Asian Indices:

- Australia's ASX 200 index rose by 22.5 points (0.31%) and currently trades at 7,203.30

- Japan's Nikkei 225 index has risen by 118.01 points (0.42%) and currently trades at 27,960.34

- Hong Kong's Hang Seng index has risen by 64.39 points (0.33%) and currently trades at 19,528.02

- China's A50 Index has fallen by -10.49 points (-0.08%) and currently trades at 13,075.70

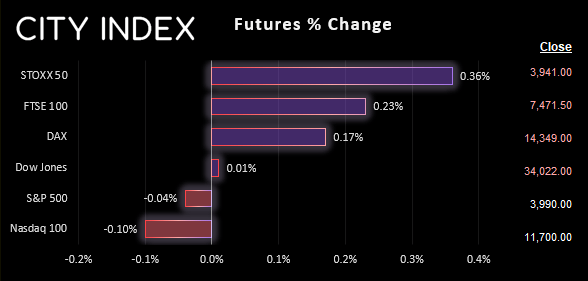

UK and Europe:

- UK's FTSE 100 futures are currently up 17 points (0.23%), the cash market is currently estimated to open at 7,462.97

- Euro STOXX 50 futures are currently up 14 points (0.36%), the cash market is currently estimated to open at 3,935.82

- Germany's DAX futures are currently up 25 points (0.17%), the cash market is currently estimated to open at 14,331.63

US Futures:

- DJI futures are currently up 5 points (0.01%)

- S&P 500 futures are currently down -12.25 points (-0.1%)

- Nasdaq 100 futures are currently down -1.5 points (-0.04%)

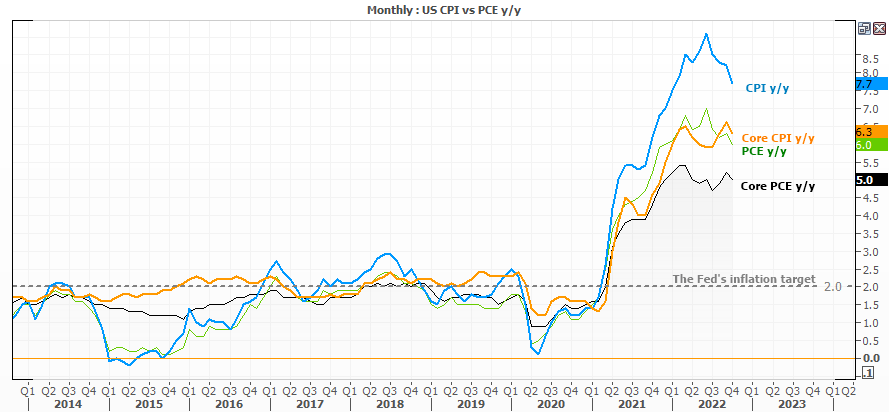

US inflation data is released at 13:30 BST and is hands down today’s main event. Friday’s higher than expected PPI has some investors nervous that today’s CPI will also come in hot. If we look at four main inflation reads for the US (CPI, core CPI, PCE and core PCE) then it certainly looks like the rate of inflation has topped, with CPI being the most prominent as food and energy prices continue to fall. Yet core CPI has only made a minor attempt to top out, so if we’re to see it unexpectedly tick higher today it would likely bolster the US dollar, as traders price in the potential for a more aggressive Fed.

- Asian equity markets were mostly higher on bets that US inflation will soften and lay the case for a slightly less hawkish FOMC meeting this week.

- Sentiment was also buoyant as China continued to scale back their COVID zero strategy with ambassador to the US saying curbs will continue to be relaxed and they look forward to international travellers soon.

- This also spilled over to oil prices which continued higher overnight after rising over 3% yesterday. TC Energy Corp’s pipeline from Canada to the US may face a prolonged outage after an oil spill was spotted in Kansan on Wednesday.

- It was less exciting in currency land with FX majors trading within tight ranges – which I doubt they will remain in after inflation data.

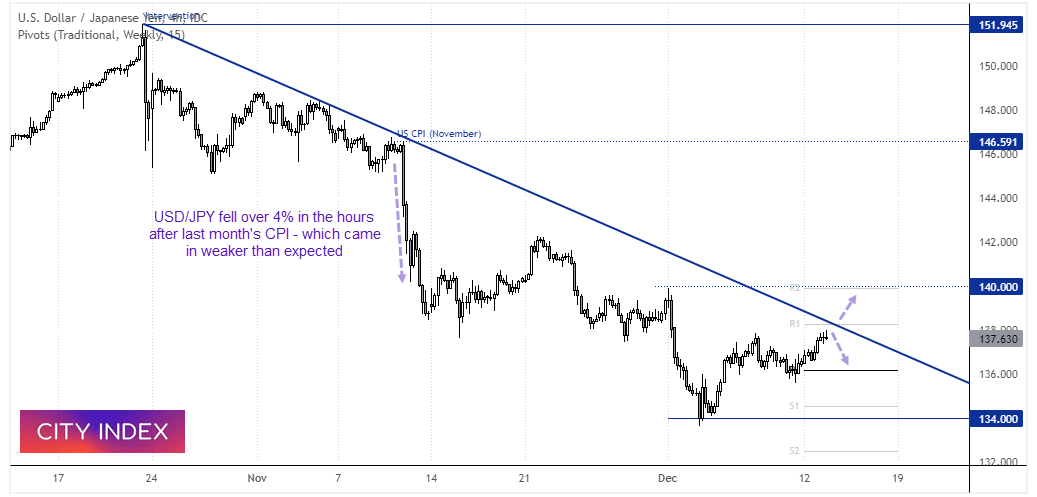

USD/JPY 4-hour chart:

Whilst I’ve outlined a bullish cases for the US dollar index on the daily chart, both sides of any bet should always be considered. And if inflation comes in softer than already expected, it could make for some volatile moves to the downside for the dollar – looking at how it reacted following weaner than expected CPI in November.

USD/JPY is within its third wave higher from the 134 low, which could be the beginning of a bullish trend or the final stages of a correction. Given trend resistance and the weekly R1 pivot are hovering nearby, we’re on guard for a swing high to form and its downtrend to continue. Whereas a break above the weekly R1 pivot invalids the trendline and signals a deeper correction.

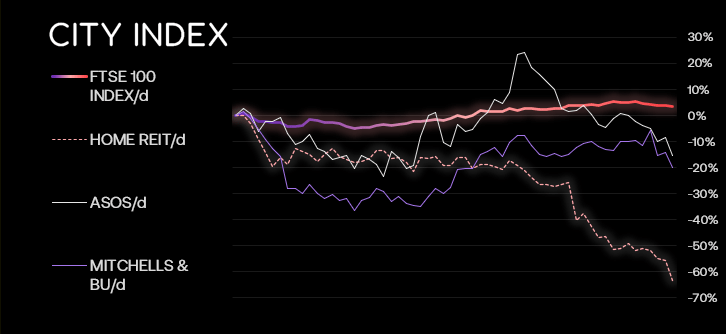

FTSE 350 market internals:

FTSE 350: 4109.99 (-0.41%) 12 December 2022

- 229 (65.43%) stocks advanced and 112 (32.00%) declined

- 3 stocks rose to a new 52-week high, 6 fell to new lows

- 12.57% of stocks closed above their 200-day average

- 50.57% of stocks closed above their 50-day average

- 5.43% of stocks closed above their 20-day average

Outperformers:

- + 8.19% - Volution Group PLC (FAN.L)

- + 5.52% - John Wood Group PLC (WG.L)

- + 3.40% - Helios Towers PLC (HTWS.L)

Underperformers:

- -17.24% - Home REIT PLC (HOMEH.L)

- -7.35% - ASOS PLC (ASOS.L)

- -6.63% - Mitchells & Butlers PLC (MAB.L)

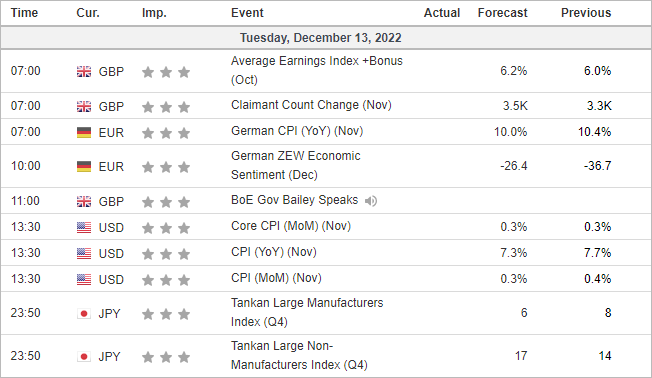

Economic events up next (Times in GMT)