Asian Indices:

- Australia's ASX 200 index fell by -77.1 points (-1.02%) and currently trades at 7,505.40

- Japan's Nikkei 225 index has risen by 8.78 points (0.03%) and currently trades at 27,531.97

- Hong Kong's Hang Seng index has fallen by -178.8 points (-0.68%) and currently trades at 26,002.66

UK and Europe:

- UK's FTSE 100 futures are currently down -7.5 points (-0.11%), the cash market is currently estimated to open at 7,146.48

- Euro STOXX 50 futures are currently up 1.5 points (0.04%), the cash market is currently estimated to open at 4,203.94

- Germany's DAX futures are currently up 7 points (0.04%), the cash market is currently estimated to open at 15,932.73

US Futures:

- DJI futures are currently up 110 points (0.31%)

- S&P 500 futures are currently down -21 points (-0.14%)

- Nasdaq 100 futures are currently down -10 points (-0.22%)

Learn how to trade indices

Indices:

A combination of weak corporate earnings and rising coronavirus cases sent the ASX 200 around -0.9% lower to extend yesterday’s losses and fall to a 7-day low. It still remains up by 1.5% in August but its correction is clearly underway.

And it was a bearish day for Asian markets overall as Afghanistan remains in crisis following the withdrawal of US troops. The KOSPI 200 fell -1.2%, the Hang Seng was down -0.95% although the TOPIX was down just -0.2%. Shares in China once again bucked the broader trend with the CSI300 rising 0.14%

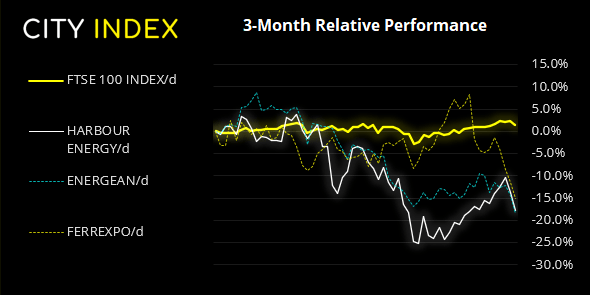

The FTSE 100 fell -0.9% yesterday and produced a large bearish engulfing candle. With risk appetite on the ropes and futures markets pointing lower, it’s possible bears will have another crack at driving the FTSE below 7100. Failure to do so could mark a turning point as the FTSE as it does have the ability to reverse course after 1-2 days of bearish trade.

FTSE 350: Market Internals

FTSE 350: 4127.39 (-0.90%) 16 August 2021

- 96 (27.35%) stocks advanced and 239 (68.09%) declined

- 25 stocks rose to a new 52-week high, 2 fell to new lows

- 76.07% of stocks closed above their 200-day average

- 68.38% of stocks closed above their 50-day average

- 25.64% of stocks closed above their 20-day average

Outperformers:

- + 5.95% - Ultra Electronics Holdings PLC (ULE.L)

- + 4.99% - Future PLC (FUTR.L)

- + 2.72% - Tyman PLC (TYMN.L)

Underperformers:

- -4.75% - Harbour Energy PLC (HBR.L)

- -4.67% - Energean PLC (ENOG.L)

- -4.15% - Ferrexpo PLC (FXPO.L)

Forex: RBA ready to act, NZD falls on new Covid Case

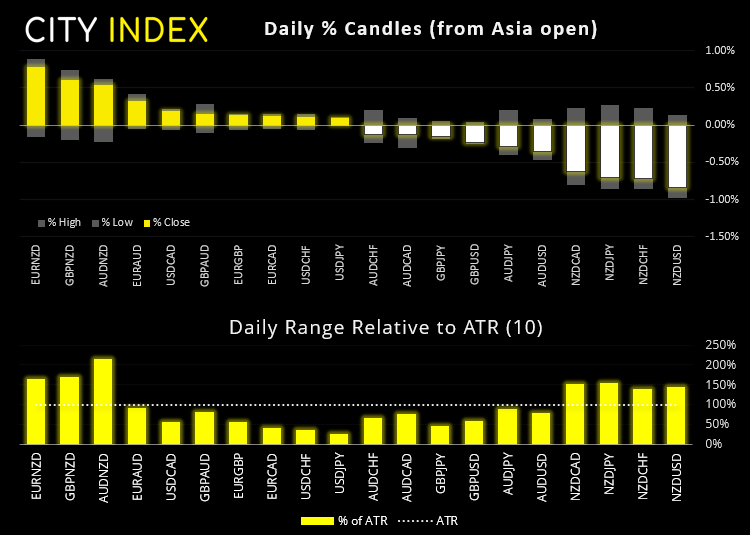

With the exception of NZD and AUD, it was quiet overnight in the currency space. The antipodean currencies took a turn lower on the release of RBA’s minutes where they said they would take action should the coronavirus outbreak worsen, and that they had discussed delaying their tapering decision ahead of this month’s meeting. The unemployment rate is expected to pick up over the near-term. Separately, the New South Wales Premier believes that COVID-19 cases are to sky rocket over the next 2-3 weeks and Japan have extended their state of emergency lockdown until September 12th.

NZD was the weakest major after a new COVID-19 case was logged in Auckland. NZD/JPY fell to an 18-day low and is probing its 200-day eMA.

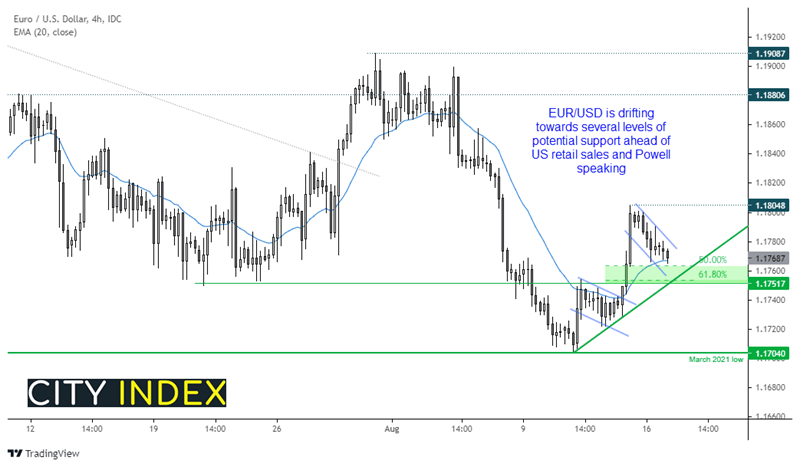

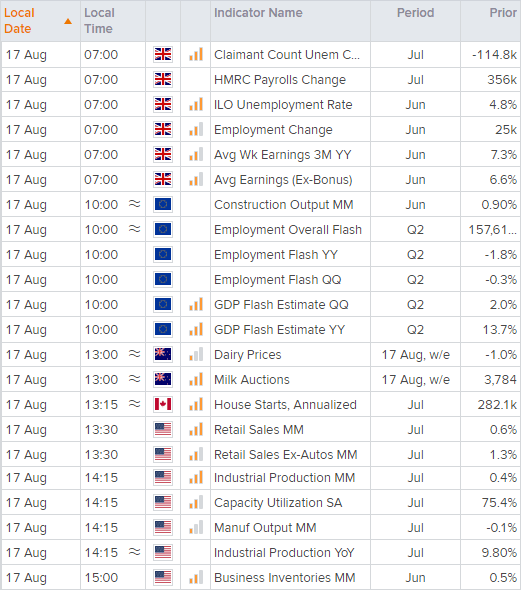

First up in today’s calendar is UK employment data at 07:00 BST - and you can read Joe Perry’s preview here. In the US session we have retail sales at 13:30 BST. Given the dire drop in consumer confidence seen on Friday it will be interesting to see if this has fed into retail spending. Jerome Powell is to speak at a virtual town hall meeting at 18:30 BST, to discuss the work of the Fed and economic education with educators and students. Neel Kashkari is also due to speak at 19:45. With two Fed members and US retail sales on the radar then we are keeping a close eye on EUR/USD.

EUR/USD found support at the March 2021 low and has printed two higher highs and a higher low on the four-hour chart. After reaching our 1.1800 bullish target (thanks to weak consumer confidence) the euro has retraced and is now trying to build support around the 20-bar eMA and 50% retracement level. The ideal scenario for a bullish EUR/USD move is for weak retail sales and some dovish commentary from Powell or Kashkari. However, should retail sales meet or exceed expectations and the dollar remain bid due to safe-haven flows then euro may struggle to move higher. Ultimately, we are looking for bullish setups around support levels.

Learn how to trade forex

Commodities:

Commodities were little changed overnight. Gold is holding near its 7-day high and just below 1789 resistance whilst it trades in a tight range. Silver nudged its way to a 7-day high although, unlike gold, bulls have failed to make their mark on the dented metal as demand remains weak. Platinum futures remains within the 1021 – 1038 resistance zone having printed an inverted hammer yesterday, and a break below 1,000 confirms the near-term reversal and also breaks below the monthly S1 and weekly pivot point.

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.