Asian Indices:

- Australia's ASX 200 index rose by 42.5 points (0.57%) and currently trades at 7,556.20

- Japan's Nikkei 225 index has risen by 7.16 points (0.03%) and currently trades at 27,743.63

- Hong Kong's Hang Seng index has risen by 462.76 points (2.1%) and currently trades at 22,502.31

- China's A50 Index has risen by 259.01 points (1.88%) and currently trades at 14,009.59

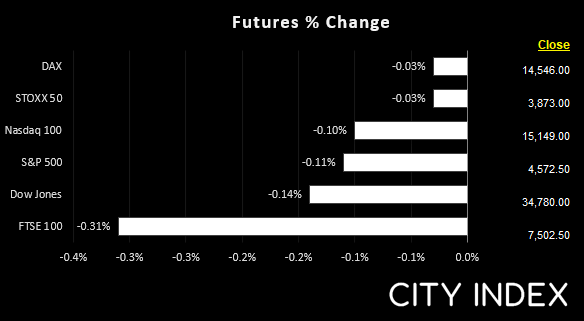

UK and Europe:

- UK's FTSE 100 futures are currently down -23.5 points (-0.31%), the cash market is currently estimated to open at 7,535.42

- Euro STOXX 50 futures are currently down -1 points (-0.03%), the cash market is currently estimated to open at 3,950.12

- Germany's DAX futures are currently down -4 points (-0.03%), the cash market is currently estimated to open at 14,514.16

US Futures:

- DJI futures are currently down -49 points (-0.14%)

- S&P 500 futures are currently down -15.5 points (-0.1%)

- Nasdaq 100 futures are currently down -5.25 points (-0.11%)

Asian equity markets mostly tracked Wall Street higher overnight with the Hang Seng and China A50 taking the lead. Japan’s were the exception as their markets moved lower on concerns for the corporate outlook. Equity futures for Europe and US were lower overnight as the US and Europe continue to plan sanctions for Russia. Joe Biden has since called for a trial of Putin due to war crimes, which Russia have denied.

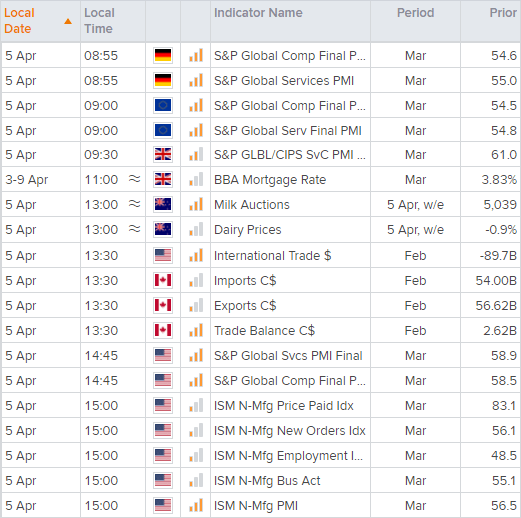

Final PMI’s for UK and Germany

The final PMI reads for Germany are scheduled for 08:55 BST. Perhaps not surprisingly, the war in Ukraine dragged Germany’s manufacturing activity to an 18-month low due to lower export demand, higher prices and supply disruptions. Yet at 56.90 it remained expansive and above its long-term average of 53.32, so from that metric it doesn’t look too bad. As with all final reads, we’d need to see a relatively large deviation from the flash report (and expectations) to provoke a large market reaction, so a surprise upside revision may be the bet hope for euro to respond appropriately, given it is not really expected. The final read for the UK’s services PMI is at 09:30 which saw it fall from a 9-month high of 60.5, down to 55.5.

ISM services PMI to fan stagflation fears?

ISM services PMI is released at 15:00. On Friday we saw the manufacturing PMI fall to a 16-month low and (more worrying) the new orders sub index fall to 53.8, its lowest level since the pandemic. Of course, prices were rising with the prices paid index hitting a 9-mont high and employment was booming as it hit a post-pandemic high. Ultimately this feeds back into the narrative of slower growth with rising inflation, stemming stagflation fears. Although for a true stagflation environment we’d need to see employment fall and unemployment rise, which is the key ingredient lacking.

And this is important for today’s services PMI as the patterns are similar to manufacturing. Only the employment index contracted in February for the first time since the pandemic. If we continue to see a faster pace of employment contraction, higher prices and lower new orders, perhaps equity markets will take notice and reconsider their current bullish stance.

What are economic indicators?

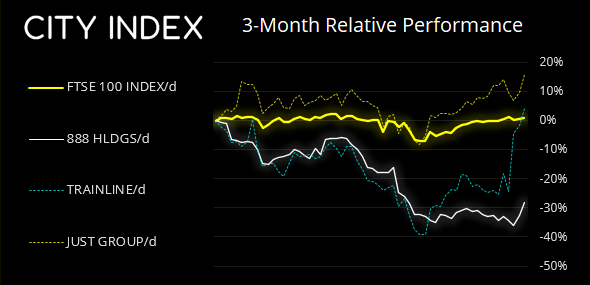

FTSE: Market Internals

FTSE 350: 4243.14 (0.28%) 04 April 2022

- 220 (62.68%) stocks advanced and 116 (33.05%) declined

- 19 stocks rose to a new 52-week high, 3 fell to new lows

- 36.47% of stocks closed above their 200-day average

- 54.13% of stocks closed above their 50-day average

- 20.23% of stocks closed above their 20-day average

Outperformers:

- + 6.69% - 888 Holdings PLC (888.L)

- + 6.18% - Trainline PLC (TRNT.L)

- + 5.82% - Just Group PLC (JUSTJ.L)

Underperformers:

- -4.11% - Bridgepoint Group PLC (BPTB.L)

- -3.84% - Ferrexpo PLC (FXPO.L)

- -3.11% - Clarkson PLC (CKN.L)

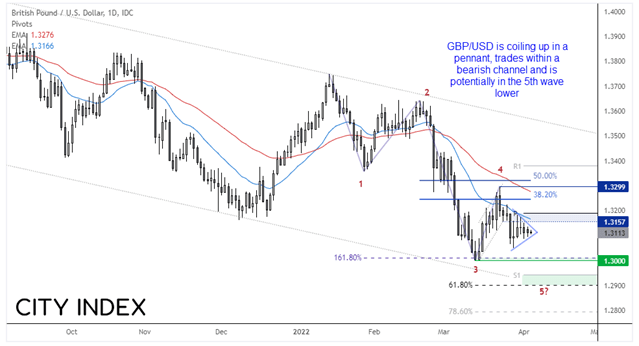

GBP/USD coils up near its cycle lows

We can see on the daily chart that GBP/USD is trading within a bearish channel, and is seemingly within a five-wave impulsive move lower. If so, it is within its 5th wave which requires a break below 1.3000 as part of its last leg lower.

The 20-day has provided dynamic resistance and prices are coiling within a pennant pattern. Due to the bearish trend we favour a downside break, but such the main feature of a coiling pattern is that is means a period of volatility is approaching. So even if we see an initial upper spike, our bias remains bearish below 1.3200. Our initial target is the 1.3000 low, with the potential for a move to 1.2900 near the monthly 1 pivot, 61.8% Fibonacci projection and lower channel line.

RBA held rates yet a hike could be on the cards

The RBA held interest rates as widely expected, yet it remained up for debate as to whether they would retain their dovish views (against market pricing) up to and through the general election. Yet by removing the word 'patient' from their statement is as good a sign from the 'reserved' RBA as we can expect under the circumstances. In recent years they have preferred to use public speeches or even newspapers to reveal their policy changes, and perhaps we'll see more of this when the general election is out of the way. But it does now appear a hike is on the cards within the next few months. AUD is the strongest major of the session and rallied just shy of our 0.7600 upside target outlined in today's Asian Open report.

Up Next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade