- Dovish rate hike by ECB

- EUR falls across the board

- Attention turns to Lagarde at ECB presser

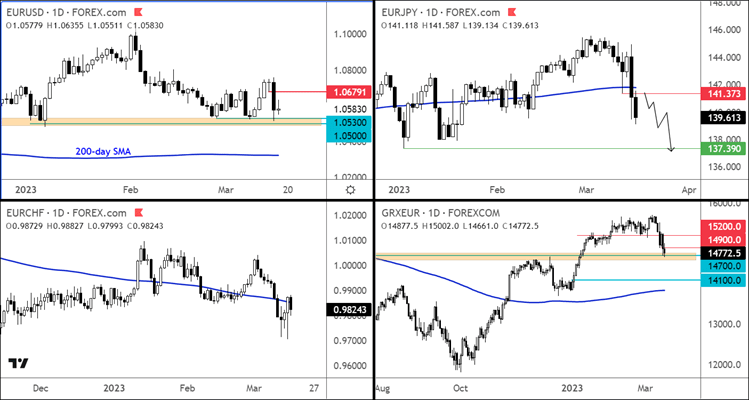

The ECB had set itself up to disappoint some market participants after talking up 50 basis points. As it turned out, and despite all the troubles in the banking sector, it stuck to script and delivered that 50-bps hike. Initially, the euro rose a tiny bit, but then it slumped. The DAX hit a new weekly and multi-month low, before bouncing back a little off its worst levels. Keep an eye on the EUR/JPY, which could drop to a new low for the year in light of the risk off sentiment.

Traders realised that this was the best the ECB could have done in these circumstances. By not hiking and going back on their words, this would have seen the ECB lose some credibility. It had to hike. BUT here is the clever bit: the ECB also didn’t want to disappoint those who were calling for a smaller or no rate hike at all. So, it provided no forward guidance and/or commitment to future hikes. It said that “the elevated level of uncertainty reinforces the importance of a data-dependent approach to the Governing Council’s policy rate decision." In other words, this was as dovish a rate hike as you would have seen in these circumstances.

In addition to providing no forward guidance, it said that it has the toolkit to provide liquidity support if needed and that it is ready to respond to financial and price stability risks.

But the ECB could deliver more rate hikes, if the financial stability risks subside. It hasn’t ruled out the chance for more rate hikes and that’s what I expect the ECB President Christine Lagarde to hone in at the press conference, which is about to get underway.

Indeed, inflation remains uncomfortably high, which may require further tightening down the line. The recently released Eurozone inflation data barely slowed in February. Headline CPI eased a tad to 8.5% annual pace but remained above expectations of a slowdown to 8.3%. Meanwhile core CPI accelerated to a fresh record high of 5.6% from 5.3%. Core inflation is the key focus for the ECB and the fact that it rose further warrants even more tightening.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade