Short to medium-term technical outlook on AUD/CAD

click to enlarge charts

Key Levels (1 to 3 weeks)

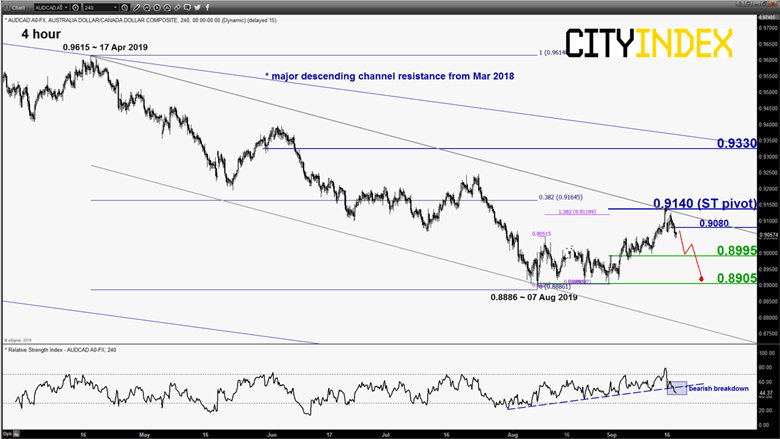

Intermediate resistance: 0.9080

Pivot (key resistance): 0.9140

Supports: 0.8995 & 0.8905

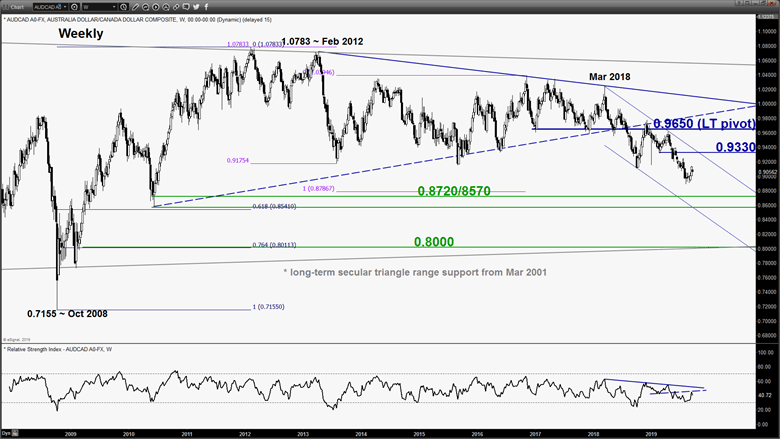

Next resistance: 0.9330

Directional Bias (1 to 3 weeks)

Bearish bias below 0.9140 key medium-term pivotal resistance for another potential downleg sequence to target 0.8995 follow by the recent range support of 0.8905 (swing low areas of 07/30 Aug) in the first step.

On the other hand, a clearance with a daily close above 0.9140 invalidates the bearish scenario for a continuation of the corrective rebound in place since 07 Aug 2019 towards the major resistance of 0.9330 (50% Fibonacci retracement of the major downtrend from Nov 2018 to 07 Aug 2019 low & upper boundary of the major descending channel from Mar 2018 high).

Key elements

- The recent 256 pips rebound from its 07 Aug 2019 low of 0.8869 has stalled at the upper boundary of a medium-term descending channel from 17 Apr 2019 high of 0.9615.

- The medium-term descending channel resistance of 0.9140 confluences closelywith a Fibonacci cluster; 38.2% retracement of the medium-term downtrend from 17 Apr high to 07 Aug 2019 low and 1.382 projection of the recent rebound from 07 Aug low to 08 Aug high projected from 30 Aug 2019 low.

- The 4-hour RSI oscillator has staged a bearish breakdown from a significant corresponding resistance after it hit an extreme overbought level on 13Aug 2019. These observations suggest the revival of medium-term downside momentum in price action.

Charts are from eSignal