- Australia's ASX 200 index rose by 39.3 points (0.58%) and currently trades at 6,850.20

- Japan's Nikkei 225 index has fallen by -70.12 points (-0.26%) and currently trades at 27,361.72

- Hong Kong's Hang Seng index has risen by 289.93 points (1.89%) and currently trades at 15,607.60

- China's A50 Index has fallen by -60.75 points (-0.51%) and currently trades at 11,737.39

UK and Europe:

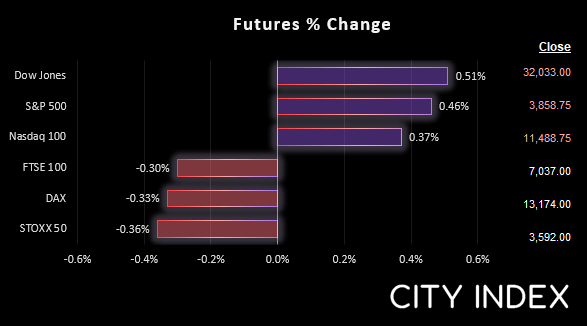

- UK's FTSE 100 futures are currently down -22 points (-0.31%), the cash market is currently estimated to open at 7,034.07

- Euro STOXX 50 futures are currently down -13 points (-0.36%), the cash market is currently estimated to open at 3,592.31

- Germany's DAX futures are currently down -43 points (-0.33%), the cash market is currently estimated to open at 13,152.81

US Futures:

- DJI futures are currently up 166 points (0.52%)

- S&P 500 futures are currently up 43.5 points (0.38%)

- Nasdaq 100 futures are currently up 17.5 points (0.46%)

Asian equities were mixed overnight, with China’s markets gapping higher of rumours of the ‘plunge protection team’ stepping in, the Nikkei tracking the Nasdaq 100 lower, and the ASX 200 making a mild attempt to break out of its 3-week range.

One supporting feature for equity traders is the hope that the Fed will be less aggressive with rate hike. But in reality it still seems likely that the Fed will hike by 75bp, but the market estimate of that occurring have dropped from over 100% to 89.3% (so it’s still quite likely).

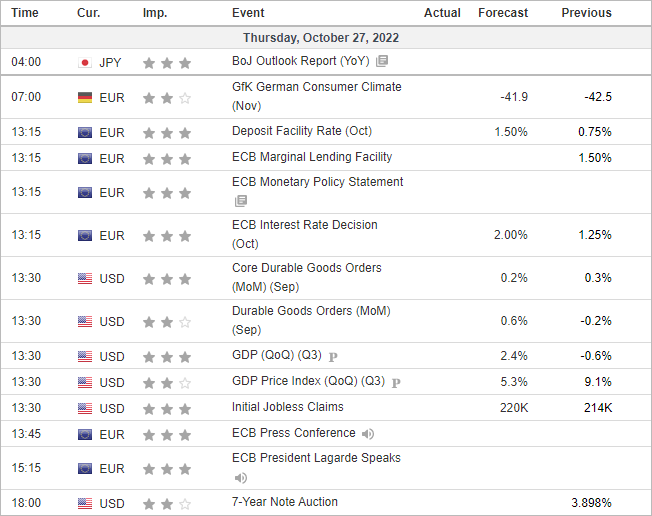

US Q3 GDP is released at 13:30:

US GDP is expected to drag itself out of a ‘technical recession’ and actually print a positive number. A technical recession is defined as two consecutive quarters of negative growth (or contraction, for want of a better word) – and the US ticked that box with Q1 GDP at -1.5% and Q2 GDP at -0.6%. The consensus is for GDP to have expanded by 2.4%. I don’t think a miss by a few percentage points here or there really matters in the grand scheme of things, but hold on to your hats if it surprises with a third negative print, as the markets latest obsession is whether we are at – or near to – a Fed pivot. And as excited as they have been at that potential scenario, I think we’ll need to wait until next year to get that answer.

But the ECB meeting is the main event at 13:15

The bigger event is of course the ECB meeting, where they are expected to hike interest rates by 75bp. But who knows, given we have seen the RBA and BOC take their foot of the hiking accelerator, perhaps they’ll surprise with a 50bp hike – given the high risk of a prolonged recession. But I’ll hang my hat on a 75bp hike as the ECB are far beyond the days of surprises.

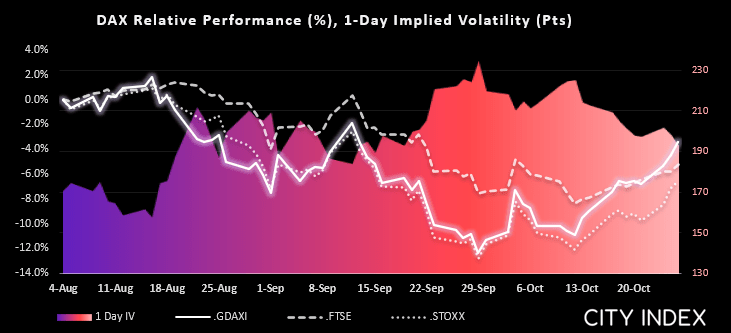

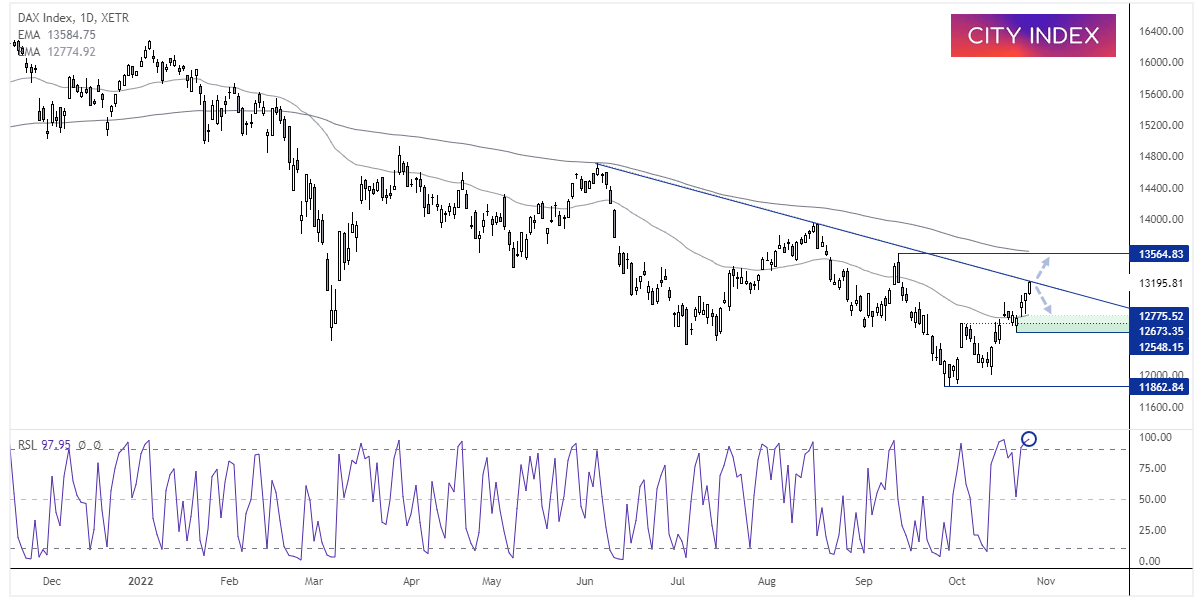

DAX 40 daily chart and implied volatility (IV):

Like the Nasdaq, the DAX has risen over 11% from its recent low. But its rally has stalled at trend resistance ahead of today’s ECB meeting. The RSI (2) is also in oversold territory which can (but not always) show that momentum is overextended to the upside. I suspect the DAX will take its directional cue from global equity movements over today’s ECB meeting, unless they throw a rare curveball. But traders have a clear line in the sand between bullish or bearish, depending on which side of trend resistance it trades.

FTSE 350 – Market Internals:

FTSE 350: 3903.4 (-2.26%) 26 October 2022

- 281 (80.29%) stocks advanced and 62 (17.71%) declined

- 2 stocks rose to a new 52-week high, 4 fell to new lows

- 22% of stocks closed above their 200-day average

- 67.14% of stocks closed above their 50-day average

- 25.71% of stocks closed above their 20-day average

Outperformers:

- + 11.18% - Wizz Air Holdings PLC (WIZZ.L)

- + 10.71% - Liontrust Asset Management PLC (LIO.L)

- + 9.69% - Synthomer PLC (SYNTS.L)

Underperformers:

- -13.79% - Bytes Technology Group PLC (BYIT.L)

- -5.12% - Standard Chartered PLC (STAN.L)

- -4.09% - Reckitt Benckiser Group PLC (RKT.L)

Economic events up next (Times in BST)

Asian Indices:

Asian Indices:

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade