Uncertain sentiment after the U.S.-China truce will keep the Dow capped.

Global shares have been far from sure-footed after the long-awaited trade war truce between the U.S. and China. With the U.S. session in its final stretch, Wall Street stock investors have retreated into the perceived safety of the S&P 500 Utilities and Consumer sectors. It’s partly a reaction to Washington’s curious timing to increase threatened tariffs against the European Union. (Please see our coverage of Europe’s stock market reaction to the raised U.S. tariff threat here, here and here). It will take some time for greater clarity to emerge about trade discussions and more. (Note that the White House has yet to release substantial details of how Washington and Beijing will proceed with a pledge to resume negotiations).

In the meantime, one of the U.S. stock market patterns that’s highly likely to continue given current conditions is the relative underperformance of the Dow Jones Industrial Average relative to large-cap counterparts. Unlike the S&P 500 index, the Dow Jones Industrial Average’s price weighting methodology (as opposed to a market-capitalisation based one) leaves it at the mercy of constituent stocks that may have a high price denomination whilst continuing to underperform.

Boeing for instance, contributes most weight to the Dow—about 9%–and remains becalmed by MAX 737 woes. After reporting a new glitch in the grounded model, separate to the flight-control issue linked to two crashes since October, the company has signalled that its highest revenue generating aircraft will remain out of service till at least 1st October. The stock is by no means a big underperformer, rising 10% vs. the Dow’s 14% this year. But that mean’s Boeing’s ability to hoist the DJIA higher any time soon is questionable.

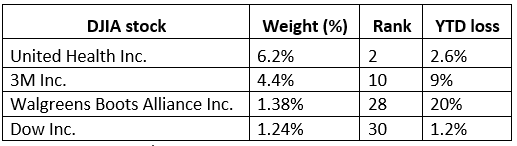

The influence of Microsoft, the Dow’s best performer (and 15th heaviest) also looks largely spent for now after a 34% sprint since the beginning of the year to fresh records in June. The second most influential Dow industrial, United Health, weighted at 6.2% was among just four in the red for the year near Wednesday’s close as shown below

Dow Jones Industrial Average shares lower for the year to date [02/07/2019 20:08:10]

Source: Bloomberg/City Index

UNH’s revenue has flatlined since the second quarter of 2016. Now, Democratic Presidential candidates are adding pressure to health shares as some push for Medicare-for-All. It’s possible the share could stay hamstrung for the entire 2020 Presidential campaign that will begin in earnest later this year. Any recovery by other laggards sometime soon may make little difference given their low weighting. Perhaps good news from the upcoming earnings season could boost the index. Well, earnings are widely expected to edge lower in coming quarters, though the first Dow stock won’t report earnings till JPMorgan releases second quarter results on 16th July. The Dow is set to have a hard time catching up with the string of new record peaks marked by other U.S. indices anytime soon.

Chart thoughts

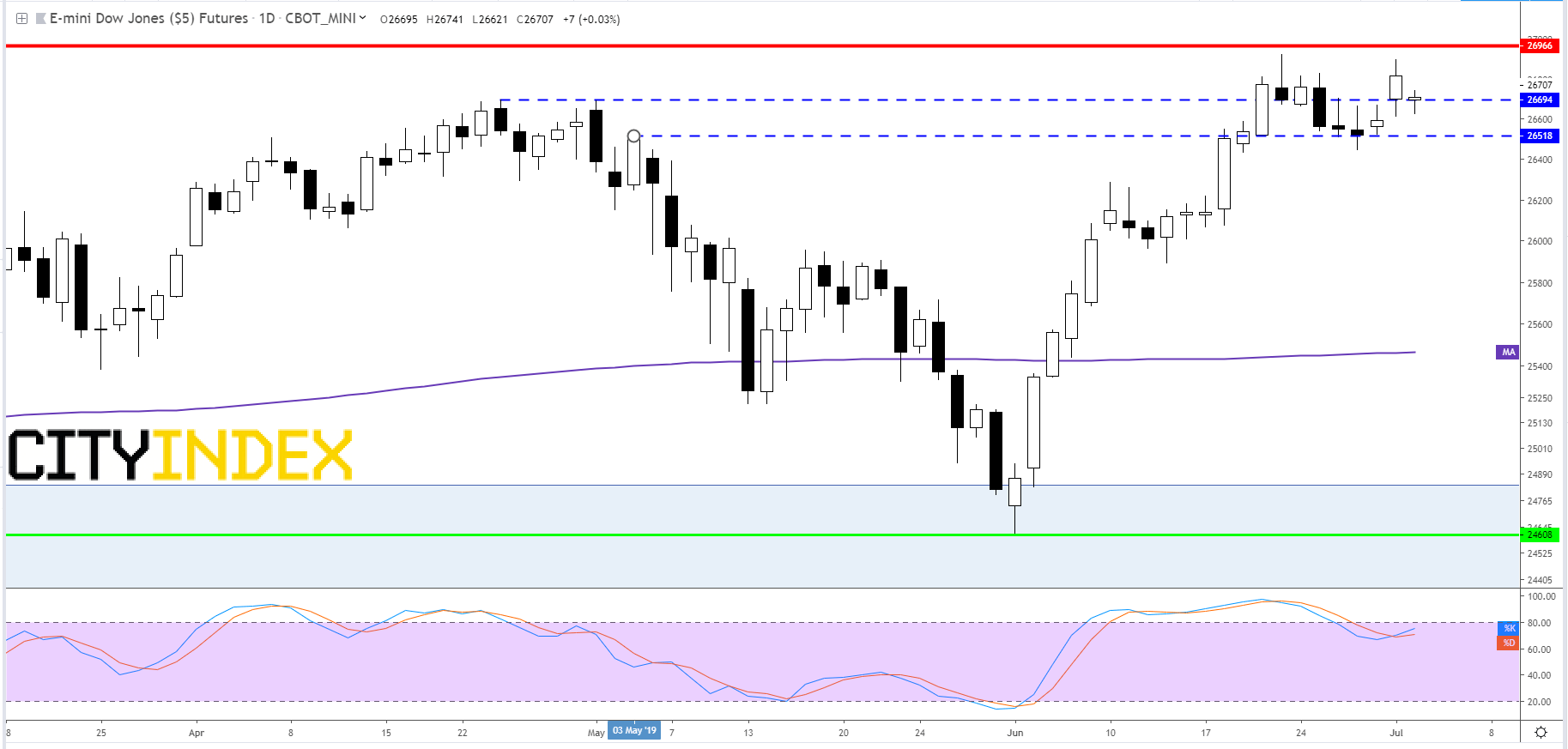

The Dow is becoming more and more like a broken record. It has now failed to break above the same approximate levels, topped by 27000, for around 18 months. It ill behoves any analyst to add to the boredom. Suffice to reiterate that for front-month E-Mini Dow Jones futures contracts, 26966, 3rd October spike high, remains the market’s main topside bugbear. There is a decent case for support currently at the 26694 pivot which switched from resistance to support again just on Monday. Downturns below that can also expect to be buffered by 26518. Below these would point to another deeper disappointment for buyers, targeting the early June swing low at 24608.

E-mini Dow Jones Future (continuous chart) – daily

Source: Tradingview