Stock market snapshot as of [1/7/2019 2:44 PM]

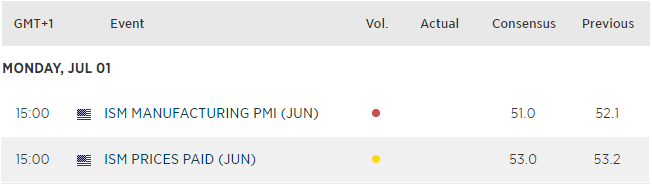

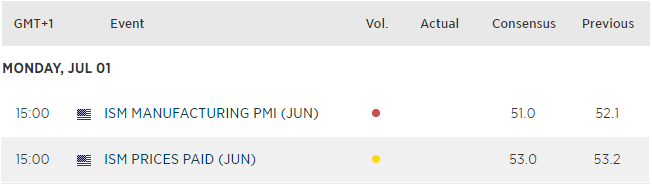

- The trade-fuelled rally faces its next big challenge from the U.S. Institute of Supply Management’s purchasing managers’ indices (PMI) for the manufacturing sector. The main gauge is forecast to retreat to the 51 level from 52.1. That would at least point to continued growth. However, a miss will do severe damage to sentiment after key Asia-Pacific prints showed deeper growth contractions than forecast

- These fresh indications of slowing global growth appeared to slow the retreat of ‘safer’ assets like U.S. Treasurys, keeping the benchmark yield on the 2% handle whilst Europe’s counterpart, Germany’s 10-year bund yield, etched deeper into negative territory to stand at minus 0.331 a short while ago. In short, risk seeking is no less ambivalent after Presidents Trump and Xi agreed to a trade ceasefire and to resume talks on Saturday

Corporate News

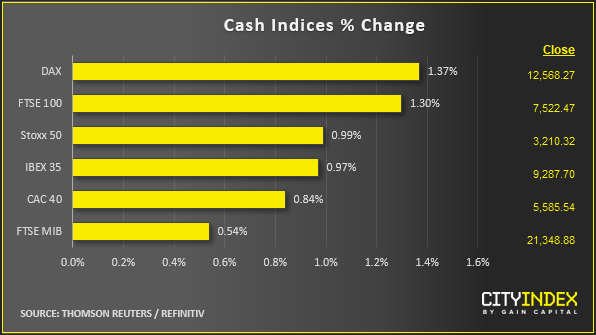

- Among STOXX’s European ‘super sector’ indices, only the perceived ‘safety’ of Utilities is on the backfoot

- Washington’s concession to beleaguered Huawei props the Continent’s hardware focused IT shares; China-facing mining and steel producers are also favoured and the bank stock most sensitive to Washington’s falling out with Beijing, HSBC, leads lenders higher with a 1% advance

- U.S. shares are posting a commensurately strong start to the second half of the year, though the heavyweight semiconductor sector could still outshine most others. Huawei news is boosting Philadelphia’s PHLX gauge of chip shares by some 4%

Upcoming economic highlights

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM