The ECB interest rate meeting will take place on Thursday 14th April at 12:45 GMT followed by a press conference at 13:30pm.

The economic backdrop

The meeting comes at a tine when economic uncertainty remains high amid the continued fallout from the Ukraine war. The economic backdrop has moved more towards stagflation since the last meeting, with inflation rising to a record high of 7.5% YoY in March, confidence falling, and growth slowing. The ongoing war and energy prices continue to pose a risk to the outlook and risks are tilted to the downside.

In the March meeting, the ECB guided to end APP bond purchases in Q3 and for the first interest rate increase to come “some time” after the end of asset purchases. ECB President Christine Lagarde was no longer ruling out an interest rate hike. The more hawkish stance from the ECB left the market expecting a rate hike in the third quarter, keeping in mind that the ECB has repeatedly said that it will not raise interest rates until it has ended its sovereign bond purchases.

What to expect?

The ECB are not expected to take any meaningful policy decision in the April meeting given the lack of hard data reflecting the impact of the Russia war. Christine Lagarde could give some clarity to the possible policy options which lay ahead, whilst re-iterating March’s decision. The macroeconomic projections in the June meeting could provide cover for a sooner end to asset purchases.

Market expectations have turned more hawkish recently, which could leave investors vulnerable to disappointment. There is a good chance that the ECB won’t ride to the rescue of the euro which is suffering versus the USD, as the Fed plans aggressive tightening and ahead of the French elections. Any sense of disappointment could pull the euro lower.

Learn more about the ECBWhere next for EUR/USD?

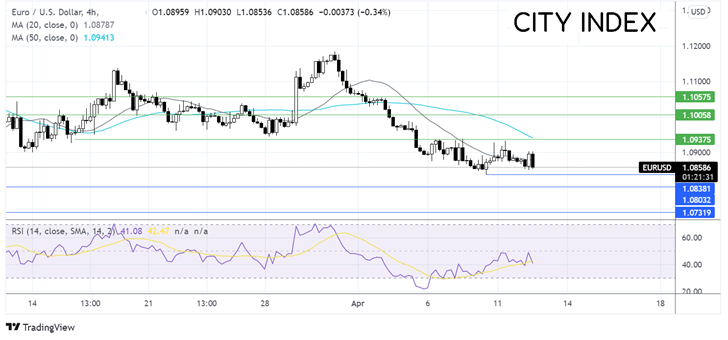

After facing rejection at the 50 sma on the daily chart, EURUSD has been steadily trending lower, hitting support at 1.0835. The price has attempted to recover from this level but has struggled to meaningfully move above the 20 sma . Meanwhile, the 20 sma crossed below the 50 sma in a bearish move. The RSI is also hinting towards more downside.

Sellers will look to take out support at 1.0835 to open the door to 1.08 the 2022 low.

On the flip side, resistance can be seen at 1.0930 and 1.10 round number.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.