Asian Indices:

- Australia's ASX 200 index fell by -1.4 points (-0.02%) and currently trades at 6,986.70

- Japan's Nikkei 225 index has risen by 369.64 points (1.38%) and currently trades at 27,086.98

- Hong Kong's Hang Seng index has risen by 252.18 points (1.07%) and currently trades at 23,802.26

- China's A50 Index has fallen by -254.78 points (-1.7%) and currently trades at 14,769.78

UK and Europe:

- UK's FTSE 100 futures are currently up 39 points (0.53%), the cash market is currently estimated to open at 7,505.07

- Euro STOXX 50 futures are currently up 47.5 points (1.15%), the cash market is currently estimated to open at 4,184.41

- Germany's DAX futures are currently up 163 points (1.06%), the cash market is currently estimated to open at 15,481.95

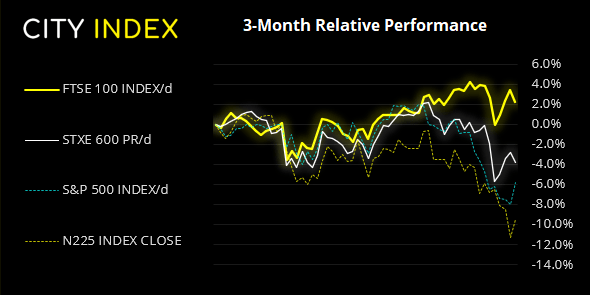

Futures markets have opened higher and the majority of Asian indices posted gains, suggesting we could see a lift in sentiment today unless bears return in force. And this flies in the face of North Korea’s confirmation that it had tested its biggest missile since 2017.FTSE futures are up around 0.5% although the STOXX 50 and DAX futures markets are currently up over 1%.

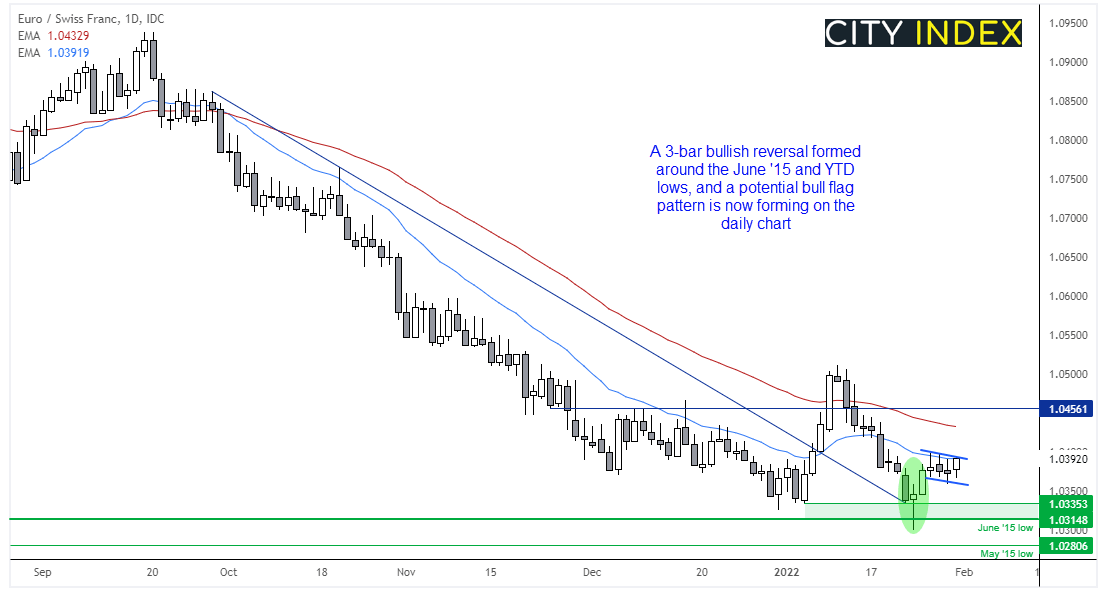

Potential bull flag on EUR/CHF

EUR/CHF has been in a strong downtrend since the marked topped in March 2021. However, price action is suggesting it is trying to turn the bearish ship around, or at the very least provide another countertrend bounce.

A bullish pinbar marked the low last Monday, which us the second candle or a 3-bar bullish reversal pattern called a Morning Star. Prices have since pulled back somewhat although trading along the 20-day eMA and forming a potential bull flag pattern. A measure move of the mast projects a target around 1.0456, although the 50-day eMA around 1.0423 could also be used as an interim target.

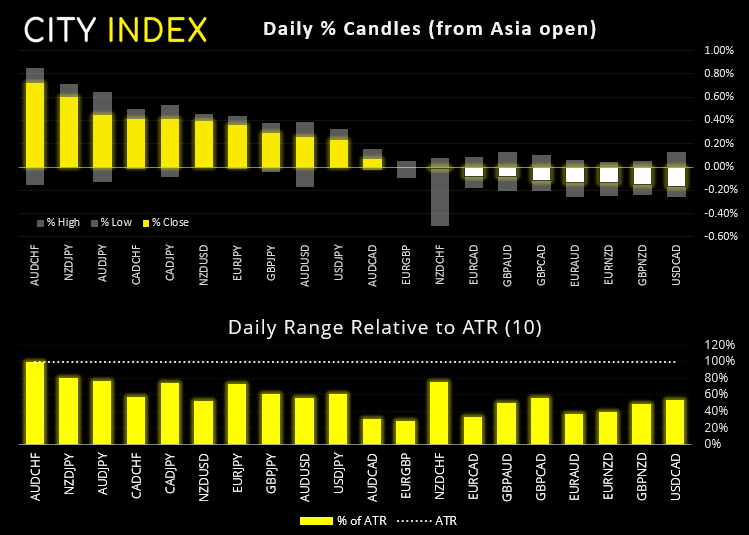

Elsewhere for currencies we saw a slight risk-on tone confirm the moves seen with equity traders with NZD and AUD being the strongest currencies overnight whilst CHF and JPY were the weakest. On that note, we are also keeping an eye on CHF/JPY as it is showing the potential to form a trough around the December high after an extended pullback.

Euro explained – a guide to the euro

WTI struggles to retest $90

We noted on Thursday how oil may be vulnerable to a pullback due to its bullish hammer at the highs, and that view remains in place given Friday also produced a bearish hammer. Whilst prices remain within the tight bullish channel and / or the October highs we suspect it will be a minor retracement at best. Whereas solid break below 85 invalidates the bullish channel, takes prices back beneath the October highs and likely suggests a deeper countertrend move is underway.

FTSE 350: Market Internals

FTSE 350: 4209.39 (-1.17%) 28 January 2022

- 82 (23.43%) stocks advanced and 262 (74.86%) declined

- 3 stocks rose to a new 52-week high, 22 fell to new lows

- 33.43% of stocks closed above their 200-day average

- 32.57% of stocks closed above their 50-day average

- 5.43% of stocks closed above their 20-day average

Outperformers:

- + 3.92% - 3I Infrastructure PLC (3IN.L)

- + 3.88% - HgCapital Trust PLC (HGT.L)

- + 3.46% - HarbourVest Global Private Equity Ltd (HVPEa.L)

Underperformers:

- -10.22% - Oxford BioMedica PLC (OXB.L)

- -8.04% - Carnival PLC (CCL.L)

- -7.56% - Ocado Group PLC (OCDO.L)

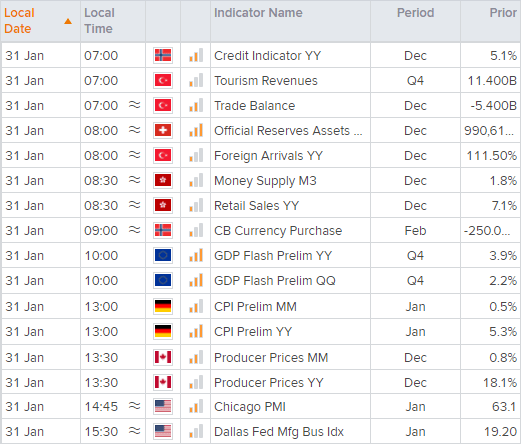

Up Next (Times in GMT)

GDP data for the eurozone is released at 10:00 GMT and, if Friday’s data set from Germany is anything to go by, it’s very likely we’ll see the quarterly read drop notably, with expectations for it to have grown just 0.3% from 2.2%. Germany then release CPI data at 13:00, which places euro pair into focus.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade