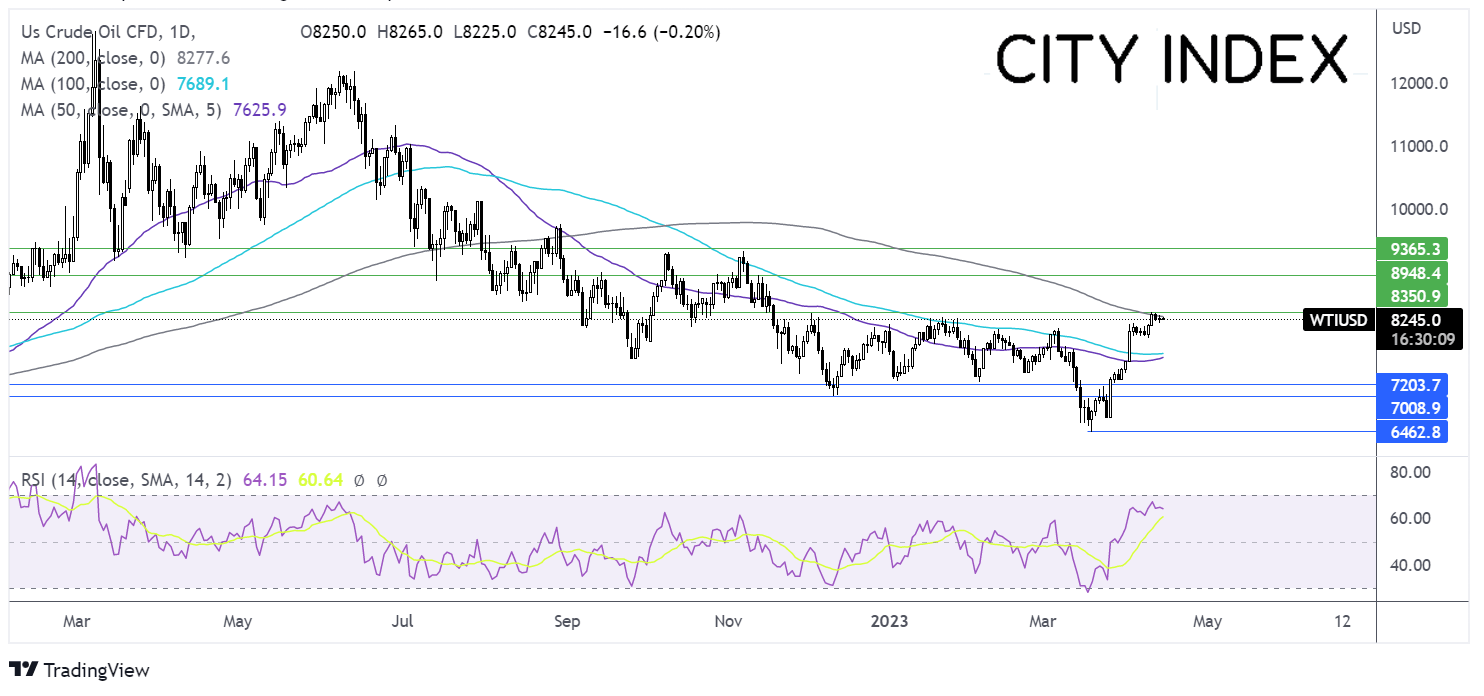

Where next for EUR/USD?

EUR/USD rose to a high of 1.1075 on Friday, before falling below 1.10 heading into the weekend. The RSI remains in bullish territory and decent support can be seen at 1.,0930 the March high and the January high. A break below here could open the door to 1.09 round number and 1.0850. Below here, the confluence of the 50 sma and the rising trendline support at 1.0750 could offer strong support.

Meanwhile, on the upside, buyers will look for a rise over 1.10 psychological level and 1.1045 at the 2023 high to extend the bullish uptrend towards 1.11 and 1.1180 at the March 2022 high.

Oil looks to Chinese data dump

- Oil steadies after solid gains last week

- Chinese GDP could support a stronger demand outlook

- WTI tests 200 sma resistance

Oil prices are holding steady at the start of the week after gaining over 2% last week, marking its fourth straight weekly gain.

Oil is looking ahead to tomorrow’s China GDP data for the next catalyst, which is expected to show that growth bounced back in a solid fashion as the economy re-opened after Covid. Retail sales and industrial production data is also due. The data comes as the Citi group surprise index sits at a 17-year high.

The data is expected support the narrative that the economic recovery in China will lift oil demand to a record high. A point that was reiterated by the IEA on Friday.

While the price of oil has rebounded from recent 15-month lows following the OPEC+ decision to cut output, the rally has run into resistance amid rising concerns over a recession in the US as interest rates continue to rise.

The USD is rising today, which makes oil more expensive for buyers with other currencies. A slew of Fed speakers are due to hit the airwaves with week. Their comments will be closely watch and could also drive oil prices.

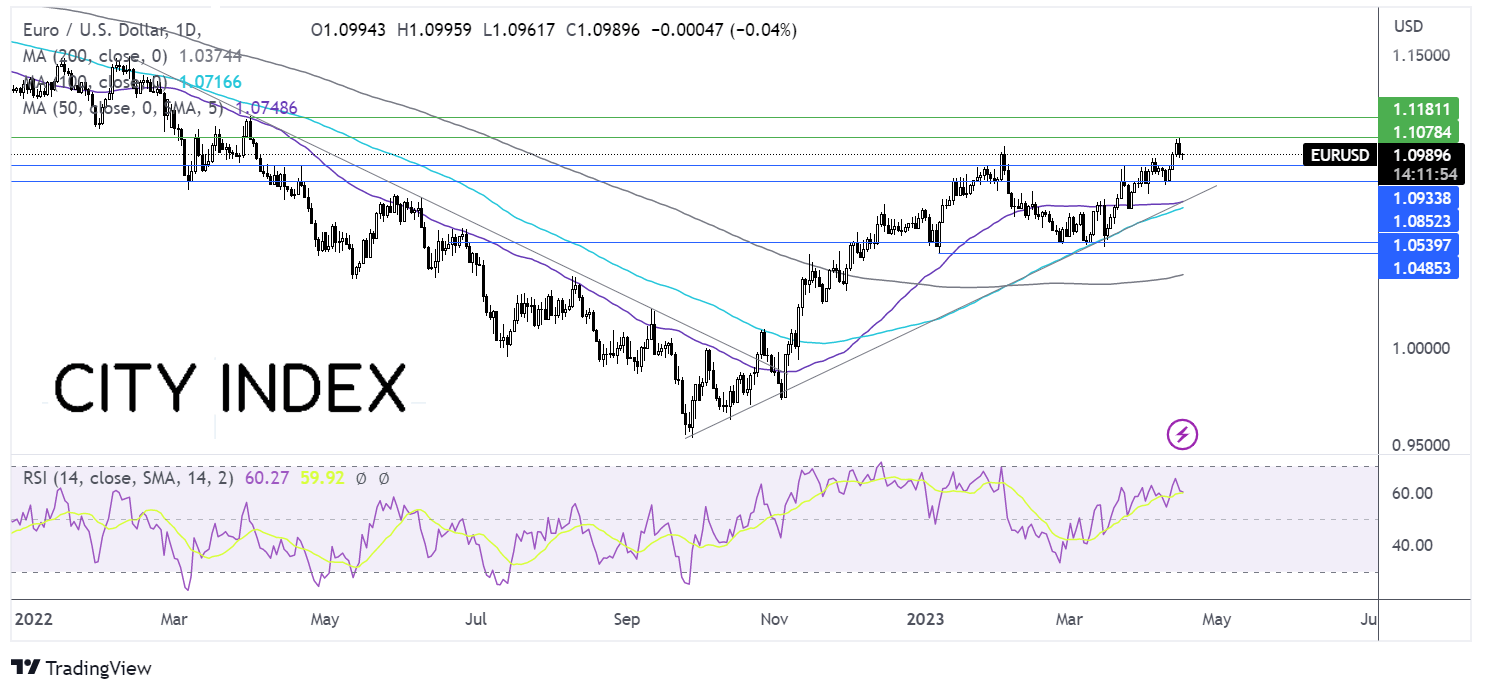

Where next for Oil prices?

Oil has been trading in a holding pattern since the start of April. The price rebounded from 67.90 the 2023 low, rising above the 50 & 100 sma the 80.00 psychological level, before running into resistance at the 200 sma at 82.80.

The RSI supports further upside but buyers will need to break above the 200 sma and 83.35 the December high, to break out of the holding pattern and bring 90.00 the round number, and November 10 high into play ahead of 93.20.

Should sellers successfully defend the 200 sma the price could look support at 80.00 round number ahead of 76.90 the 100 sma. It would take a break below the 72.30 lower band of the holding pattern for bears to take control.