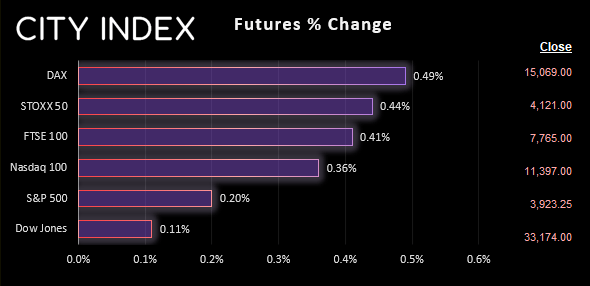

Asian Indices:

- Australia's ASX 200 index rose by 16.9 points (0.23%) and currently trades at 7,452.20

- Japan's Nikkei 225 index has risen by 90 points (0.34%) and currently trades at 26,495.23

- Hong Kong's Hang Seng index has risen by 245.34 points (1.13%) and currently trades at 21,896.32

- China's A50 Index has risen by 63.99 points (0.46%) and currently trades at 13,970.52

UK and Europe:

- UK's FTSE 100 futures are currently up 33.5 points (0.43%), the cash market is currently estimated to open at 7,780.79

- Euro STOXX 50 futures are currently up 18 points (0.44%), the cash market is currently estimated to open at 4,112.28

- Germany's DAX futures are currently up 73 points (0.49%), the cash market is currently stimated to open at 14,993.36

US Futures:

- DJI futures are currently up 37 points (0.11%)

- S&P 500 futures are currently up 40.5 points (0.36%)

- Nasdaq 100 futures are currently up 8 points (0.2%)

Let us assume China has reached peak covid as claimed, we also need to factor in the mass migrations across China expected to happen today for the biggest event of the year next week – Chinese lunar new year. Still, the yen is the weakest currency and equity futures point to a slightly higher open. But as you can see below, I am not ‘buying’ it, as this sets the stage for a rise in cases after the new year celebrations.

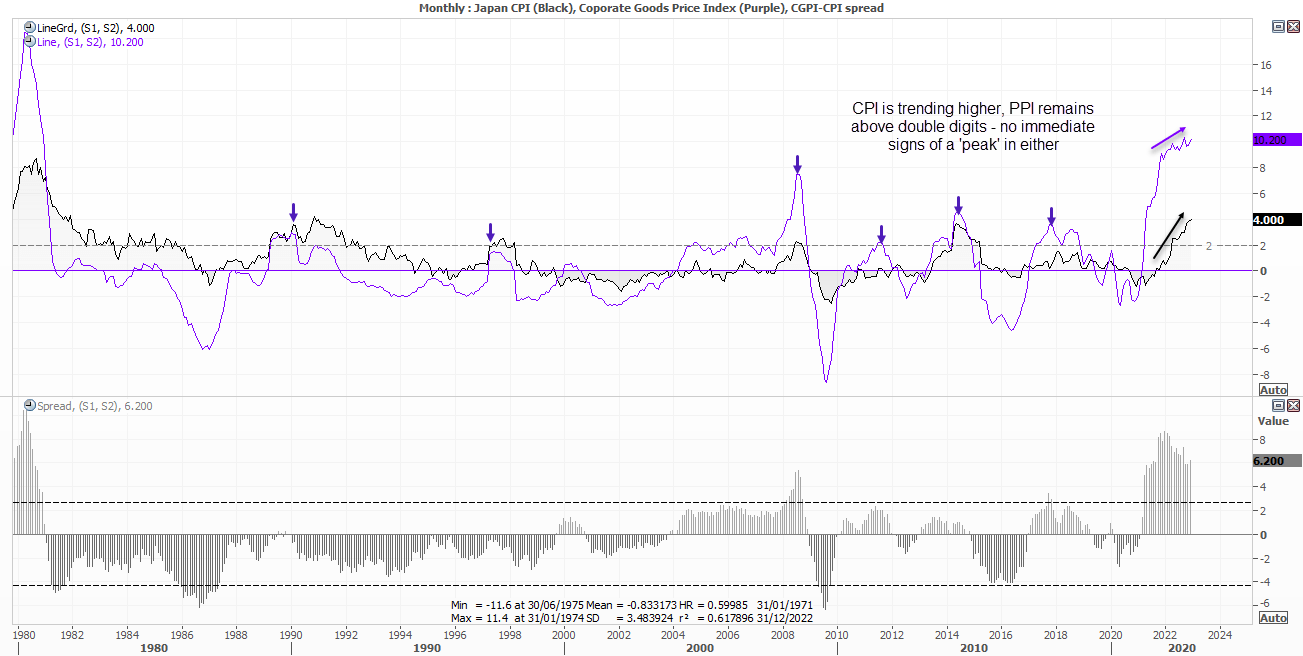

Japan’s inflation rises to a 41-year high

As sensational as it sounds, it was forecast to rise to 4% y/y anyway – but let’s not forget it is twice the BOJ’s target of 2%. Let’s take a step back and admire the view of Japan’s inflation and corporate goods prices (PPI) since 1980. Generally speaking, PPI peaks ahead of inflation – if not, they peak around the same time. As CPI is trending higher and PPI remains sticky around the 10% mark, it is hard to believe the BOJ will not have to raise rates, scrap their YCC policy at some point. But as Kuroda is till pushing the ultra-easy policy message, I doubt it will happen before his last meeting in March and instead will leave it to his successor from April onwards. And that could be very bullish for the yen in general (but not so great for the Nikkei). Certainly a theme to watch.

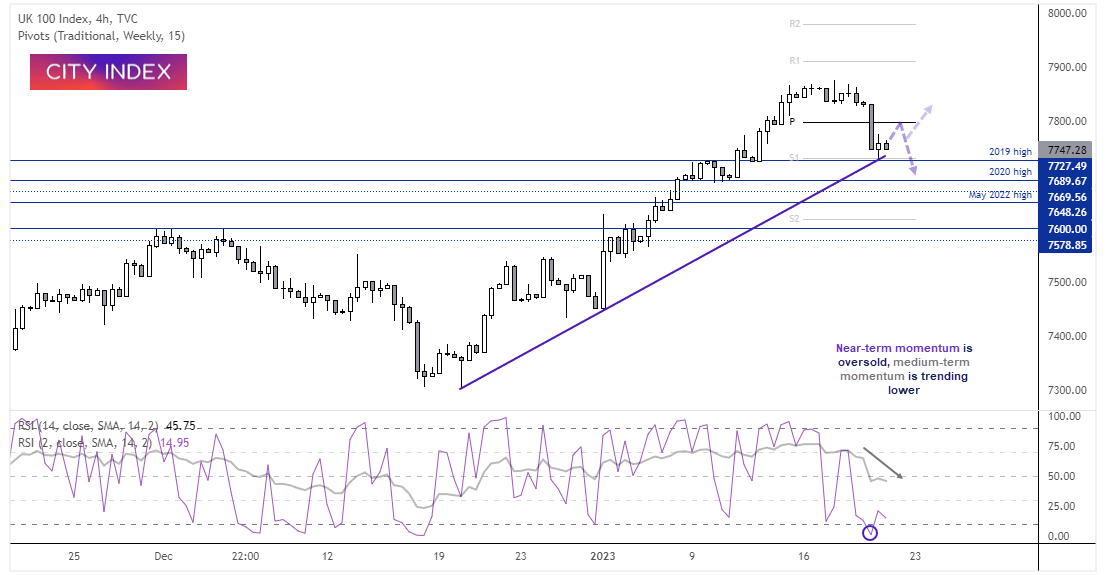

FTSE 100 daily chart:

The FTSE rallied over 17% between the October low and YTD, or 7.8% from the December low to the YTD high. All else aside, it’s fair to say a retracement was due. Prices pulled back aggressively yesterday before finding support at the 2019 high and bullish trendline, and as futures are pointing higher I see the potential for it to rise to 7800 (near the weekly pivot point) before trying to break lower. Note that RSI (2) was oversold yesterday to show near-term momentum as overbought, yet as the RSI (14) is below 50 and tracking prices lower, I suspect it may try to break below 7747 after an initial bounce. Just keep in mind there are several historical highs which could act as support, so traders may want to remain nimble as stick to lower timeframes.

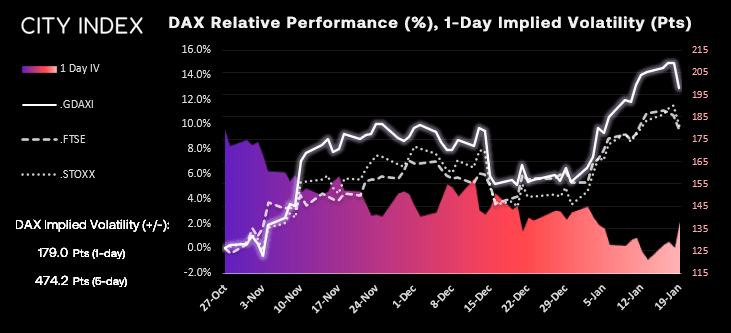

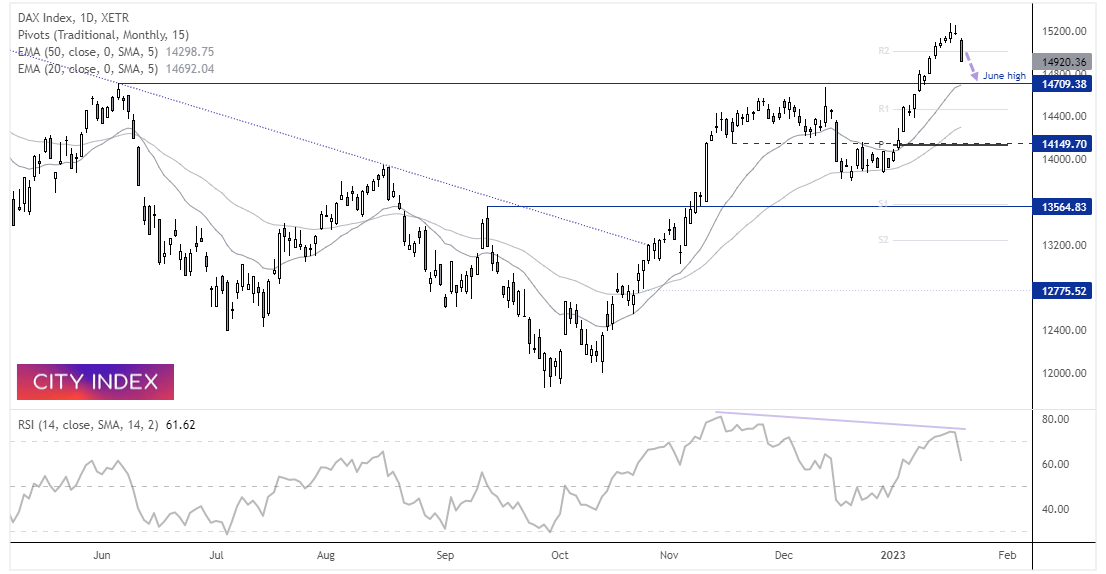

DAX implied volatility and daily chart:

The bias for DAX is similar to the FTSE (initial pullback before break of yesterday’s low) but is easier to see on the daily chart. The DAX closed at the low of the day yet futures point to a higher open. With the weekly R1 pivot sitting near the 15,000 level, we’re looking for signs of weakness beneath that key level for an intraday swing short. Next major support is the June 2022 high at 14709, although 14800 may also provide support along the way.

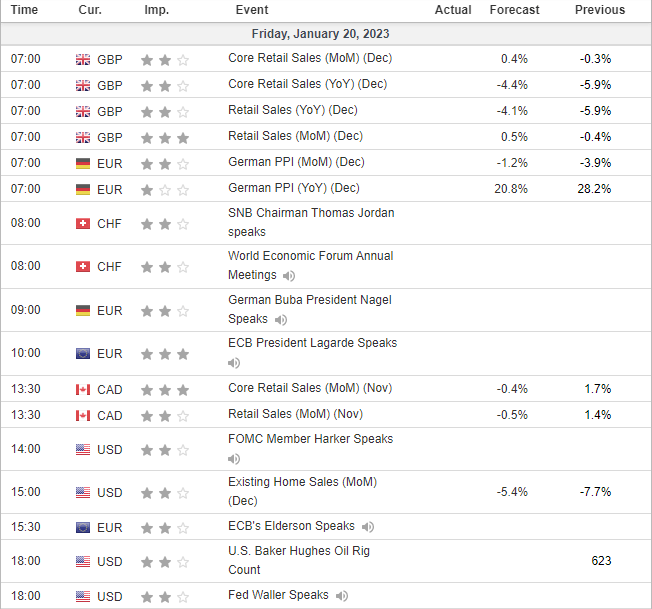

Economic events up next (Times in GMT)

UK retail sales are scheduled for 07:00 GMT and if it is to follow the trend of the US it may provide some disappointment. Although it is starting with low expectations anyway as the World cup and Black Friday sales failed to lift November’s sales, so unless shoppers splurged over Xmas then a contraction seems the more likely, given high levels of inflation and extensive media coverage of it.

German producer prices are also released alongside UK retail data, and at 28.2% y/y they still bring a tear to the eye. And is jut one of the reasons a “large number of ECB officials” wanted a more aggressive hike in December (likely 75bp) instead of the 50bp with a hawkish message. Still, it underscores the likelihood that the ECB are far from done with their tightening cycle yet, and another hot PPI print from Germany increases the odds further.

And on that note, Christine Lagarde is scheduled to speak at the WEF in Davos at 10:00 on a panel discussion titled: “Global Economic Outlook – is this the end of an era?”, whilst SNB chairman speaks at 08:00.