Asian Indices:

- Australia's ASX 200 index rose by 25 points (0.33%) and currently trades at 7,501.70

- Japan's Nikkei 225 index has risen by 25.24 points (0.09%) and currently trades at 27,351.35

- Hong Kong's Hang Seng index has risen by 82.25 points (0.38%) and currently trades at 21,924.58

- China's A50 Index has risen by 5.85 points (0.04%) and currently trades at 13,891.82

UK and Europe:

- UK's FTSE 100 futures are currently up 8 points (0.1%), the cash market is currently estimated to open at 7,779.70

- Euro STOXX 50 futures are currently up 7 points (0.17%), the cash market is currently estimated to open at 4,170.45

- Germany's DAX futures are currently up 28 points (0.18%), the cash market is currently estimated to open at 15,156.27

US Futures:

- DJI futures are currently down -79 points (-0.23%)

- S&P 500 futures are currently down -48.25 points (-0.4%)

- Nasdaq 100 futures are currently down -11.25 points (-0.28%)

- The conclusion of the FOMC meeting at 19:00 GMT is hands down the main even, so we could be in for a session of tight ranges beforehand

- Markets expect ~99% chance of a 25bp hike (and an 85% chance of another in March), and today is really about whether they deliver a dovish or hawkish hike

- With expectations of a dovish undertone, the USD is vulnerable to a move higher should the Fed not be as dovish as expected (a scenario I currently favour)

- Traders will feverishly comb through the statement and listen to the press conference at 19:30 for clues of a less aggressive tightening cycle (perhaps a pause down the track) – but I would be very surprised if they even considered discussing cuts anticipated later in the year in February, when they are still fighting inflation at nearly 3x their target rate of 2%

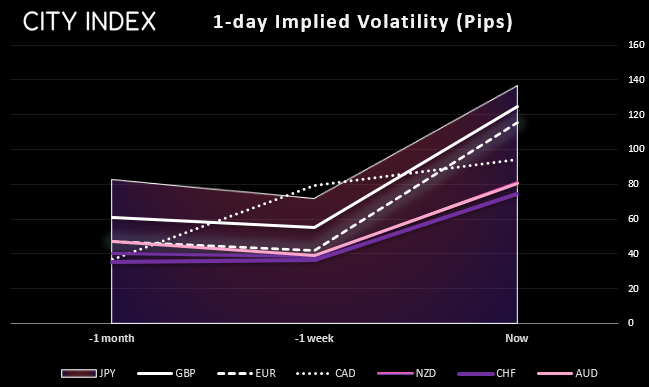

- Overnight implied volatility has risen for FX majors ahead of the Fed, with options markets implying USD/JPY could move +/- 136 pips from the open, GBP/USD +/- 124 pips and EUR/USD +/- 115 pips

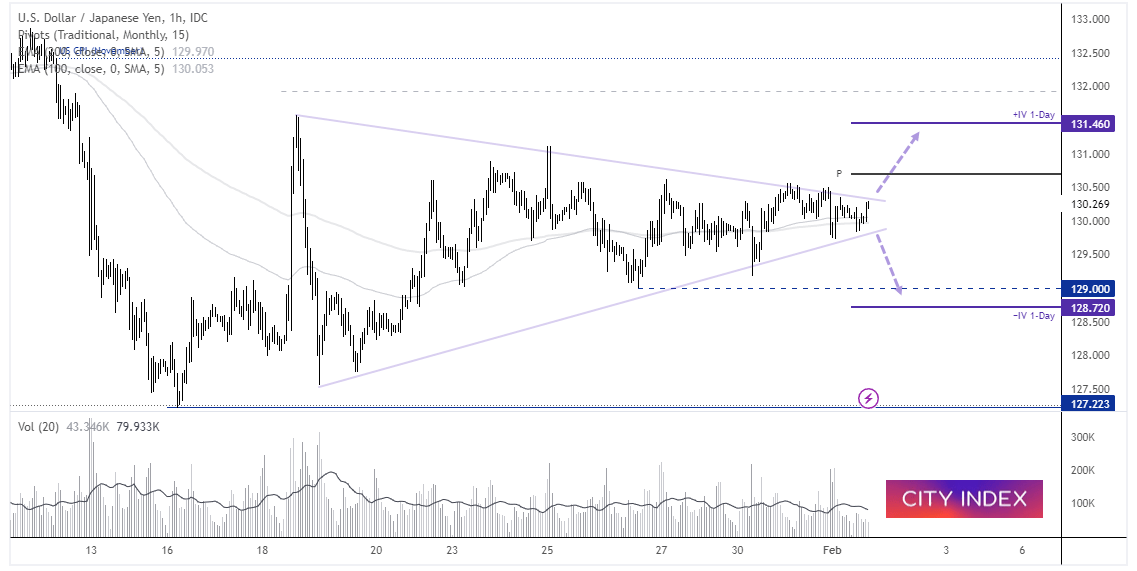

USD/JPY 1-hour chart:

We can see on the hourly chart that prices have converged within a triangle a volatility receded ahead of the FOMC meeting. Yet implied volatility clearly favours a breakout, in one direction or other. In simple terms, a hawkish hike likely send USD/JPY higher and a dovish hike likely sends it lower. But by quite how far depend is down to how much of a surprise the outcome it. And as argued previously, the upside potential for the dollar is likely greater for a hawkish hike than the downside reaction for a dovish one, given markets expect a dovish undertone at today’s meeting.

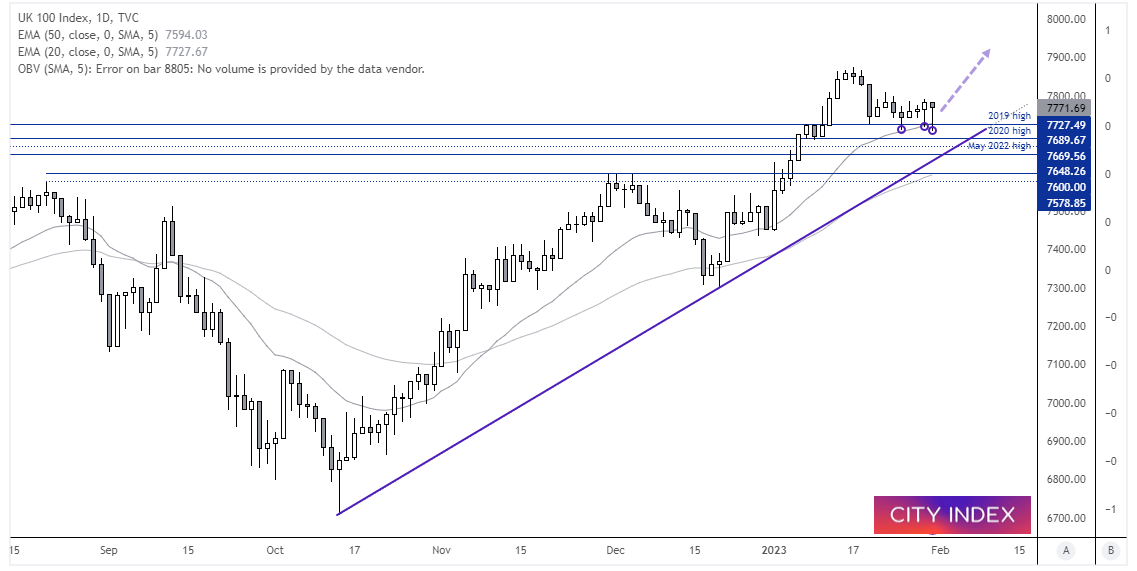

FTSE 100 daily chart:

The FTSE remains within a strong uptrend on the daily chart, although prices have pulled back to the 2019 highs and remain confined to a tight range. We have also seen three lower wicks on the daily chart which have respected the 20-day EMA as support, and the past two days have presented potential bullish hammers.

With the pending FOMC meeting likely to keep volatility capped today, we may need to be patient for any anticipated leg higher. But given how support has done its job, bulls may be interested in dips above this week’s lows. But if the Fed deliver a dovish hike and the BOE deliver the last 50bp hike in the cycle (and even hint at a pause), it could potentially FTSE to new cycle highs towards 8,000.

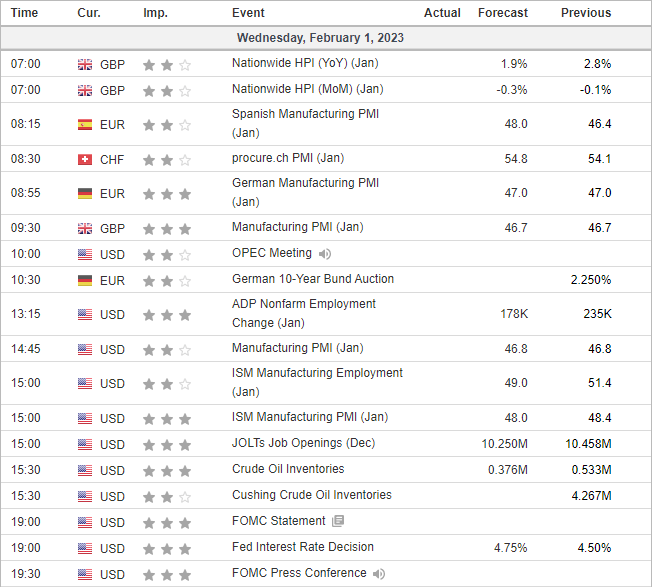

Economic events up next (Times in GMT)