Asian Indices:

- Australia's ASX 200 index fell by -22.5 points (-0.32%) and currently trades at 7,105.20

- Japan's Nikkei 225 index has fallen by -248.23 points (-0.85%) and currently trades at 28,974.54

- Hong Kong's Hang Seng index has fallen by -124.74 points (-0.63%) and currently trades at 19,797.71

- China's A50 Index has fallen by -178.64 points (-1.29%) and currently trades at 13,616.80

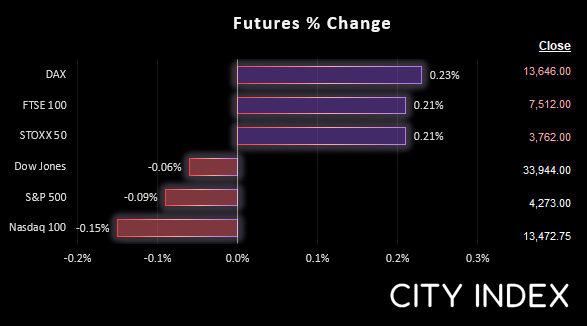

UK and Europe:

- UK's FTSE 100 futures are currently up 15 points (0.2%), the cash market is currently estimated to open at 7,530.75

- Euro STOXX 50 futures are currently up 7 points (0.19%), the cash market is currently estimated to open at 3,763.06

- Germany's DAX futures are currently up 26 points (0.19%), the cash market is currently estimated to open at 13,652.71

US Futures:

- DJI futures are currently down -18 points (-0.05%)

- S&P 500 futures are currently down -19 points (-0.14%)

- Nasdaq 100 futures are currently down -3.5 points (-0.08%)

Asian equity markets took the obligatory step of tracking Wall Street lower following the FOMC minutes, with China leading the way lower. Yet the ASX was the best of a bad bunch, helped by the fact that yesterday’s weaker-than-expected wage growth has removed some pressure from the RBA to hike so aggressively.

But today’s employment data was a mixed bag, with unemployment hitting a 48-year low whilst job growth contracted at its fastest pace since October. But to see 86k full-time jobs disappear has come as a surprise, and likely noted by the RBA. And that could tip the scales towards a 25bp hike at their next meeting over a 50bp hike – and in turn provide further relief to equity traders (and potentially support the ASX) which is holding above 7100 despite deeper selloffs amongst its peers.

Elsewhere it was a quiet session for currency and commodity markets, which remained trapped within tight ranges.

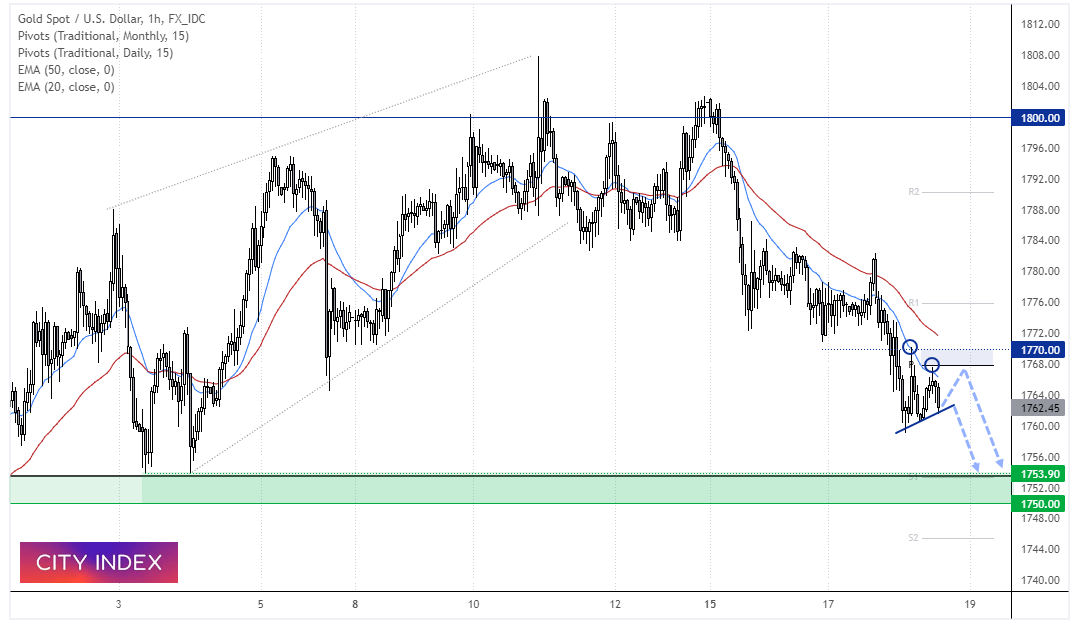

Gold 1-hour chart:

Gold didn’t hold above $1800 for long before bears regain control, and a strong bearish trend is now apparent on the 1-hour chart. And I think gold might continue to struggle over the near-term now that the US dollar is perking up again. It’s trading in a tight range today but near yesterday’s post-FOMC lows, so downside risks remain in place in today’s European and US sessions.

The 20-bar eMA and daily pivot point is capping as resistance, and prices are forming a potential continuation pattern such as a pennant or triangle. Bears could either seek a break of the retracement line near the lows, fade into pullbacks below the daily pivot point or wait for evidence of a swing high for potential shorts. The next logical support zone sits between $1753 - $1750.

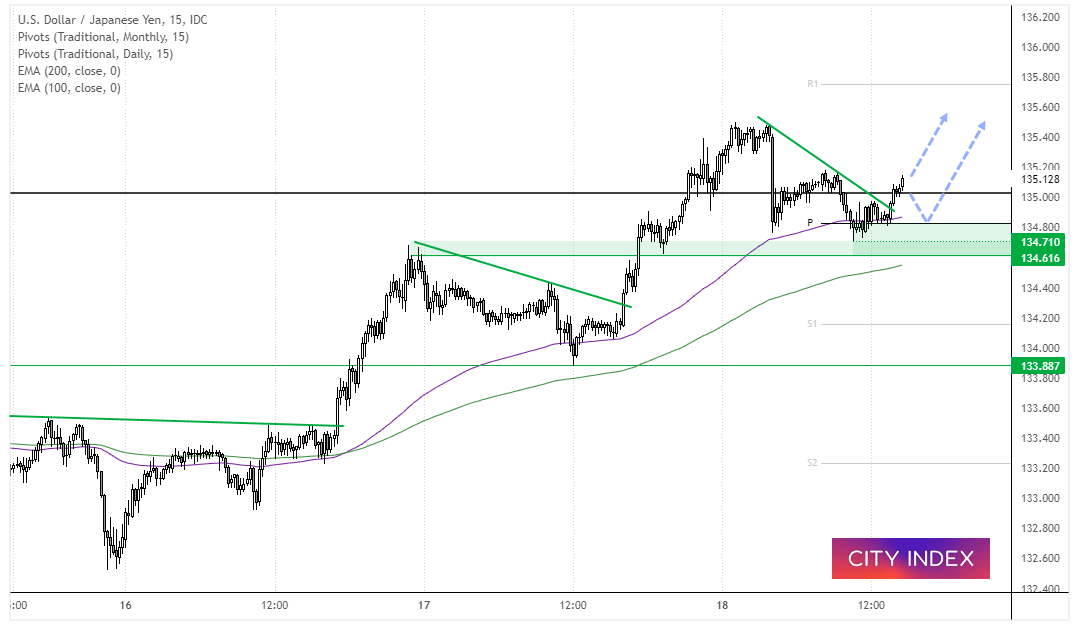

USD/JPY 1-hour chart:

History doesn’t repeat, but it can rhyme. And that’s what we’re hoping to see on USD/JPY today. Yesterday’s bullish bias played out quite well, having spent the Asian hours retracing before breaking higher in Europe and continuing to do so in the US session. Today we saw prices retrace throughout the European session, hold above the 100-bar eMA and break above trend resistance. From here we’d like to see prices hold above the 134.71 low (or 134.60 for added comfort) and make its way to the daily R1 around 135.80.

FTSE 350 – Market Internals:

FTSE 350: 4181.47 (-0.27%) 17 August 2022

- 62 (17.71%) stocks advanced and 284 (81.14%) declined

- 10 stocks rose to a new 52-week high, 6 fell to new lows

- 34.57% of stocks closed above their 200-day average

- 72.86% of stocks closed above their 50-day average

- 5.71% of stocks closed above their 20-day average

Outperformers:

- +9.43% - Balfour Beatty PLC (BALF.L)

- +3.96% - Darktrace PLC (DARK.L)

- +3.05% - Bank of Georgia Group PLC (BGEO.L)

Underperformers:

- -11.20% - ASOS PLC (ASOS.L)

- -7.84% - Persimmon PLC (PSN.L)

- -7.66% - Essentra PLC (ESNT.L)

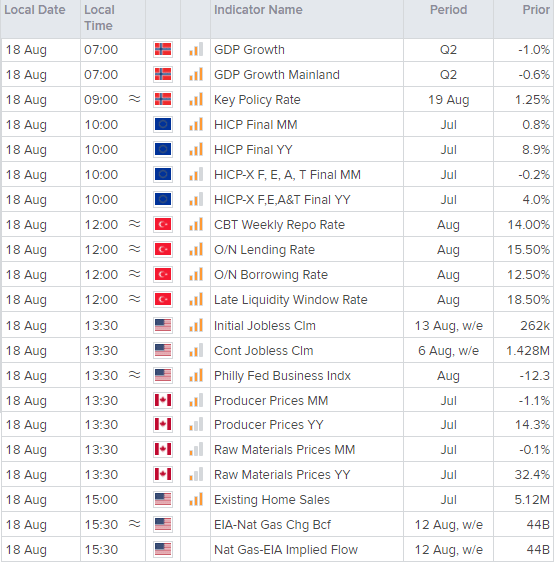

Economic events up next (Times in BST)

- Norway’s central bank is expected to raise interest by 50bp shortly, from 1.25% to 1.5%.

- European inflation data is then in focus at 10:00, although it likely goes without saying the bulk of any inflation will come from exorbitant energy costs.

- Turkey’s central bank also holds their policy meeting at 12:00 but rates are not expected to change (always expect the unexpected when it comes to Turkey).

- US jobless claims data is in focus at 13:30 – and regular readers should remember we’re looking at such data points to decipher whether the jobs market really has topped as I suspect it has.

- Philly Fed business index is also at 13:30 – and the majority of regional business sentiment reports continue to suggest that the ISM remains relatively high (for now).

- Canada’s producer prices is also at 13:30. We noted in yesterday’s CPI report that inflation remains hot, so a pickup in producer prices today will simply reinforce that view.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade