Copper has been among the commodities hurt badly by the latest news out of China, where concerns about demand have intensified amid the virus spread and corresponding lockdowns there. At last check, the metal was down 3.7% on the session. Copper has taken an additional hit by the general risk off tone across the financial markets. It has been a painful day for Chinese equity investors where the markets sold off over 5% overnight. Westerns markets haven’t been immune with European markets closing sharply lower.

When copper sells off, it is usually a bad sign. It is a key leading indicator of the global economy. Obviously, China being the world’s largest net importer of copper means this particular sell off is undoubtedly because of the latest lockdowns there. Indeed, a weakening yuan means copper imports would suffer anyway, as less of the metal could be bought with the same amount of the Chinese currency. Still, with global inflation soaring, interest rates rising, and now China potentially suffering a big economic shock, don’t take this copper sell-off lightly.

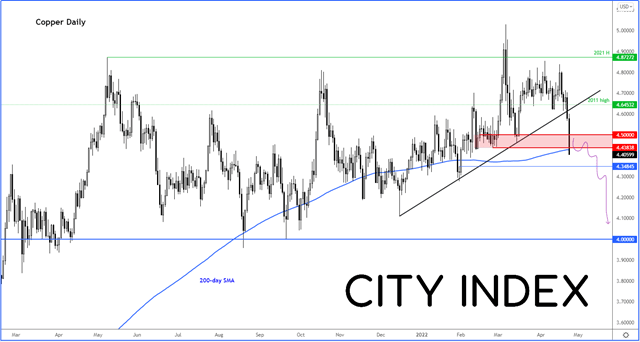

At the time of writing, copper was testing its 200-dya moving average. But there were no signs of the bulls. With key support in the $4.438-$4.500 region breaking, the bears have now got a confirmation that we have possibly seen the high, at least for a while. From here, an eventual drop to $4.00 cannot be ruled. There will be some interim support levels to watch for a potential bounce, for example around $4.348. But so long as that $4.438-$4.500 region holds as resistance, the path of least resistance would be to the downside.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

- Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the instrument you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade