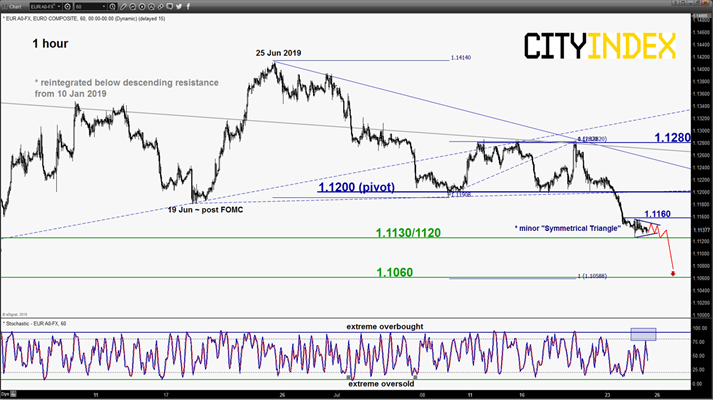

EUR/USD – 1.1200 key short-term resistance to watch ahead of ECB

click to enlarge chart

- Printed a marginal new “lower low” at 1.1126 in yesterday, 24 Jul European session, the pair has stared to consolidated in a tight range of 28 pips within a minor “Symmetrical Triangle” configuration ahead of ECB’s monetary policy decision out today later at 1230 GMT.

- Overall, the short-term impulsive down move sequence in place since 25 Jun 2019 high remains intact (click here to recap previous report), maintain bearish bias in any bounces below 1.1200 key short-term pivotal resistance for a push down to retest 1.1120 before targeting the next near-term support at 1.1060. On the other hand, an hourly close above 1.1200 negates the bearish tone for an extension of the corrective rebound towards the 1.1280 key medium-term resistance (also the descending resistance from 10 Jan 2019 high).

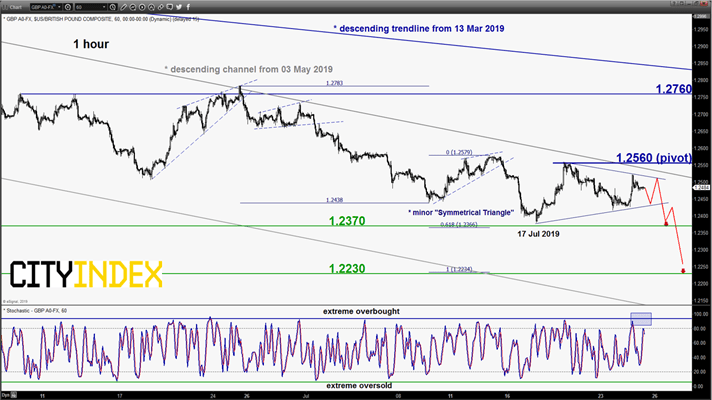

GBP/USD – Minor consolidation within bearish trend

click to enlarge chart

- Key short-term elements remain unchanged as the pair continues to evolve within a minor “Symmetrical Triangle” range configuration in place since 17 Jul 2019 minor swing low. Maintain bearish bias in any bounces below the 1.2560 key short-term pivotal resistance for a push down to retest 1.2370 before targeting the next near-term support at 1.2230.

- On the other hand, an hourly close above 1.2560 invalidates the bearish tone for an extension of the corrective rebound towards 1.2760 range resistance.

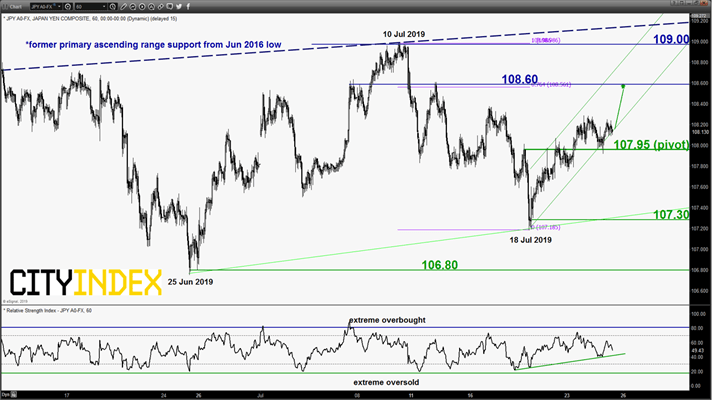

USD/JPY – Push up within range configuration

click to enlarge chart

- Maintain bullish bias with an adjusted key short-term pivotal support at 107.95 for a potential push up to target the 108.60 intermediate resistance (also a Fibonacci retracement/projection cluster) within a minor range configuration in place since 25 Jun 2019 low.

- On the other hand, an hourly close below 107.75 invalidates the push up scenario for a drop towards the range support at 107.30.

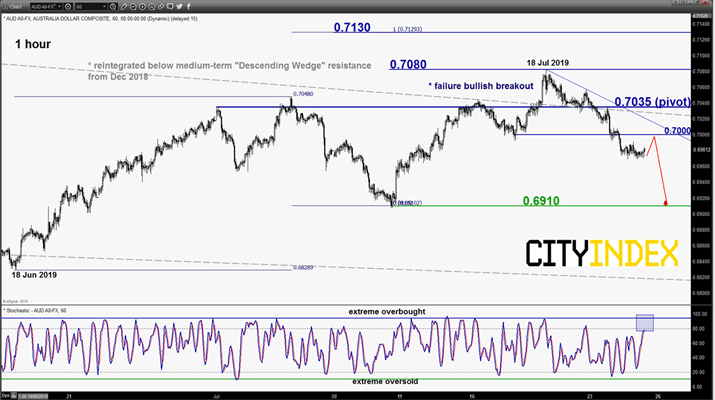

AUD/USD – Minor downtrend remains intact

click to enlarge chart

- Key short-term elements remain unchanged. Maintain bearish bias in any bounces below 0.7035 key short-term pivotal resistance for a further potential push down towards 10 Jul swing low area of 0.6910 in the first step.

- On the other hand, an hourly close above 0.7035 invalidates the bearish scenario to resume the up move to retest 0.7080 follow by 0.7130 next.

Charts are from eSignal

Latest market news

Today 08:33 AM