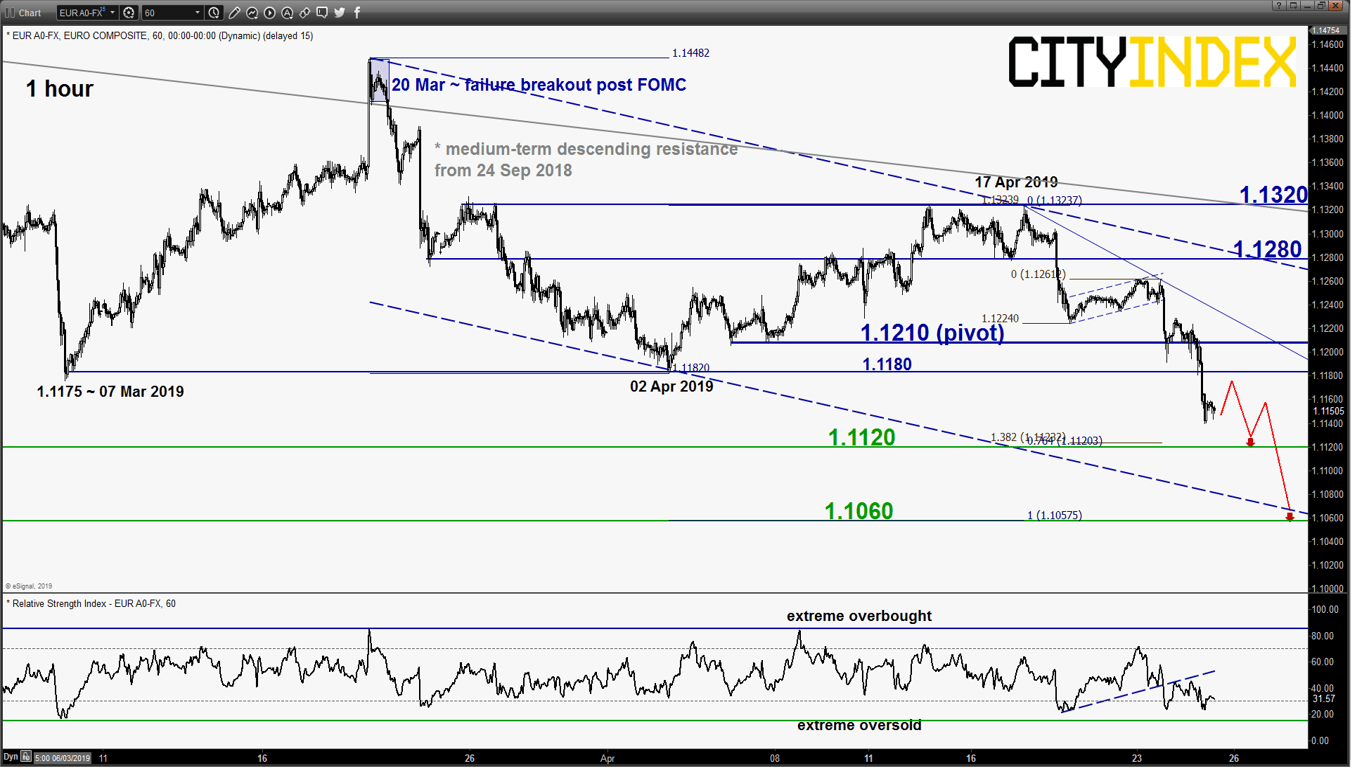

EUR/USD – Bearish breakdown from medium-term range

click to enlarge chart

- Broke below the 1.1175 medium-term range support in place since 12 Nov 2018 as expected (click here for a recap on our previous report). No change, maintain bearish bias in any bounces with a tightened key short-term pivotal resistance at 1.1210 (Fibonacci retracement cluster & minor descending trendline from 17 Apr 2019 high) for a further potential down move to target the next near-term supports at 1.1120 and 1.1060 (1.00 Fibonacci expansion of the decline from 20 Mar 2019 high to 02 Apr 2019 low projected from 12 Apr 2019 high & lower boundary of a minor descending channel from 20 Mar 2019 high).

- However, an hourly close above 1.1210 negates the bearish tone for a squeeze up towards 1.1280 and even 1.1320 (also the medium-term descending resistance from 24 Sep 2018 high).

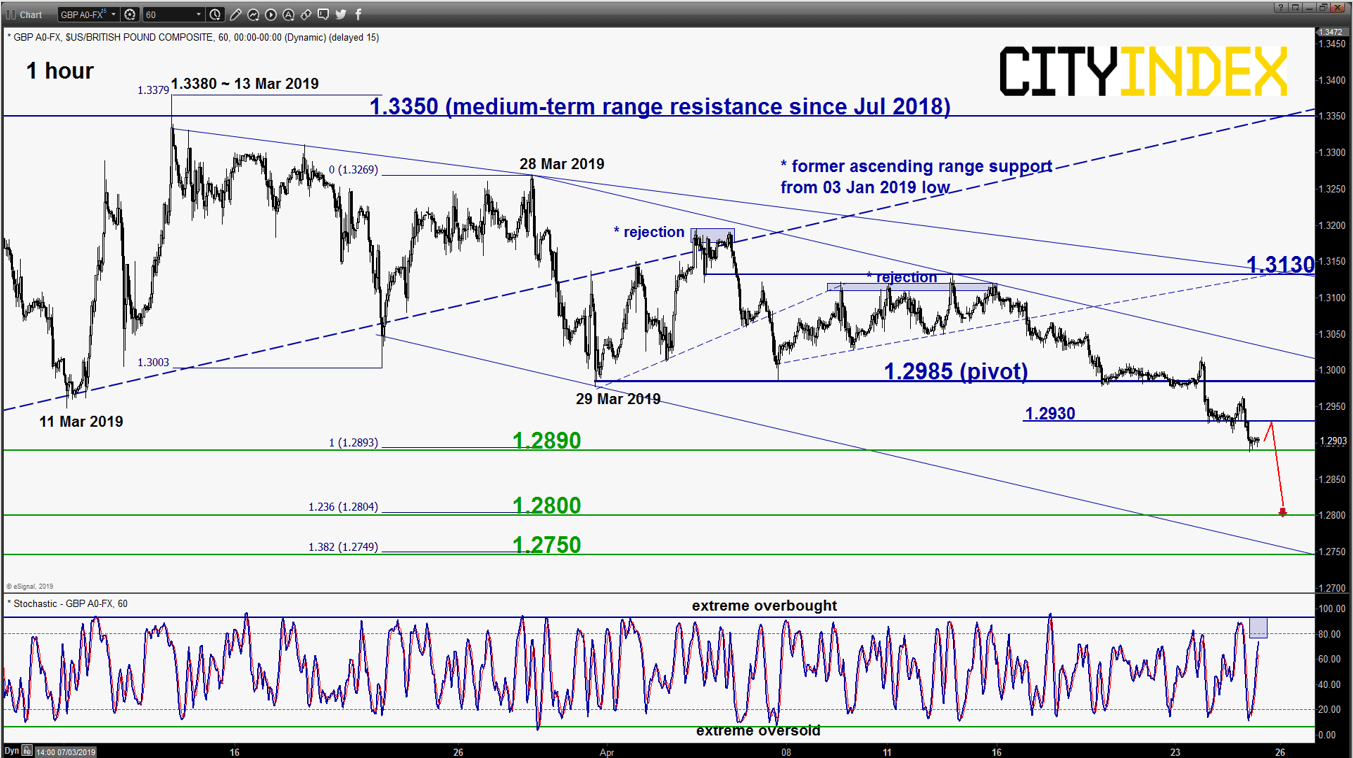

GBP/USD – Further push down

click to enlarge chart

- Shaped the expected push down to hit the first support/target of 1.2910/2890 as per highlighted in our previous report. Maintain bearish bias in any bounces with a tightened key short-term pivotal resistance now at 1.2985 (former 29 Mar/05 Apr minor swing low &Fibonacci retracement cluster) for another potential downleg to target the next near-term support at 1.2800 (61.8% Fibonacci retracement of 3-month up move from 03 Jan 2019 low to 13 Mar 2019 high & 14 Feb 2019 swing low).

- However, an hourly close above 1.2985 negates the bearish tone for a squeeze up to retest the next intermediate resistance at 1.3130.

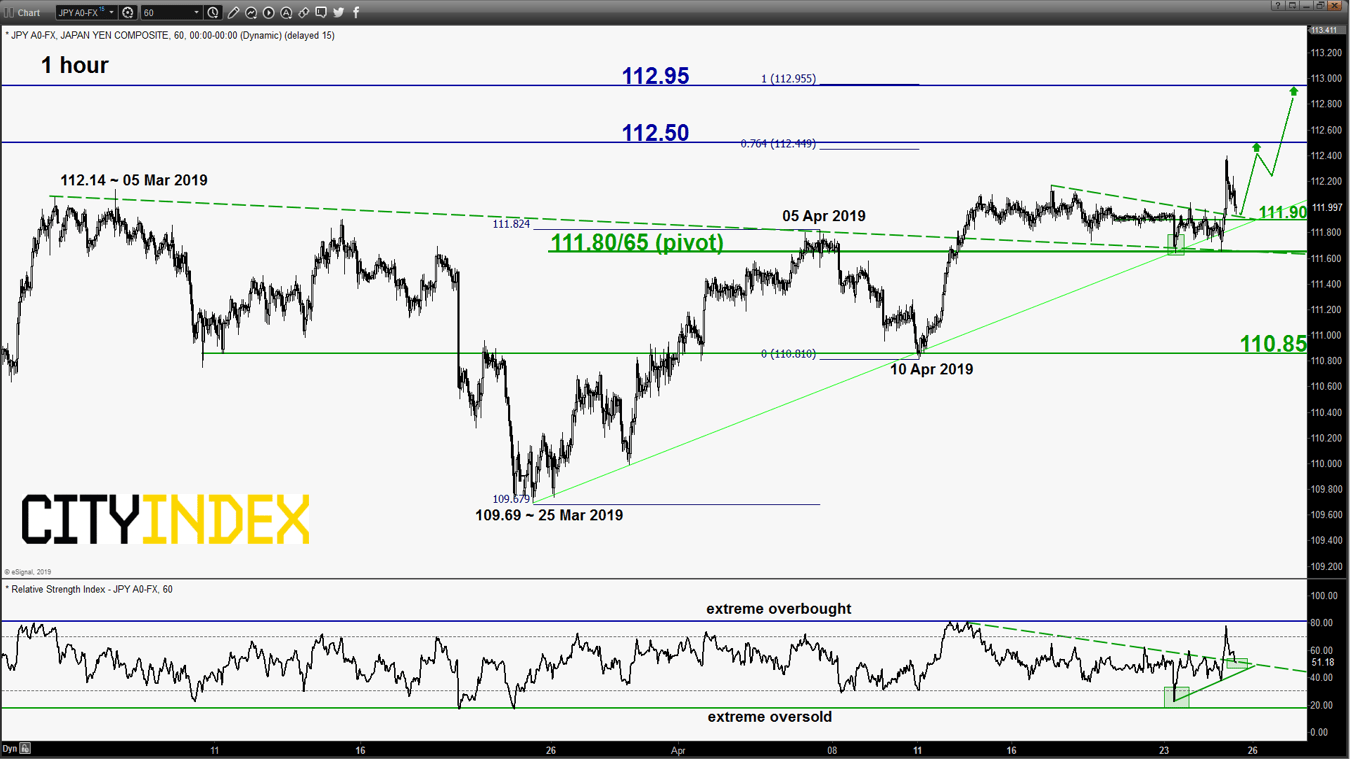

USD/JPY – 111.80/60 remains the key support to watch

click to enlarge chart

- Broke above the 112.10 upside trigger in yesterday, U.S session and printed a high of 112.40 before it staged a pull-backed to retest the former minor descending range resistance from 17 Apr 2019 high now turns pull-back support at 111.90 ahead of Bank of Japan monetary policy decision out today. No change, maintain bullish bias with 111.80/65 remains as the key short-term pivotal support for a further potential push up to target 112.50 before 112.95 (also the medium-term descending resistance from 03 Oct 2018 high).

- However, an hourly close below 111.65 negates the bullish tone for another round of slide to retest the 110.85 support.

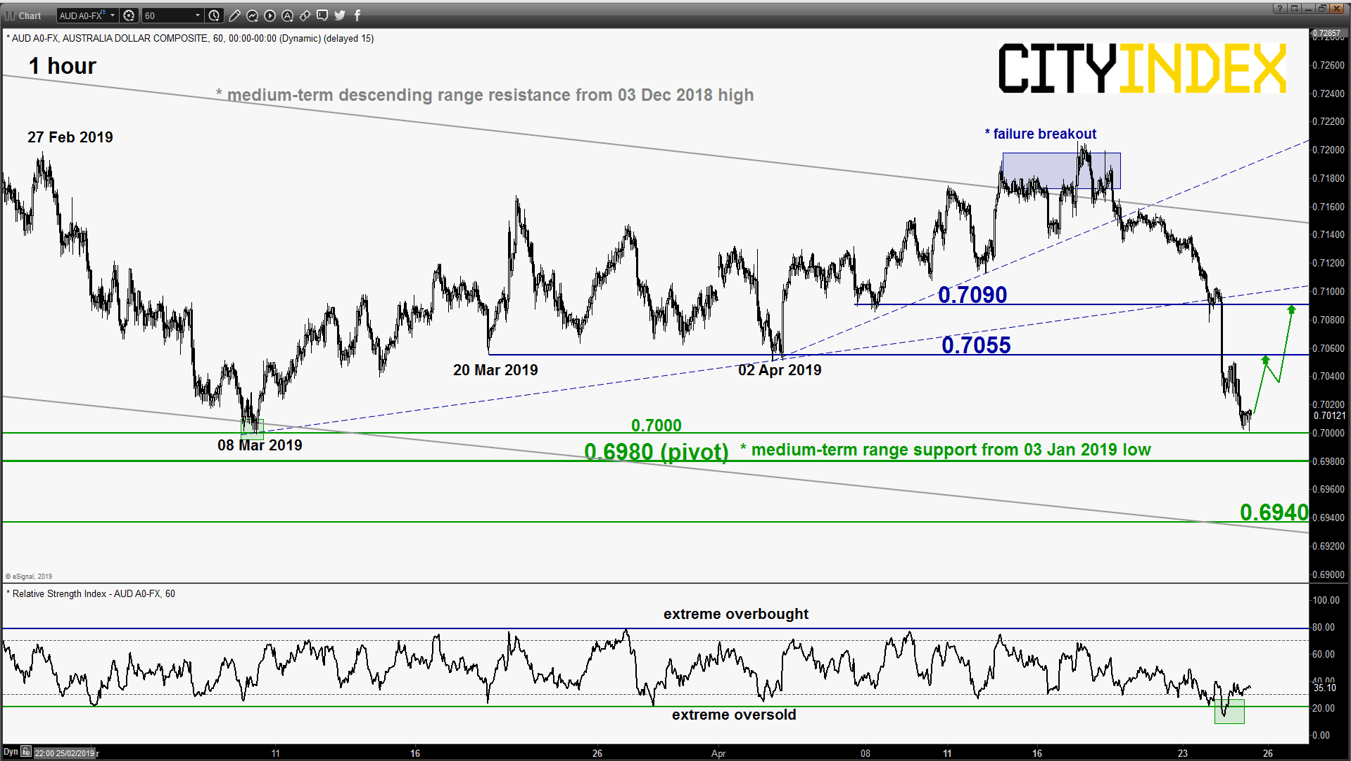

AUD/USD – At risk of a corrective bounce above medium-term range support

click to enlarge chart

- Pushed down lower as expected and hit the upper limit of the medium-term range support at 0.7000 as per highlighted in our previous report. The current decline from the 17 Apr 2018 high of 0.7206 seems to be overstretched with the hourly RSI oscillator that has just exited from its oversold region.

- Flip to a bullish bias with 0.6980 as the key short-term pivotal support (also the lower limit of the medium-term range support in place since 02 Jan 2019 low) for potential corrective bounce towards the intermediate resistances at 0.7055 and 0.7090 next.

- However, an hourly close below 0.6980 invalidates the corrective bounce scenario for a continuation of the decline to target the next near-term support at 0.6940 in the first step.

Charts are from eSignal

Latest market news

Yesterday 11:48 PM

Yesterday 11:16 PM

Yesterday 05:00 PM

Yesterday 01:13 PM