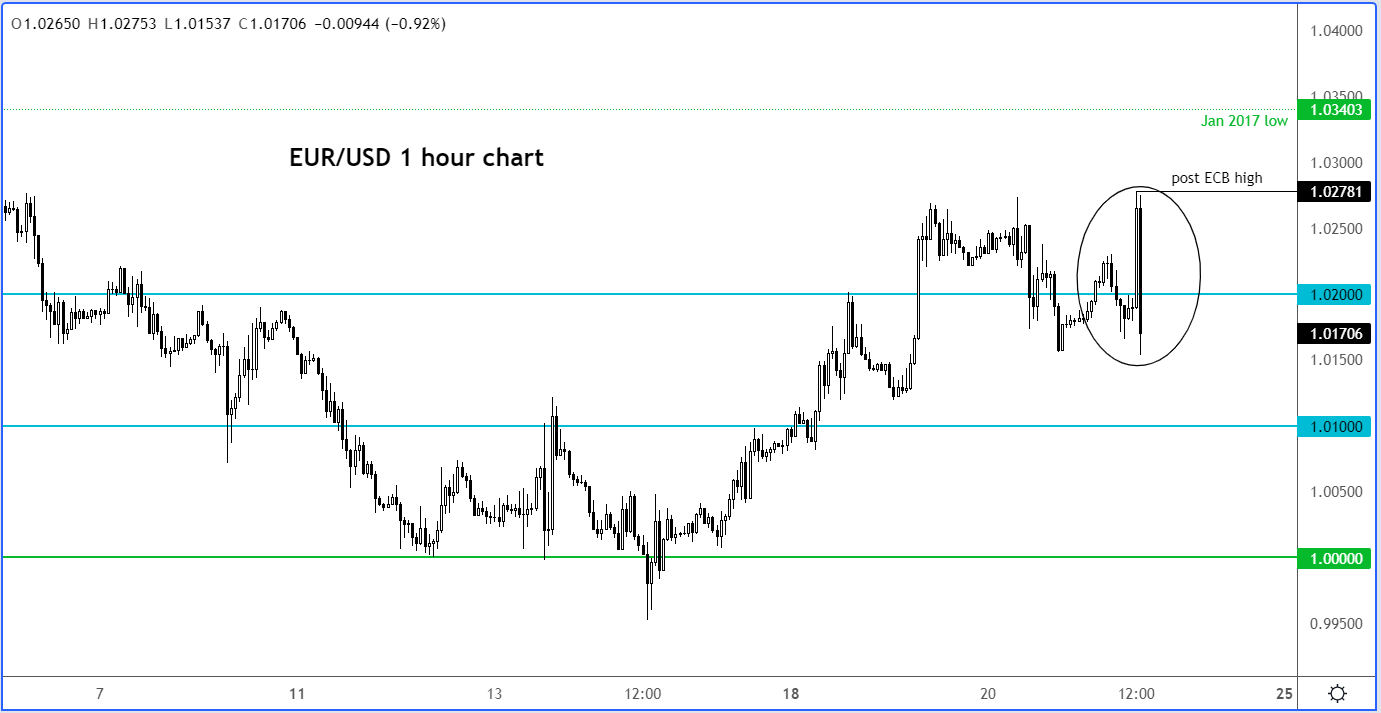

Well, the euro surged higher after the ECB decided to hike the main deposit rate by 50 bp to zero, and introduced a new tool to counter “unwarranted, disorderly market dynamics.” But during the press conference, all of those gains evaporated.

The ECB has indicated that further normalisation of interest rates “will be appropriate.”

Some would argue that it was a bit careless on their part to hike by 50 bps given that their communication all this time was for 25 bps. But what really changed that decision was threefold:

- First, the recent weakness of the euro meant that the eurozone was now importing more inflation than would have been the case had the single currency been stronger. This definitely encouraged the hawks to push for a 50 bp hike today.

- Second, Eurozone CPI climbed to a fresh record high of 8.6% YoY in June, accelerating sharply from 8.1% in May. They simply cannot afford to just sit there and watch inflation continue to accelerate.

- Third, all other central banks opted for larger increases than expected. The ECB had to surprise, otherwise the euro would have plunged – and they couldn’t risk that.

So, it was a case of common sense prevailing. Lagarde didn't try to put a bit of a dovish spin on that when she started the ECB press conference, although the euro lost all its previous gains when she was pressed about the new policy tool - Transmission Protection Instrument. .

At her press conference, President Lagarde confirmed that all countries will be eligible for TPI, and these are the four country criteria to be entitled:

1. Compliance with EU fiscal rules

2. Absence of severe macro imbalances

3. Fiscal/debt sustainability

4. Sound and sustainable macro policies

The ECB is now effectively deciding which country is fiscally solvent with sound policies. It is a dangerous territory to be stepping into. What about Italy? Will it be meeting these criteria? This may worry stock markets and send the major indices lower.

The EUR/USD rose along with the other euro pairs, most notably the EUR/JPY, before dropping during the ECB press conference.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade