Asian Indices:

- Australia's ASX 200 index fell by -78.7 points (-1.06%) and currently trades at 7,352.20

- Japan's Nikkei 225 index has fallen by -100.5 points (-0.36%) and currently trades at 27,502.27

- Hong Kong's Hang Seng index has fallen by -252.64 points (-1.2%) and currently trades at 20,861.12

- China's A50 Index has fallen by -91.49 points (-0.67%) and currently trades at 13,632.89

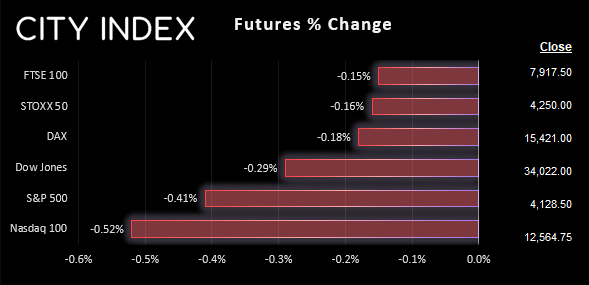

UK and Europe:

- UK's FTSE 100 futures are currently down -12.5 points (-0.16%), the cash market is currently estimated to open at 7,941.35

- Euro STOXX 50 futures are currently down -7 points (-0.16%), the cash market is currently estimated to open at 4,231.76

- Germany's DAX futures are currently down -28 points (-0.18%), the cash market is currently estimated to open at 15,352.56

US Futures:

- DJI futures are currently down -103 points (-0.3%)

- S&P 500 futures are currently down -67.5 points (-0.53%)

- Nasdaq 100 futures are currently down -17.5 points (-0.42%)

- The RBA’s governor reiterated that interest rates have not peaked and that the path to a soft landing is narrow (adding inflation remains too high and need to come down)

- Regardless, AUD and NZD were the weakest majors as they tracked Asian indices lower during a risk-off session, thanks to hawkish Fed comments and firmer US inflation

- The US dollar has pulled back slightly overnight but volatility remains intact

- USD/JPY is nearing our initial target around 133.75 with Fed funds now suggesting a ~53.1% chance of a third 25bp hike in June

- We’ve noted a potential bear flag forming on NZD/USD, with a double top having formed at a resistance cluster

- CHF/JPY broke higher and closed above key resistance, following a hot inflation report for Switzerland – we remain bullish on the daily chart, and pullbacks towards 143.24 breakout level / 100-day EMA may tempt more bears to the table

- A double bottom has formed on copper prices, which is holding up well despite US dollar strength

- Thanks to a strong employment report and higher wages in the UK, GBP/USD hit both of our upside targets from yesterday’s European open report (the second being the overnight implied volatility level from options markets

- The focus now shifts to the UK inflation report at 07:00, as another hot print all but solidifies another 25 or 50bp BOE hike in March

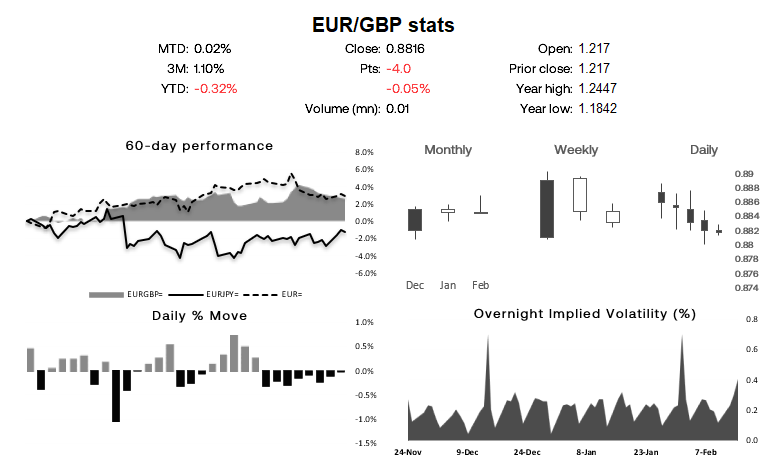

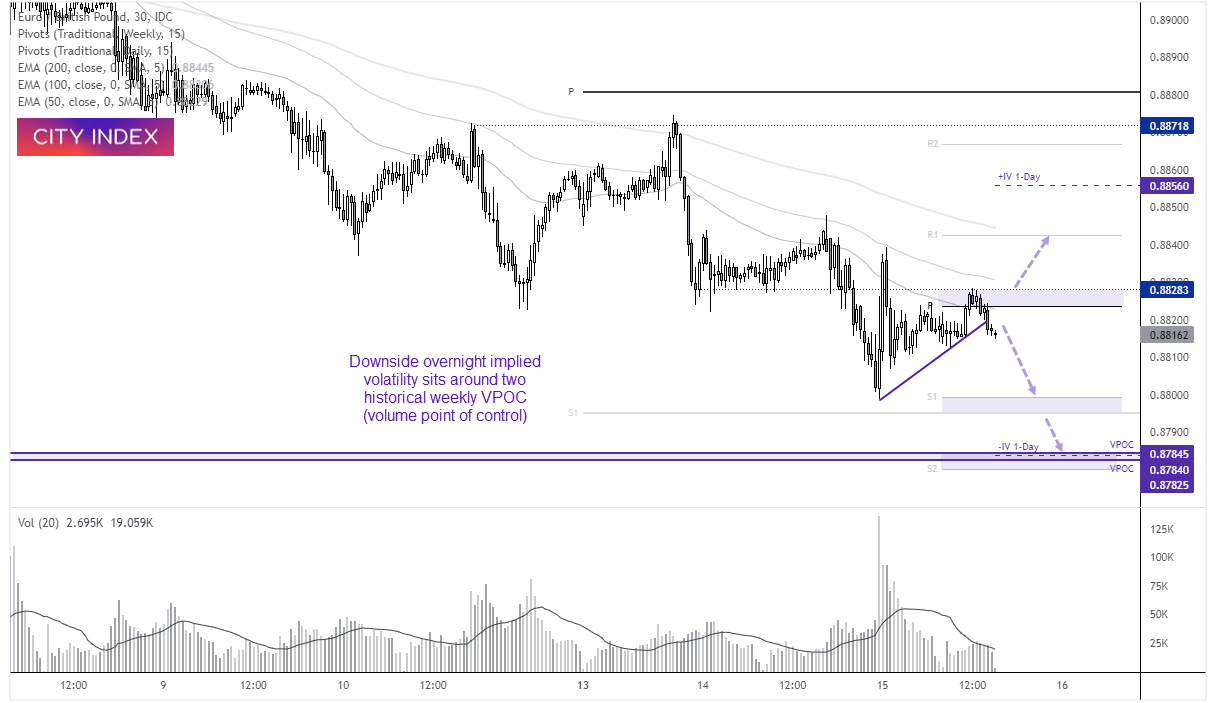

EUR/GBP daily dashboard and 4-hour chart:

EUR/GBP has continued to trend lower, having notched up seven consecutive bearish days. Given this is a rare sequence, we could warrant a case for (bullish) mean reversion on that metric alone. However, the UK inflation report could send this easily one direction or other, and overnight implied volatility suggests we could be looking at a bullish or bearish move of around 35 pips from the open price.

Interestingly, the -IV target sits on two weekly VPOC’s (volume point of control) around 0.8785, with the weekly S2 pivot just below. And that makes it a likely level of support should bears retain control.

The 30-min chart shows the pair trending lower, and a retracement line has been broken and prices remain below the weekly pivot. For now, we’re seeking bearish setups below 0.8828 and for a move towards the 0.8800 lows, near the weekly and monthly S1 pivots. A surprise inflation miss (weaker inflation) could send this pair higher and invalidate the current bias.

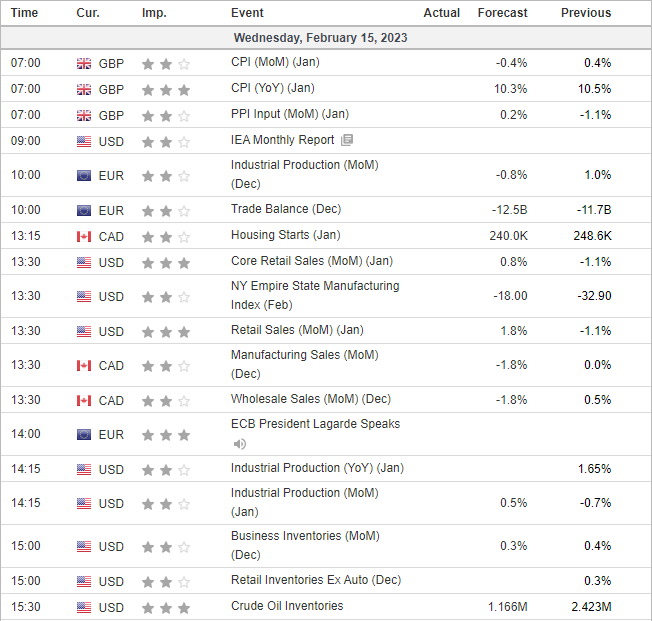

Economic events up next (Times in GMT)