Asian Indices:

- Australia's ASX 200 index rose by 35.1 points (0.49%) and currently trades at 7,259.90

- Japan's Nikkei 225 index has risen by 86.58 points (0.32%) and currently trades at 27,510.54

- Hong Kong's Hang Seng index has risen by 85.49 points (0.43%) and currently trades at 20,029.00

- China's A50 Index has fallen by -22.93 points (-0.17%) and currently trades at 13,316.09

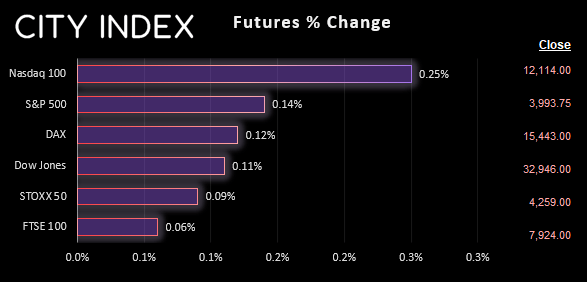

UK and Europe:

- UK's FTSE 100 futures are currently up 4.5 points (0.06%), the cash market is currently estimated to open at 7,939.61

- Euro STOXX 50 futures are currently up 4 points (0.09%), the cash market is currently estimated to open at 4,252.01

- Germany's DAX futures are currently up 19 points (0.12%), the cash market is currently estimated to open at 15,400.43

US Futures:

- DJI futures are currently up 40 points (0.12%)

- S&P 500 futures are currently up 30.75 points (0.25%)

- Nasdaq 100 futures are currently up 6 points (0.15%)

- Australian retail sales rose 1.9% in January, which keeps the pressure o the RBA to continue hiking interest rates

- Australia’s current account surplus rose to a 5-quarter high of A$14.1 billion

- New Zealand’s business outlook was its least pessimistic in four months according to NBNZ

- Whilst pricing intensions remain historically high, they were lower on the month

- Mixed data from Japan saw industrial output fall at its fastest pace in 8-months at -4.6%, yet retail sales rose 6.3% y/y

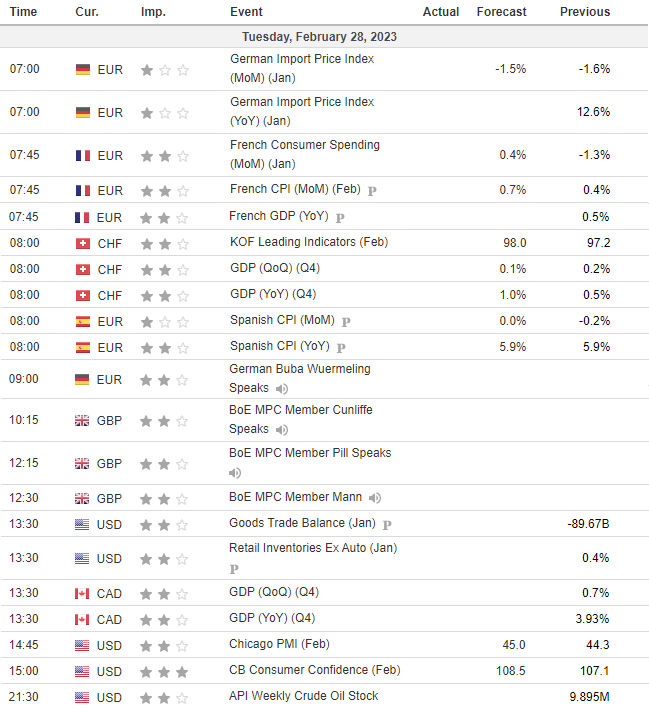

- BOE member Jon Cunliffe speaks at 10:15 GMT: Treasury Select Committee hearing: The crypto-asset industry (10.15am)

- BOE member Catherine Mann speaks at 12:30: Panellist at EIB Annual Forum and Chief Economists Meeting, ‘Interaction of monetary and fiscal policy and financing conditions’ Luxembourg

- It’s the last day of the month which leaves markets vulnerable to quirky price action due to month-end rebalancing

- Inflation data and consumer sentiment for France is scheduled for 07:45, with Spanish CPI at 08:00 alongside Swiss GDP

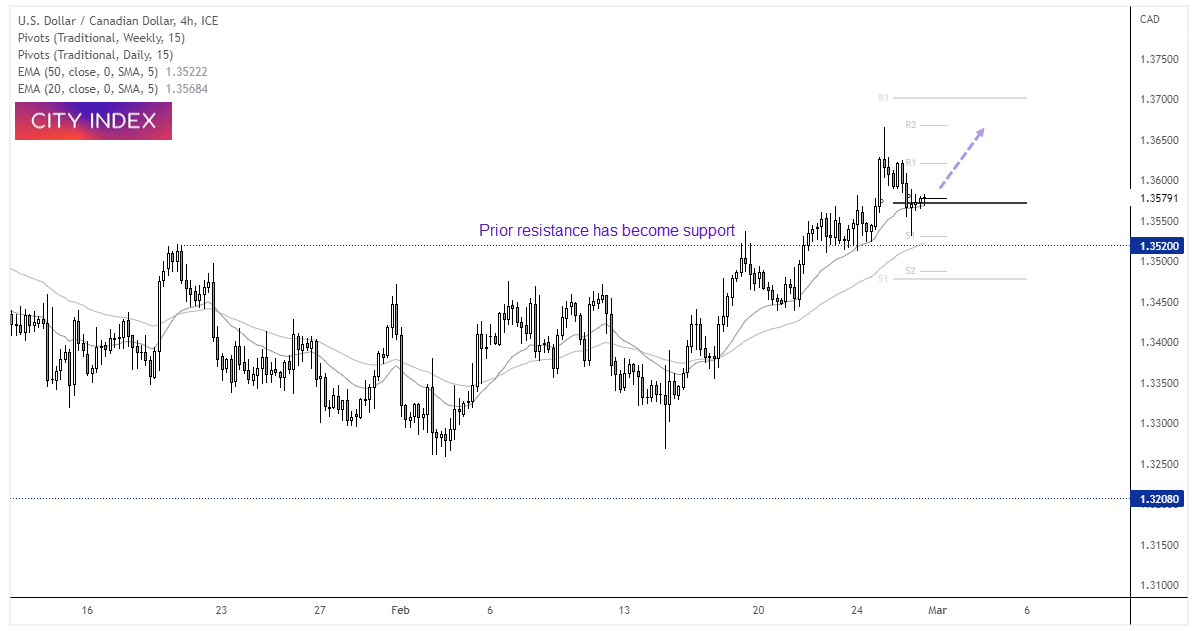

- US retail inventories is released alongside Canadian GDP at 13:30, which puts USD/CAD into focus for currency traders

USD/CAD 4-hour chart:

USD/CAD trades within a bullish trend on the 4-hour chart, with yesterday’s low forming above a prior resistance level. Prices are also back above the 20-dar EMA and the weekly pivot point, so perhaps we have seen the swing low. Strong economic data from the US could send the pair higher on bets of a more aggressive Fed, with a soft GDP report for Canada also likely to be beneficial to the bullish bias of USD/CAD.

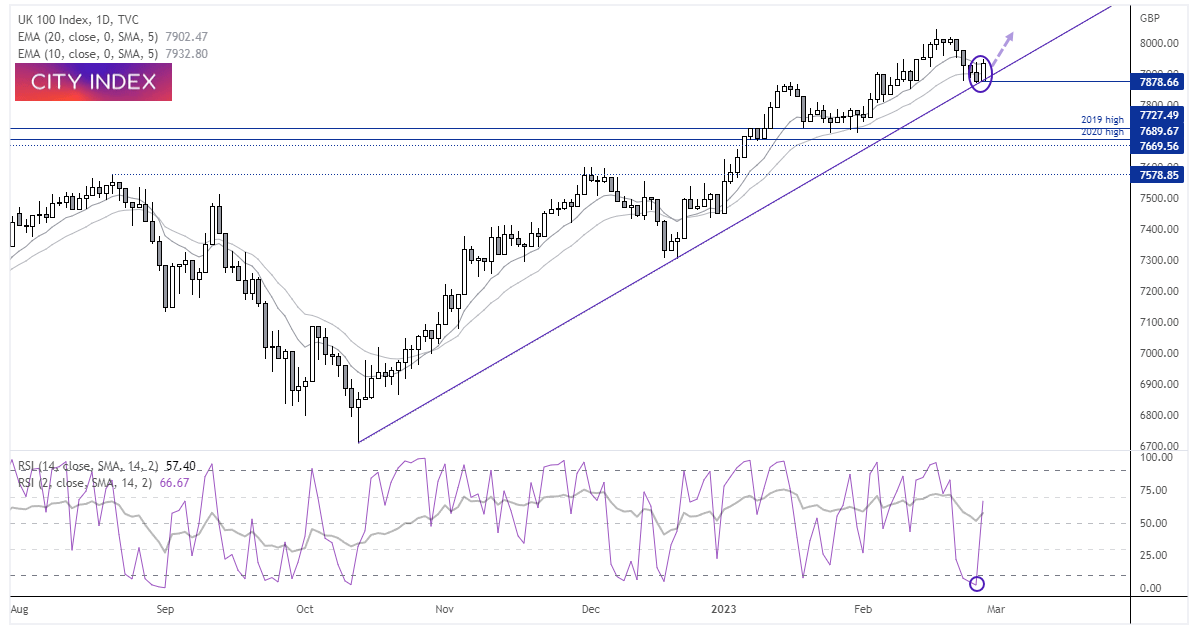

FTSE 100 daily chart:

The FTSE snapped a 4-day losing streak yesterday, after the pullback from its record high found support along the bullish trendline. A bullish engulfing candle also closed above the 10 and 20-day EMA’s, after the RSI (2) went into oversold territory the day prior. So it appears a swing low has formed and we’re looking for a move back above 8,000 whilst prices remain above last week’s low.

Economic events up next (Times in GMT)

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade