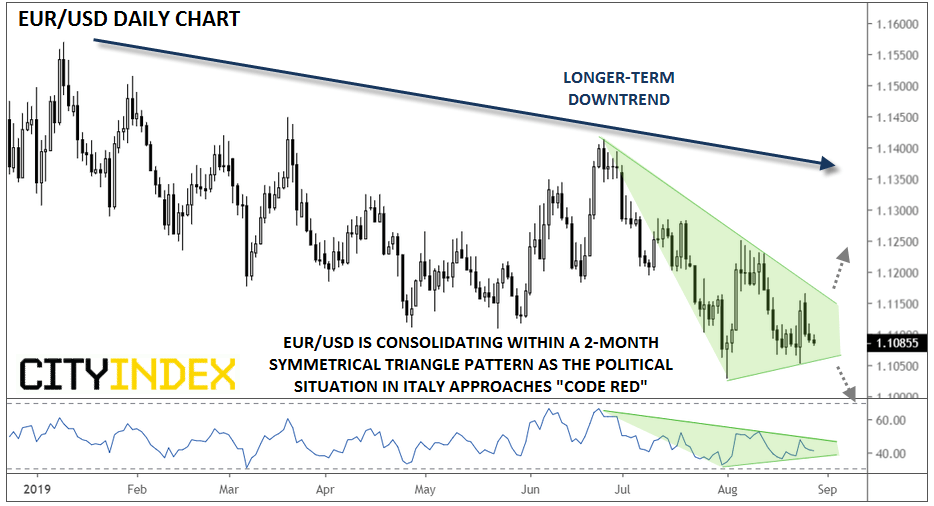

EUR/USD Coiled Like a Spring as Italian Political Situation Reaches Code Red

While Brexit developments out of the UK are grabbing most of today’s headlines, the political situation in Italy is also reaching “code red.”

Political leaders are meeting today in a last-ditch effort to form a Parliamentary majority, with the historical rival Democratic party and Five Star Movement seeking to work together. The latest sticking point is around which party will control key cabinet positions. If the two sides are unable to come to terms, an early election will be called, with Matteo Salvini’s rightest League the heavy favorite (for once, your humble author appreciates the simplicity of the two-party system in the US!).

For now, traders are taking an optimistic view to the proceedings. The 10-year Italian BTP yield has fallen sharply to hit 1%, a record low. More to the point, the 10-year spread between Italy and safe haven Germany’s bonds has dropped 173bps, the tightest level in 15 months; put simply, bond traders are feeling for more confident in Italy’s outlook than they have any point in over a year. As of writing, Italy’s FTSE MIB index is trading down about 0.5%, though that’s outperforming regional rivals like Germany’s DAX and France’s CAC 40 on the day.

When it comes to FX, the impact has been relatively limited so far. The euro is trading near the middle of the major currency pack on the day, and the single currency is essentially flat against the greenback. Taking a step back, EUR/USD has been consolidating within a symmetrical triangle pattern for the last two months. For the uninitiated, this pattern is analogous to a person compressing a coiled spring: as the range continues to contract, energy builds up within the spring. When one of the pressure points is eventually removed, the spring will explode in that direction.

Source: TradingView, City Index

While it’s notoriously difficult to predict the direction of a symmetrical triangle breakout in advance, analysts will typically defer to the dominant trend heading into the formation, which in this case was clearly to the downside. In the case of a bearish breakdown (perhaps on the back of failed coalition discussions and a return of political uncertainty), EUR/USD could quickly drop to a new 2-year low below 1.1000. Of course, an upside breakout is certainly in play, in which case the rates could rally to retest the August highs near 1.1250 or beyond.

As we move into September, monetary policy will take center stage, with key central bank meetings from both the European Central Bank and Federal Reserve around the middle of the month. The relative amounts of easing (interest rate cuts and likely quantitative easing in the case of the ECB) will determine the longer-term outlook for the world’s most widely-traded currency pair.