Following a dip in the Australian unemployment rate in September and continued optimism surrounding the U.S.- China trade deal, the RBA’s decision on the cash rate this afternoon is expected to be a non-event. The official cash rate is expected to remain unchanged at 0.75% to give the RBA additional time to assess the impact of its previous three rate cuts.

This will allow traders to focus on Melbourne Cup office sweepstakes, backing a winner and a suitable venue to watch the race. For what it’s worth, I will be cheering on Surprise Baby and Finche. Aside from watching the race, it’s an opportunity for me to meet with market colleagues at one of Sydney’s oldest Chinese restaurants to catch up, discuss markets and exchange views.

A topic of conversation likely to be discussed is the overnight recovery in the U.S. dollar despite soft economic data. U.S. September factory orders fell -0.6% and the final reading on durable goods orders was also lower with the headline at -1.2% vs an initial print of -1.1%.

Ignoring the weaker data, U.S. interest rates moved sharply higher across the board, further reducing the chance of a December rate cut following last week's FOMC meeting and the upside surprise coming from last Friday's jobs report. U.S. 2-year yields closed at 1.59% up 4bp, while U.S. 10-year yields closed 7 bps higher at 1.78%. U.S. yield outperformance is likely to be one of the drivers behind the U.S. dollar recovery.

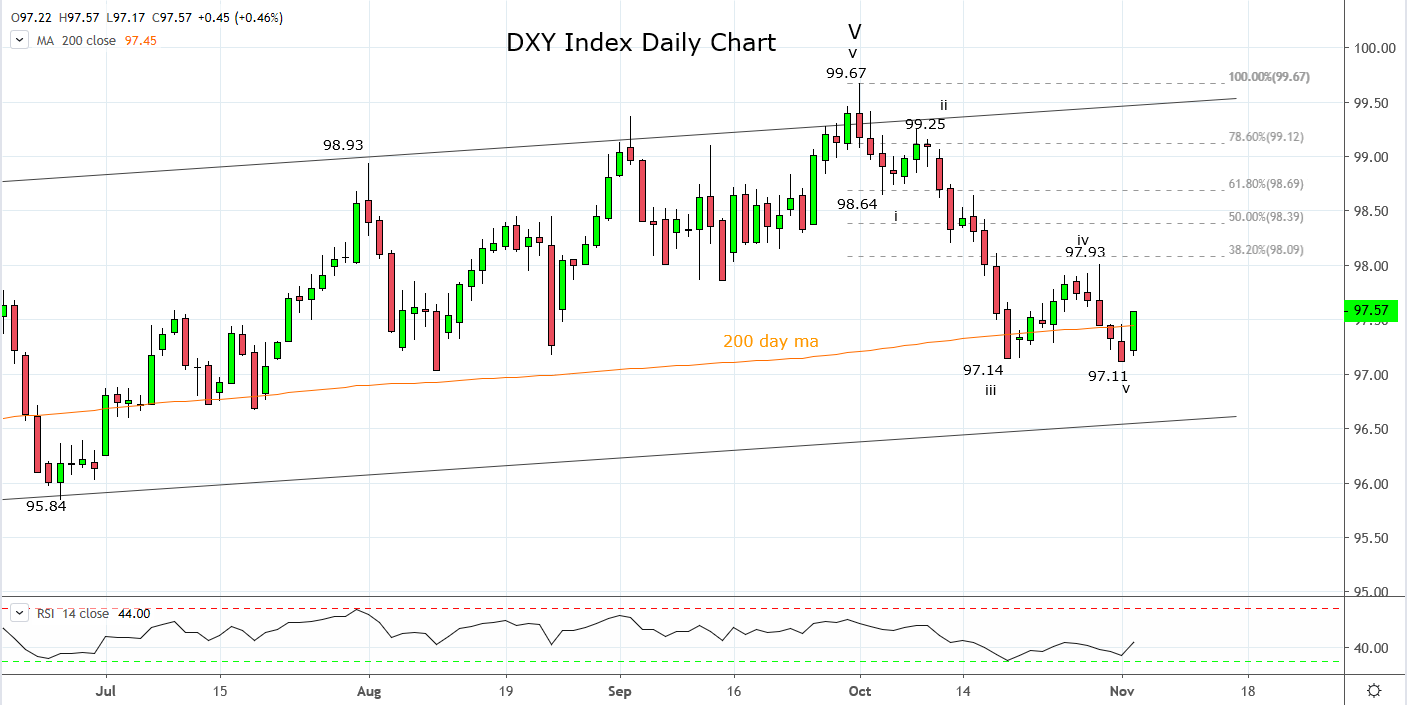

Up until last night the U.S. dollar index, the DXY has followed the road map nicely. In our last note, https://www.cityindex.com.au/market-analysis/the-us-dollar-frogger-and-the-fomc/ the expectation was for the DXY index to fall from 97.80/00 towards key support at 96.60/50 for a minor Wave v.

Following the overnight recovery, our suspicion is the DXY after making new lows at 97.11 last Friday completed a 5 wave decline from the 99.67 high and has now commenced a countertrend rally. A reasonable target for the countertrend rally is the 50% Fibonacci retracement at 98.39, after which I would expect to see U.S. dollar weakness resume.

Source Tradingview. The figures stated areas of the 5th of November 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.