Asian Indices:

- Australia's ASX 200 index fell by -49.5 points (-0.74%) and currently trades at 6,681.20

- Japan's Nikkei 225 index has fallen by -77.63 points (-0.29%) and currently trades at 26,929.33

- Hong Kong's Hang Seng index has fallen by -28.06 points (-0.17%) and currently trades at 16,252.16

- China's A50 Index has risen by 3.51 points (0.03%) and currently trades at 12,402.26

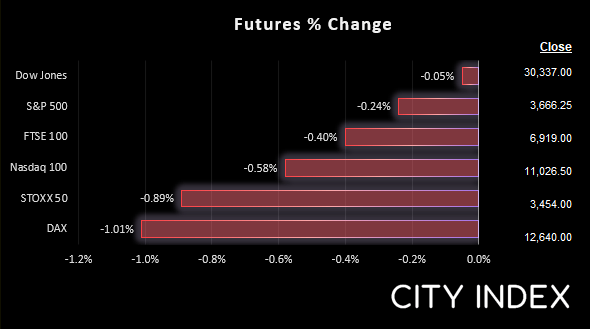

UK and Europe:

- UK's FTSE 100 futures are currently down -27.5 points (-0.4%), the cash market is currently estimated to open at 6,916.41

- Euro STOXX 50 futures are currently down -30 points (-0.86%), the cash market is currently estimated to open at 3,462.85

- Germany's DAX futures are currently down -124 points (-0.97%), the cash market is currently estimated to open at 12,643.41

US Futures:

- DJI futures are currently down -28 points (-0.09%)

- S&P 500 futures are currently down -70.5 points (-0.64%)

- Nasdaq 100 futures are currently down -10.25 points (-0.28%)

The fact that US yields continued marching higher yesterday and have extended those gains today is a clear sign that the markets know the Fed mean business regarding rate hikes. But the reality is sinking in that the Fed will have to break something to get the inflation genie back in the bottle. And with bond prices remaining in freefall, investors do not see that happening quickly.

USD/JPY tracks yields higher

And with higher yields comes a higher USD/JPY. The BOJ have increased their amount of bond purchases at today’s scheduled event. But the threat of currency intervention remains in place, with Japan’s Finance Minister saying that speculators will be dealt with “strictly”.

Japan’s nationwide CPI rose to an 8-yer high of 3%, making it the sixth month above the BOJ’s 2% target. And the fact that the yen continued to weaken despite another hot CPI print from Japan underscores how traders expect no change in policy from the BOJ next Friday, who are more likely to reiterate their ultra-loose policy. What is worth keeping in mind is that the MOF intervened in the currency following last month’s BOJ meeting, when BOJ reiterated their ultra-loose policy…

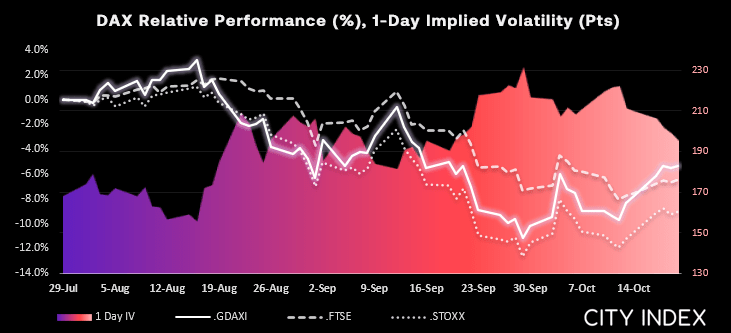

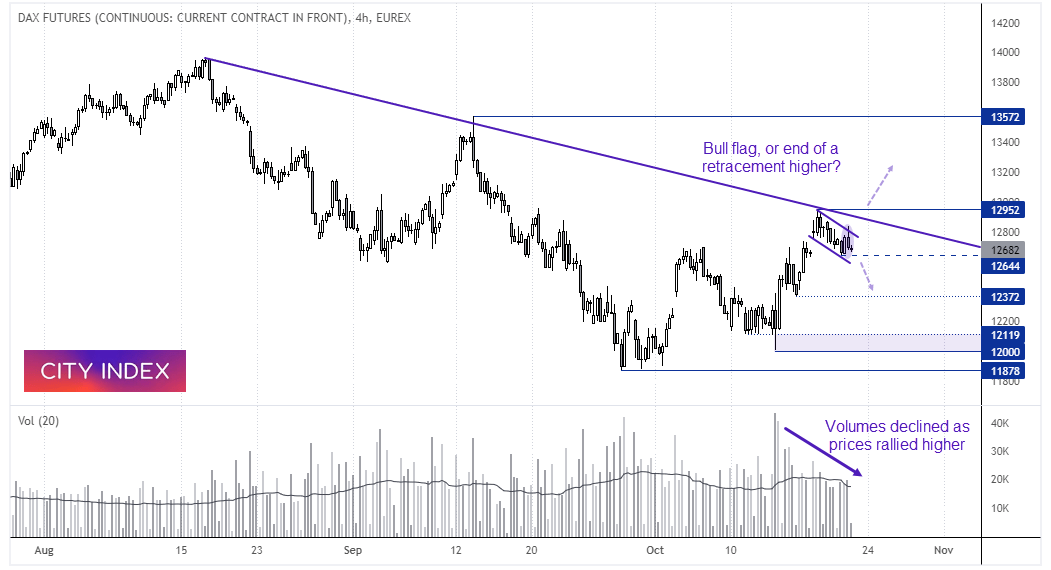

DAX Performance:

The DAX has rallied from the September low in three waves, which could either be part of a new bullish trend or part of a 3-wave retracement. If we look at price action alone, the rally from 12,000 has been strong and a potential bull-flag is forming. Should we see prices break above 13,000 then we’ll assume the bullish trend is set to continue.

But there are two potential flies in the ointment which could scupper such a break higher. The rally has been seen on declining volumes, which suggests the ‘rally’ is corrective and not impulsive. Furthermore, the bull flag remains stuck beneath trend resistance. And given we recently saw a -bar reversal on the four-hour chart within the supposed bull flag, we are on guard for a break beneath yesterday’s low to assume bearish continuation.

FTSE 350 – Market Internals:

FTSE 350: 3827.73 (0.27%) 20 October 2022

- 237 (67.71%) stocks advanced and 106 (30.29%) declined

- 1 stocks rose to a new 52-week high, 2 fell to new lows

- 14.57% of stocks closed above their 200-day average

- 98.29% of stocks closed above their 50-day average

- 17.71% of stocks closed above their 20-day average

Outperformers:

- + 10.09% - Jupiter Fund Management PLC (JUP.L)

- + 8.62% - Darktrace PLC (DARK.L)

- + 7.18% - John Wood Group PLC (WG.L)

Underperformers:

- -4.20% - ITV PLC (ITV.L)

- -4.05% - Liontrust Asset Management PLC (LIO.L)

- -4.00% - Coats Group PLC (COA.L)

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade