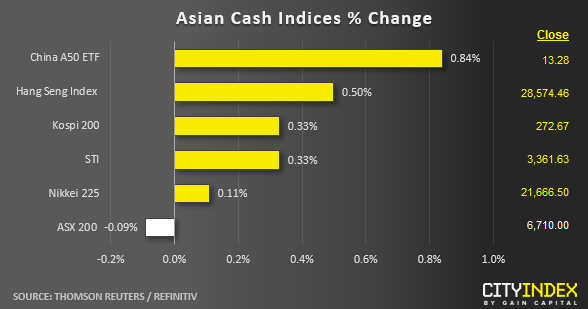

Stock market snapshot as of [12/07/2019 0415 GMT]

- Ahead of the European opening session, most Asian stocks have recorded modest gains as at today’s Asian mid-session in a positive follow through where the U.S. S&P 500 has managed to close higher overnight at 2999 after it probed the 3000 psychological level again in yesterday’s 11 Jul U.S. session at the opening hour.

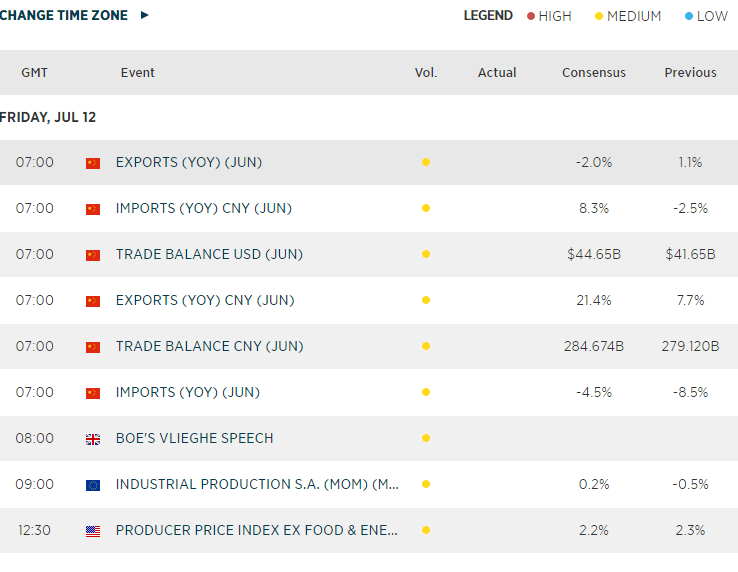

- The top performer for the Asian stock markets is China A50 which has rallied by 0.84% while we wait for the release of China Jun trade data out at 0700 GMT where consensus is set at a -2% y/y decline in exports and 8.3% y/y gain in imports with a trade balance at US$44.65 billion.

- Singapore Q2 GDP flash estimates came in worse than expected where it contracted on a quarterly basis (-3.4% q/q versus 0.1% q/q consensus). Annualised growth came in at 0.1%y/y, also below consensus of 1.1% y/y. The quarterly contraction of -3.4% q/q is the biggest contraction seen in 7 years. The Singapore stock market has shrugged off this negative economic data release and the benchmark Straits Time Index (STI) has remained resilient with a gain of 0.33% above the key medium-term support of 3320. Therefore, market participants are now expecting the Singapore central bank, MAS to adopt an easing policy in the next Oct policy announcement.

- The S&P E-mini futures has broken above the 3000/3006 psychological/minor range resistance in place since 10 Jul as it rallied by 0.34% to print a current intraday high of 3012 in today’s Asian session. We had reiterated earlier in our previous reports; the medium-term uptrend of the S&P 500 remains intact with a further potential up move ahead to target the next significant medium-term resistance at 3045.

- European stock indices CFD futures are showing modest gains with the FTSE 100 and German DAX up by around 0.30%. We are now getting a bit cautious on the medium-term bullish outlook for the German DAX as it has closed lower by 5 consecutive days since last Fri, 05 Jul. For this week, it has declined by -1.67% which underperformed the Euro Stoxx 50 that has declined by a lesser magnitude of -0.81%. Thus, the DAX needs to have a weekly close back above 12400 to keep the “bulls alive”.

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Today 07:49 AM

Today 04:24 AM

Yesterday 10:48 PM