The Federal Reserve (Fed) is the central bank of the United States and operates under a dual mandate to effectively promote the goals of maximum employment while maintaining price stability.

Prices are considered stable when consumers and businesses don’t have to worry about rising or falling prices when making plans or borrowing or lending for long periods.

With official inflation readings at multi-decade highs and the unemployment rate at multi-decade lows, policymakers are acting to reverse the trends in both by raising interest rates, as they are legally required to do.

However, the concern is that growth is slowing, and as acknowledged by Fed Chair Powell overnight, there is a risk that steep interest rate hikes may tip the U.S economy into recession.

How close to a recession is the U.S. economy?

The most common definition of a recession is two consecutive quarters of negative growth, which means that a recession is confirmed retrospectively.

In Q1 of 2022, real GDP in the U.S unexpectedly decreased at an annual rate of 1.5%, the worst quarterly fall since the 31.2% pandemic decline in Q2 of 2020. If GDP were to decline again in Q2 2022 (released July 28), it would all but confirm the U.S economy had entered a recession.

While a second unexpected decline cannot be ruled out in Q2, especially given the soft patch in recent data, most economists expect to see a positive GDP number for Q2 2022, which means that a recession is more than likely a story for 2023.

Why are we talking about a recession now?

While the timing and probabilities of a recession are open to debate, markets are forward-looking. They are acutely aware that the Fed has a very dubious track record of raising interest rates high enough to tame inflation without sending the economy into a recession.

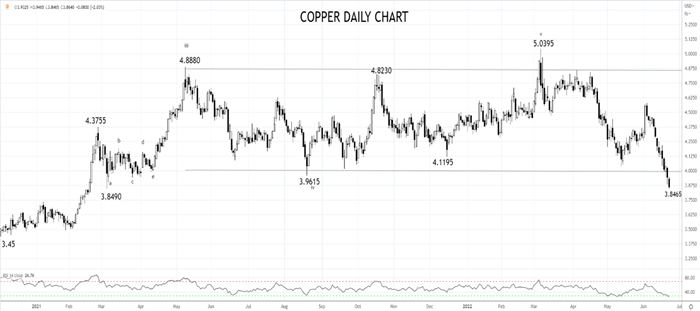

Dr Copper chimes in with his verdict

One of the traditional measures of global economic health and recession is the price of copper. Demand for copper increases during an expansionary economic cycle, while demand for copper drops when global growth is slowing.

Overnight the price of copper futures fell to a 15-month low, almost 25% below its $5.0395 l/b cycle high from just four months ago.

As viewed on the chart below, copper has extended its break lower during today’s session in Asia. Providing copper remains below resistance at $4.00/$4.15 (formerly support), the pullback has room to extend lower towards weekly support at $3.50.

Source Tradingview. The figures stated are as of June 23 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade