In our CPI preview report, we noted that a hotter-than-expected US inflation reading, especially on the more predictive “core” (ex-food and -energy) reading, could put the proverbial nail in the coffin for another 75bps interest rate from the Fed to start next month.

As it turns out, the market is suggesting that may not have been aggressive enough!

Headline CPI printed at 0.4% month-over-month and 8.2% year-over-year while the “Core” CPI reading came in at 0.6% m/m and 6.6% y/y. Both readings were above economists’ expectations, suggesting that inflation may be more intractable than previously thought. Digging into the details, the big factor driving the hotter-than-anticipated print was shelter inflation, which rose 6.6% y/y to the highest level on record; similarly rent inflation came in at 7.2%, a record high of its own.

According to the CME’s FedWatch tool, Fed Funds futures traders are now pricing in a 90%+ probability of yet another 75bps interest rate increase from the Federal Reserve in three weeks’ time, with some traders even pricing in an outside chance at a full 100bps rate hike! Likewise, a total of at least 150bps of rate hikes by the end of the year is now the market’s base case as the Fed continues to scramble to catch up with rising prices.

Market reaction

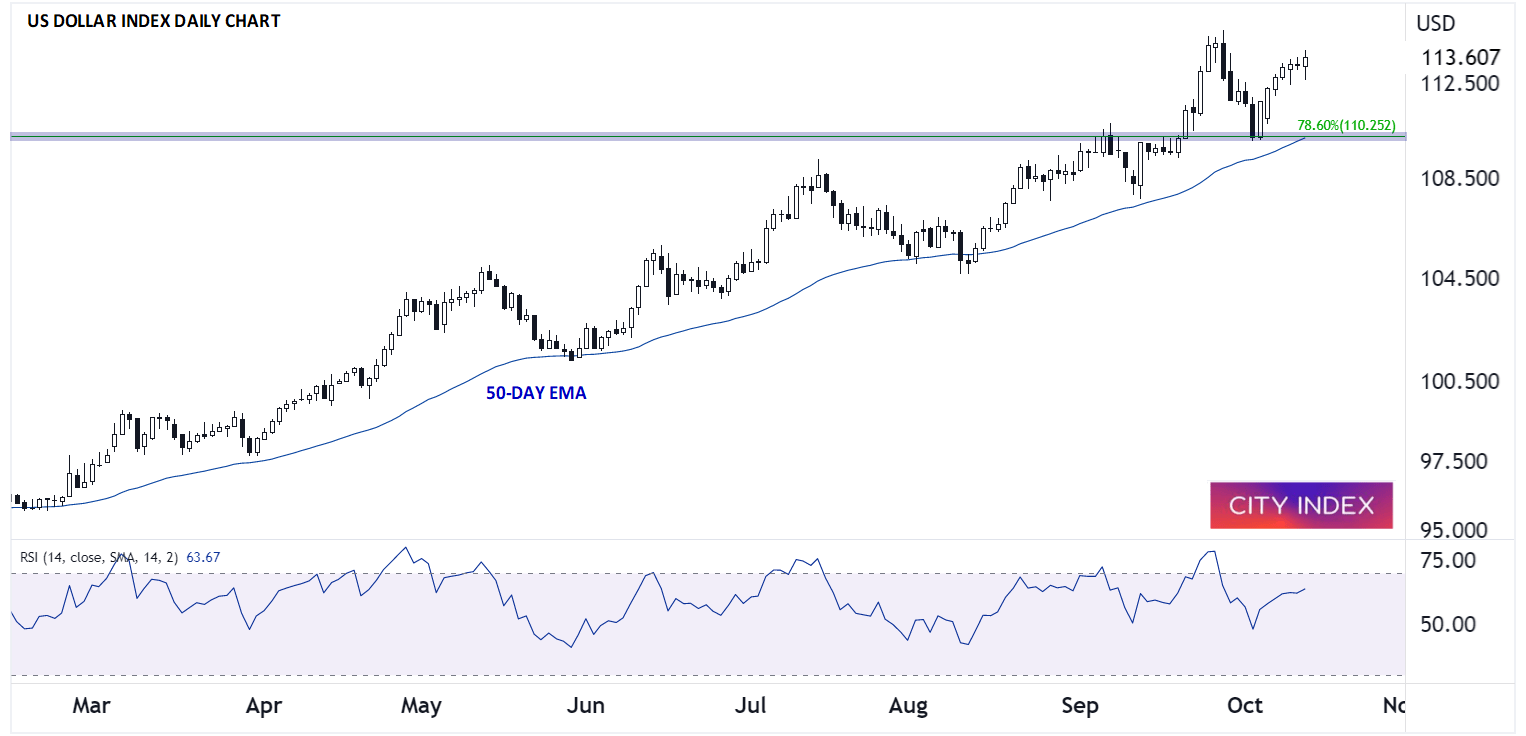

Traders, already on edge after months of sticky inflation and surging interest rates, are opting to sell risk assets first and ask questions later. The monetary policy-sensitive 2-year Treasury yield has spiked nearly 20bps to test 4.50%, its highest level in 15 years, and major US indices are falling nearly 3% from their pre-CPI levels ahead of the open. Both gold and oil are dumping on the broad-based strength in the US dollar, and the US dollar index (DXY) is nearing its 20-year highs around 115.00 as we go to press.

Source: TradingView, StoneX

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade