As my colleague Joe Perry noted in his Currency Pair of the Week article, the loonie has been on absolute tear of late, with the ongoing rally in the price of oil, Canada’s most important export, and more recently, Friday’s strong Canadian jobs report pushing the loonie to test multi-year highs against a number of its major rivals.

Check out our guide to the Canadian dollar!

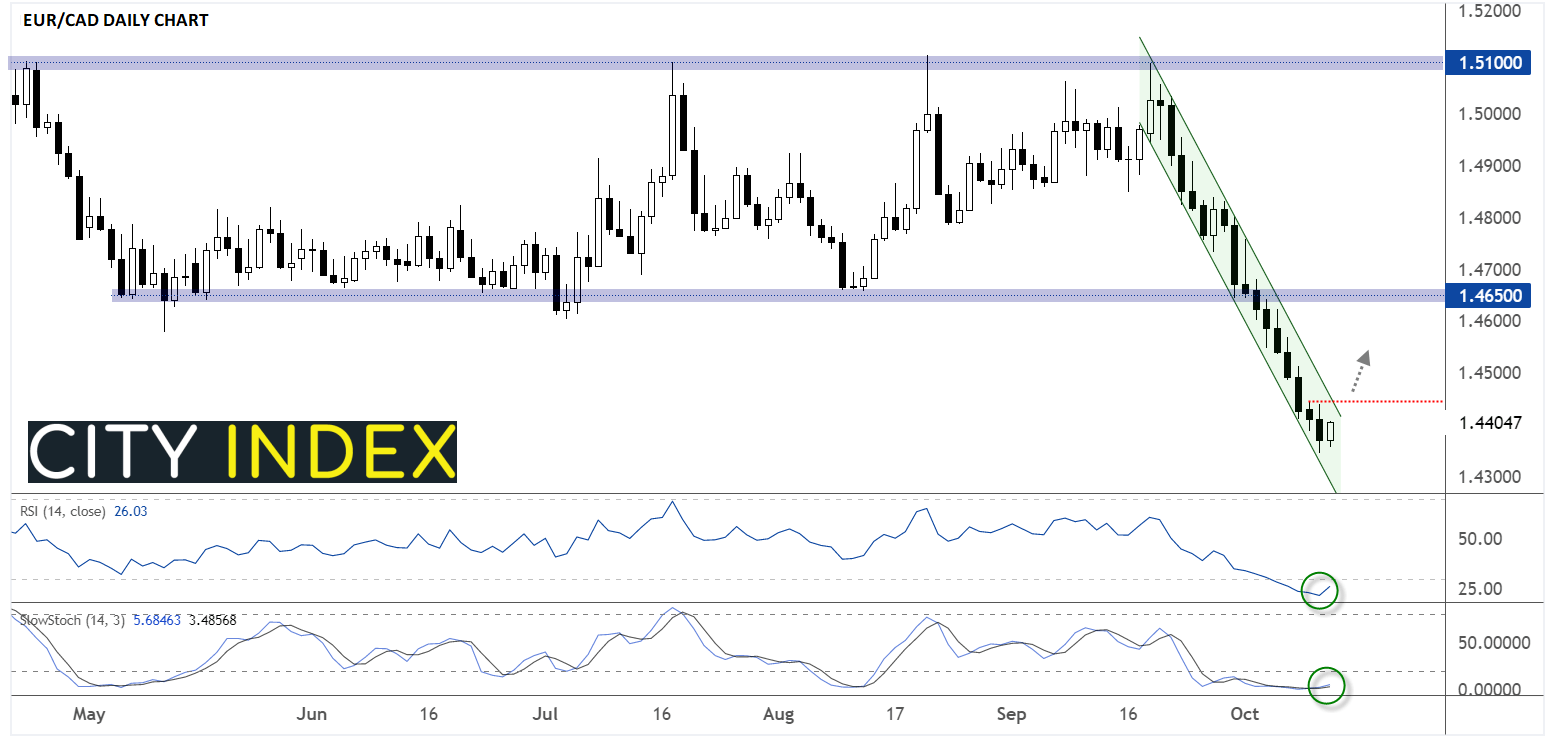

Keying in on the EUR/CAD cross, our traders have certainly taken notice: According to our internal data, a staggering 91% of outstanding volume short the pair across StoneX Retail platforms. As the chart below shows, the lopsided positioning has paid off in recent weeks, with EUR/CAD shedding more than 700 pips from its peak near 1.5100 to yesterday’s low below 1.4400 in the last three weeks alone; this marks the sharpest 3-week fall in half a decade!

Source: TradingView, StoneX

One of the first axioms any new trader learns is that “the trend is your friend” and the near-term trend in EUR/CAD is undeniably bearish…but it’s equally true that no trend lasts forever and the risk of a sharp bullish reversal in EUR/CAD is growing. For one, the extreme bearish positioning is a potential contrarian indicator; after all if “everyone” is already short a pair, it suggests that there may be less incremental selling pressure to push rates lower regardless of future fundamental and technical developments.

Meanwhile, the momentum oscillators on the pair are beyond stretched. Both the RSI and Slow Stochastic indicators are deep in oversold territory, showing both a strong past downtrend and a market that may be vulnerable to a sharp rally on any “good” (or even “less bad”) news, such as a dip in the price of oil or any decent data of the Eurozone.

Moving forward, the key level to watch will be 1.4445, which marks the confluence of the weekly high and the top of the bearish channel. If that level gives way in the coming days, it could mark a changing of the proverbial tide and open the door for a sharp rally in the deeply oversold pair as the overwhelming number of retail shorts look to close their positions en masse.

Of course, no analysis is foolproof, but when a market is seeing lopsided short positioning in deeply oversold territory after an historic collapse, the risks of an abrupt trend change start to rise.

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade