EUR/CAD - The Weakest of All the CAD Pairs

When the anticipated supply of something goes down, the price usually goes up. Such is the case with oil as a result of the attack over the weekend on Saudi Arabia’s largest faciality. Because of the attack, the anticipated supply of oil went down, causing prices to go up. If the price of oil is going up, the price of a currency of other oil exporting countries usually will go up as well.

Canada is an oil export led economy. When the price of crude oil goes up, generally, the price of the Canadian Dollar will as well. Today, the Canadian Dollar was up against all major currencies across the board. However, it was up most vs the Euro, almost 1% with a low at 1.4555.

Source: Tradingview, City Index

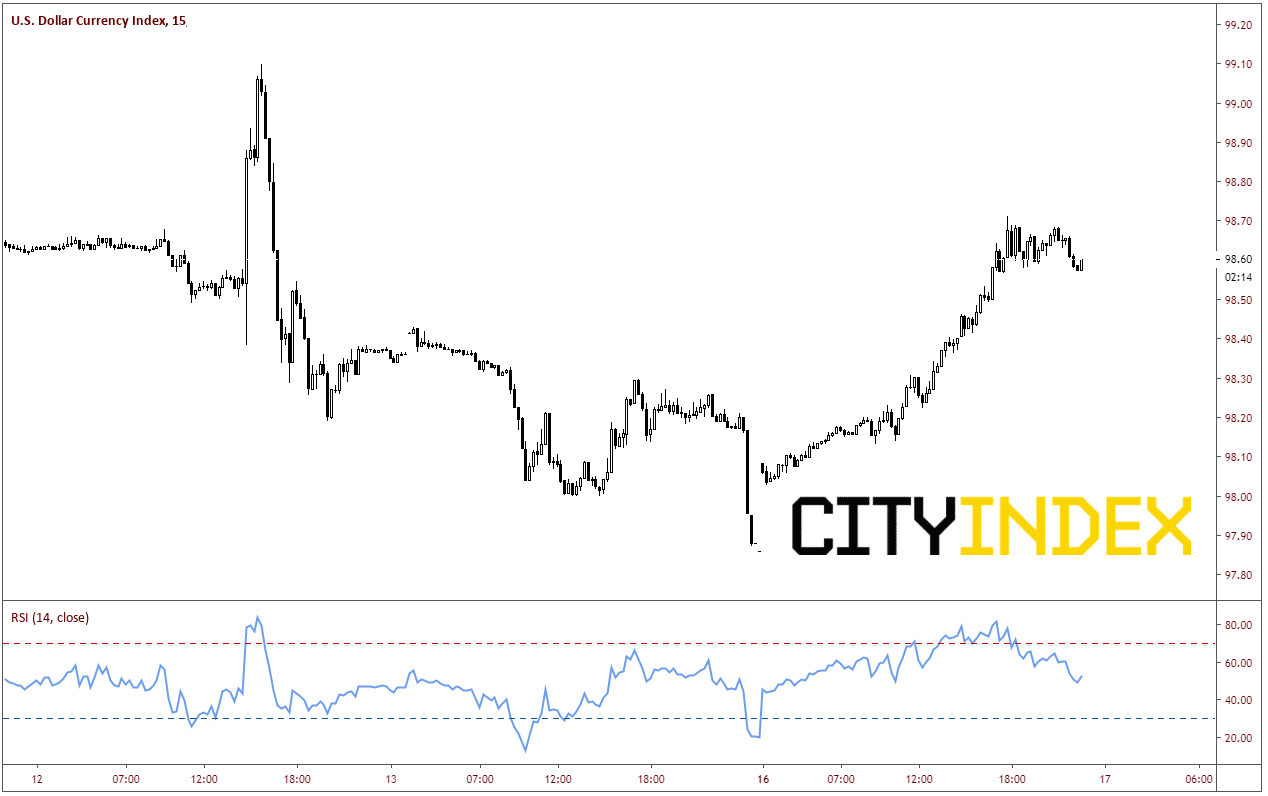

Why so weak vs the the Euro? Mainly because DXY was bid all day. Over 60% of the US Dollar Index is made up of the Euro. So often, when the DXY goes higher, the Euro will go lower.

Source: Tradingview, City Index

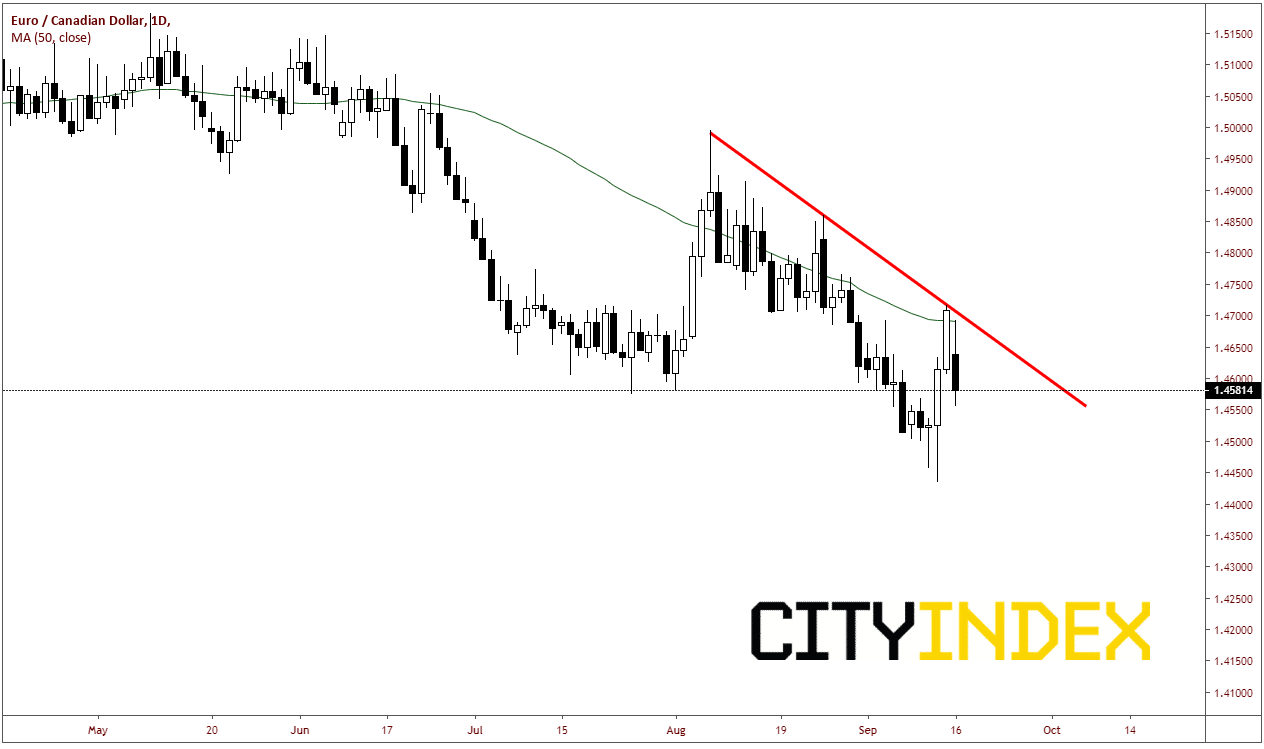

Also, EUR/CAD closed at trendline resistance and the 50 Day Moving Average on Friday. After the gap lower on the opening earlier, the pair was never able to recover to fill the gap because of strength of the US Dollar and Canadian Dollar.

Source: Tradingvew, City Index

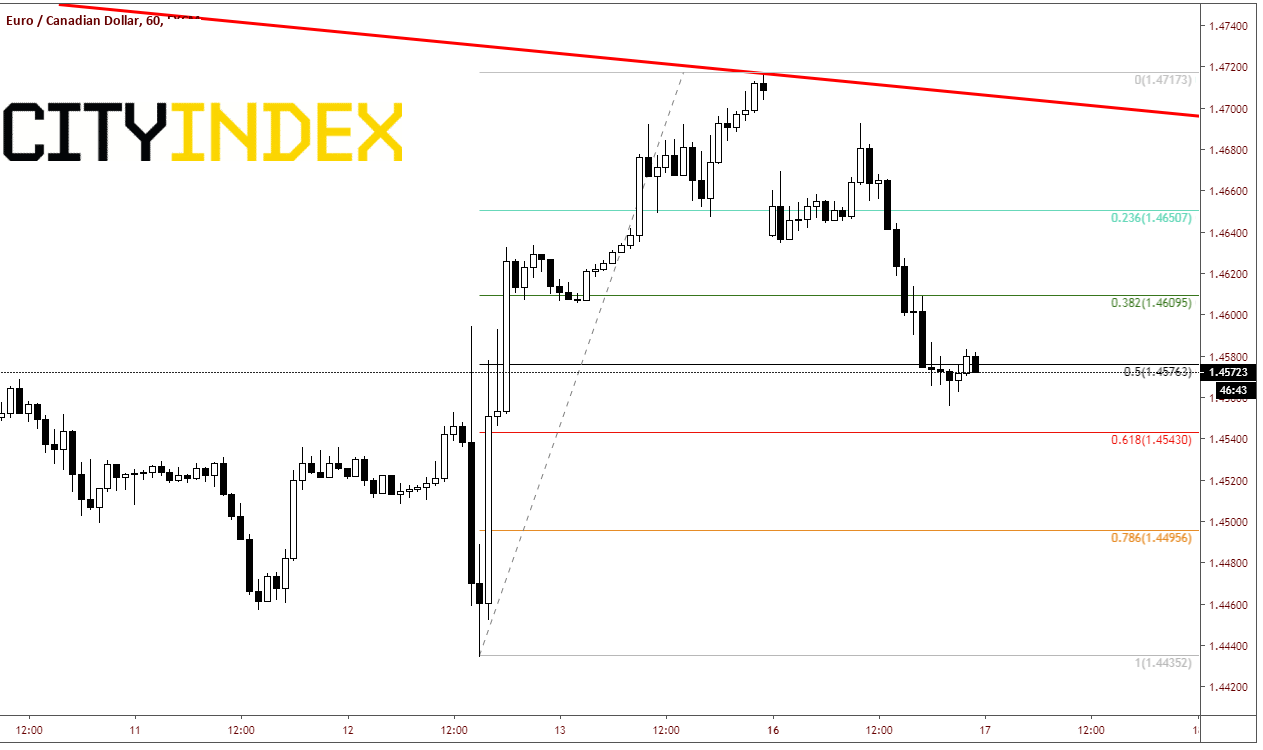

Where can EUR/CAD go from here? If news continues indicate that Iran is to blame for the attacks, the price of crude is likely to rise, and therefore, the price if EUR/CAD is likely to continue to decline. Support comes in at 1.4543, which is the 61.8% retracement level for Thursday’s/Friday’s range. Below that, support comes in at Thursday’s lows of 1.4435. Resistance doesn’t come in until the gap fil near 1.4700, which is also the descending trendline and the 50-day moving average.