Currency Pair of the Week: NZD/JPY

The Reserve Bank of New Zealand (RBNZ) meets on Wednesday this week and expectations are that they will leave rates unchanged at 0.25%. Recall that at the August meeting, the RBNZ upped their asset purchase program to NZD 100 billion on fears of a renewed increase in Coronavirus cases as Auckland went into lockdown again. However, things aren’t turning out as bad as expected and therefore the central bank is likely to leave the purchase program unchanged as well. New Zealand’s Q2 GDP was -12.2%, however economic activity has picked up so far during Q3. Watch for a more dovish tone, as the RBNZ falls in line with other central banks around the world. The risk is that the statement is not as dovish as other monetary policy makers.

Yoshihide Sugar became the new Prime Minister of Japan last week and is expected to continue down the path of “Abenomics”. Recall that last week the BOJ met and although they upgraded their economic assessment for the first time since the coronavirus pandemic began, they also hinted that they may buy more JGBs going forward. These events combined with a weak US Dollar caused the USD/JPY to move from 106.08 down to 104.55.

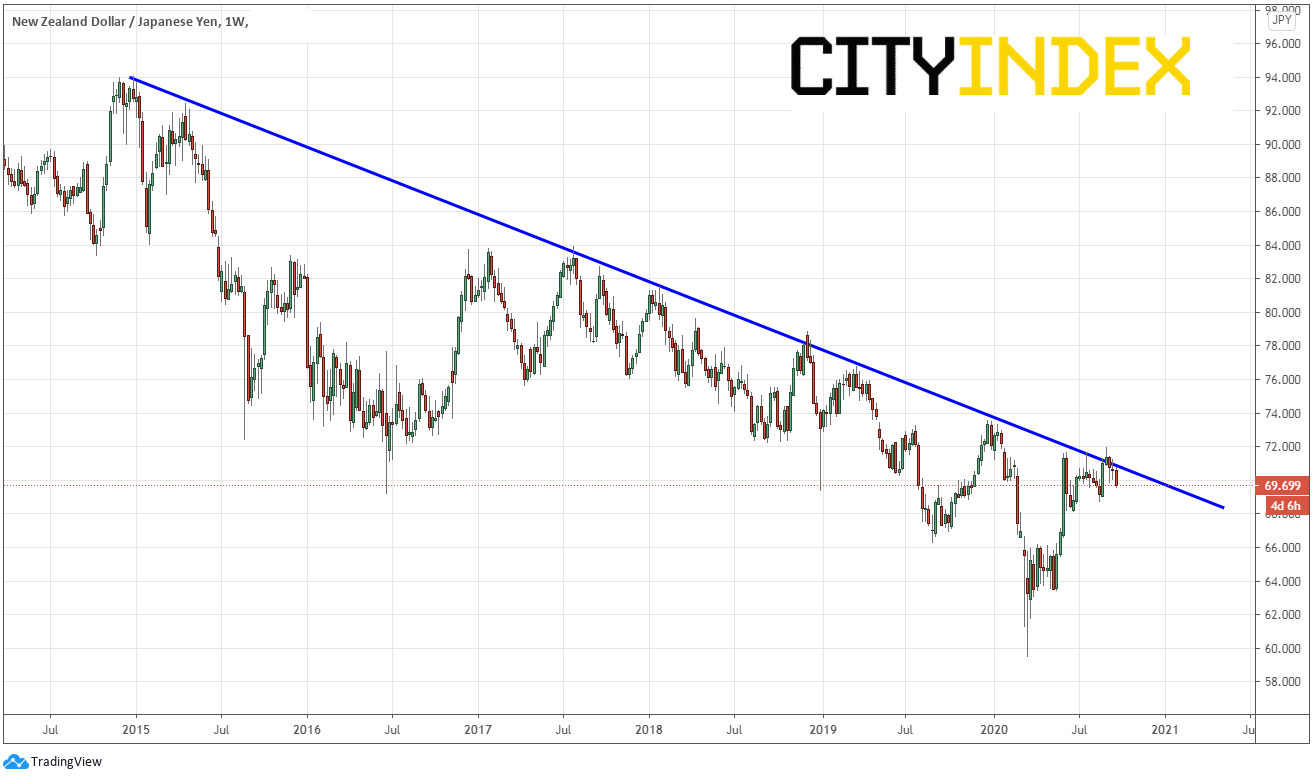

The NZD/JPY has been in a long-term downtrend since early 2015. However, the pair traded significantly away from the downward sloping trendline as the coronavirus hit during February and March. The pair then began to trade higher, in part due to the US Dollar weakness. It made a false breakout above the trendline during the beginning of September near 71.30 and formed a shooting star candlestick formation on the weekly timeframe. The pair is moving lower since.

Source: Tradingview, City Index

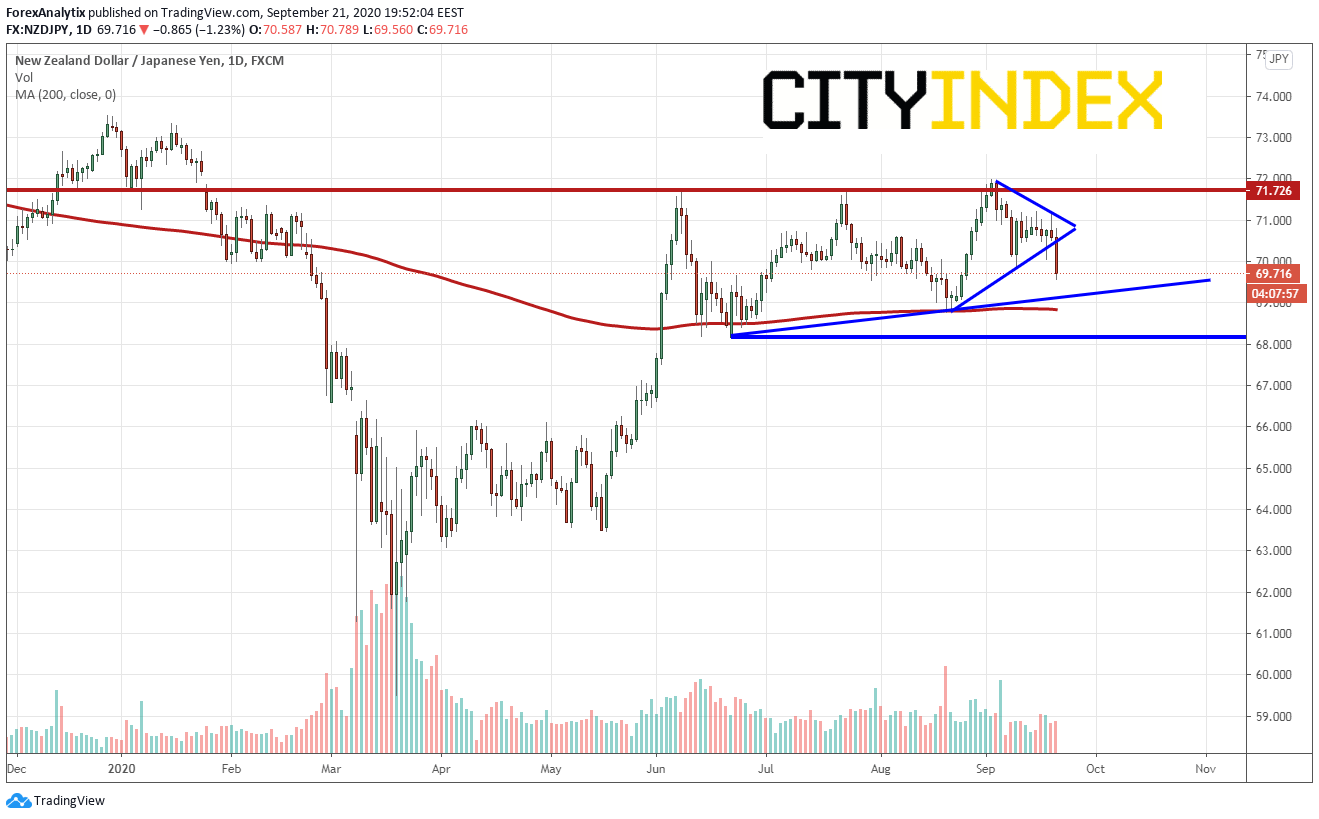

On a daily timeframe, on September 2nd, price also posted a false breakout above two prior highs from the summer at 71.70 and traded lower, consolidating in a symmetrical triangle. On Monday, price broke lower from the triangle and is closing in on an upward sloping trendline from June 22nd near 69.20. This provides the first level of support. The next level of support is 68.83, which is the 200 Day Moving Average. The third short term support level is the low from June 22nd, near 68.15. First resistance is back at the triangle breakdown point near 70.50, then the highs from last week near 71.22. The third resistance is the high from the failed breakout near 72.00

Source: Tradingview, City Index

Last week, the Yen strengthened on the back of the BOJ and Suga begin chosen as the new PM for Japan. The US Dollar strength today is causing the NZD/USD to fall. If the RBNZ is extremely dovish and there is a flight to safety in the Yen, NZD/JPY could push much lower. If, however, the RBNZ is more bullish and the US Dollar moves lower again, we could see NZD/JPY strengthen. Either way, be on the lookout for more volatility!