Asian Indices:

- Australia's ASX 200 index rose by 4.7 points (0.06%) and currently trades at 7,366.70

- Japan's Nikkei 225 index has risen by 517.7 points (1.81%) and currently trades at 29,068.63

- Hong Kong's Hang Seng index has fallen by -77.39 points (-0.31%) and currently trades at 25,253.57

UK and Europe:

- UK's FTSE 100 futures are currently down -8.5 points (-0.12%), the cash market is currently estimated to open at 7,225.53

- Euro STOXX 50 futures are currently down -1.5 points (-0.04%), the cash market is currently estimated to open at 4,181.41

- Germany's DAX futures are currently down -14 points (-0.09%), the cash market is currently estimated to open at 15,573.36

US Futures:

- DJI futures are currently up 382.2 points (1.09%)

- S&P 500 futures are currently down -49.75 points (-0.33%)

- Nasdaq 100 futures are currently down -5 points (-0.11%)

Indices

Asian equity markets were mostly lower overnight as China’s data dump landed on the soft side. GDP fell to 4.9% y/y (down from 7.9% and below the 5.2% expected) whilst industrial production and urban investments also missed the mark. Futures markets are pointing towards a slightly soft open in Europe today.

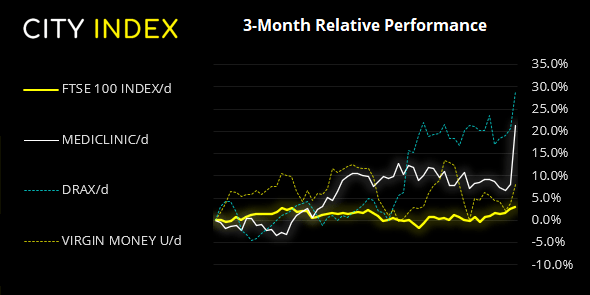

The FTSE 100 broke to its highest level since February 2020, which is when the COVID-induced selloff was just getting started for Western markets. Yet it break above the August high was not convincing enough for us to firmly believe it will stay above it. Should prices retrace then we would look for a higher low to form above 7159.

FTSE 350: Market Internals

FTSE 350: 4141.99 (0.37%) 15 October 2021

- 232 (66.10%) stocks advanced and 106 (30.20%) declined

- 14 stocks rose to a new 52-week high, 2 fell to new lows

- 58.97% of stocks closed above their 200-day average

- 33.33% of stocks closed above their 50-day average

- 18.23% of stocks closed above their 20-day average

Outperformers:

- + 12.3%-Mediclinic International PLC(MDCM.L)

- + 6.91%-Drax Group PLC(DRX.L)

- + 3.96%-Virgin Money UK PLC(VMUK.L)

Underperformers:

- ·-14.9%-Pearson PLC(PSON.L)

- ·-8.15%-Darktrace PLC(DARK.L)

- ·-3.41%-RHI Magnesita NV(RHIM.VI)

Forex:

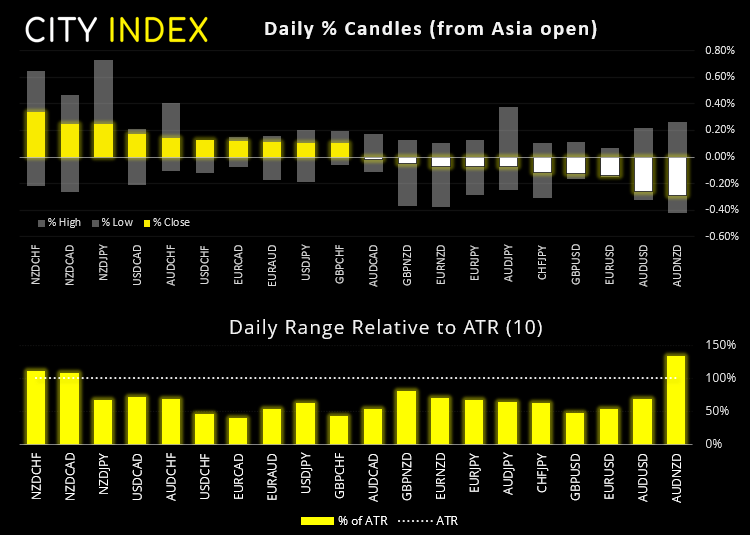

NZD was higher earlier in the session due to stronger-than-expected inflation. At 4.9% y/y, CPI has risen at its fastest rate since the 5.3% peak in July 2011. This all but confirms another hike could be due this year from RBNZ, although the Kiwi dollar failed to hold onto early gains following China’s weak GDP.

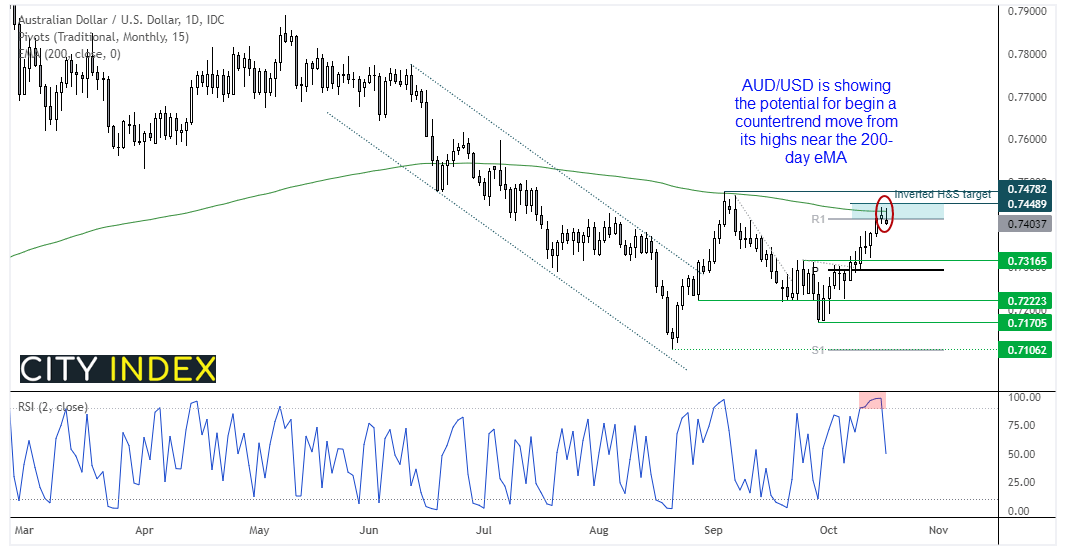

The Australian dollar has held up surprisingly well considering the weak GDP print from China. But that is not to say it can’t move lower from here. Its rally from the 0.7170 low has seen little I the way of a pullback, and Friday’s trade produced a Spinning Top Doji at the 200-day eMA and monthly R1 pivot. RSI (2) was also overbought at 98.8 on Friday to suggest overextension to the upside.

At the time of writing the Aussie is carving out a bearish pinbar on the daily chart although, with two trading sessions left in the day, we doubt it will close around current prices. So perhaps traders across Europe and the US may decide to book or a few profits or switch to the short side as part of a countertrend move.

USD/JPY remained bid overnight and probed Friday’s high. The next major resistance level for bulls to conquer is the October 2018 high at 114.55. And perhaps it will have another crack today, with the 50-hour eMA providing support and a Morning Star pattern (bullish reversal) appearing on the 1-hour chart.

At 10:30 BST Fed board member Randal Quarles speaks on the “Financial Stability Board”. Then BOC’s Deputy Governor Timothy Lane joins a panel discussion hosted by the Institute of International Economics.

Commodities:

Gold remains in the doldrums after Friday’s selloff. It is consolidating near Friday’s lows, so if the weekly pivot (1772.5) continues to cap as resistance, a break of last week’s low assumes bearish continuation.

Copper managed to trade higher despite weak China data and traded at its highest level since its May high. Yet with resistance nearby the reward to risk ratio for bulls around current levels seems unappealing.

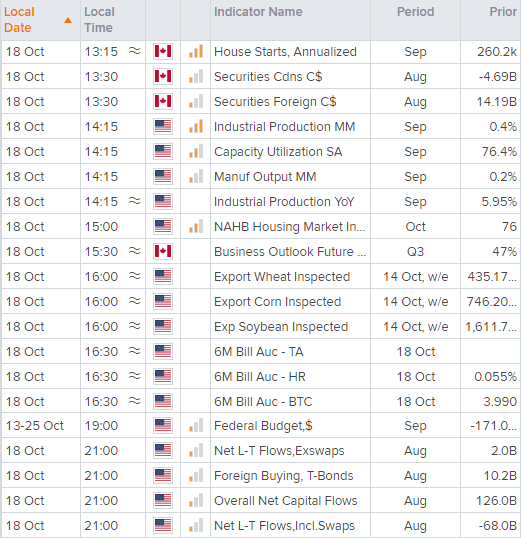

Up Next (Times in BST)

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade