China’s inflation beat forecasts in April, rising 0.4% (0.2% expected) and 2.1% y/y (1.8% expected). The annualised rate is the second highest reading this year, with food prices rising 1.9% and non-food items up 2.2% y/y. However, producer prices fell to a 1-year low of 8% y/y despite the rise in commodity prices, making it the sixth consecutive month of weaker producer prices. And parts of China in lockdown with no immediate end in sight, it increases the odds of further stimulus to aid the economy. According to the government there are no plans to reopen until new cases outside quarantine areas are cleared of Covid-19.

A50 bounces to a 3-day high

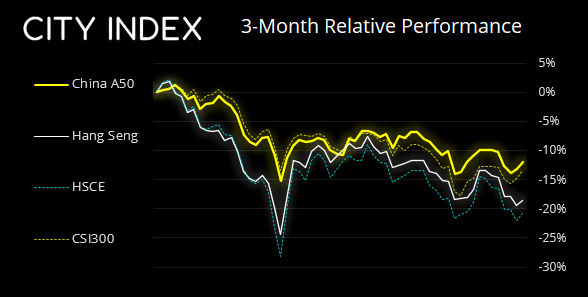

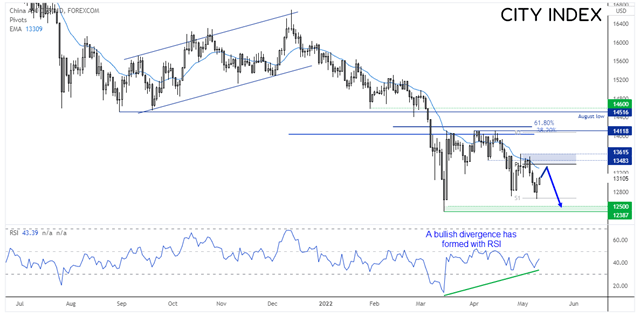

The China A50 index is trading back above 13,000 after breaking below it on Monday. The market remains in a strong downtrend and our core view remains for a retest and potential break of 12,500 as outlined in our previous report. However, there are signs that it now wants to retrace against the dominant bearish trend.

A bullish divergence has formed with the RSI indicator, and the swing lows on the 28th of April and 10th of May were seen on high volume, which shows demand around 12,600 – 12,700. Furthermore, support was found yesterday at the monthly S1 pivot point.

From here we expect prices to retrace back towards 13,325 (20-day eMA) and print a lower high beneath the monthly pivot point (13,400). At which point we would then seek bearish opportunities as we anticipate prices will turn lower, in line with the bearish trend and head for the 12,387 – 12,500 support zone.

Alibaba earnings in focus

A1 earnings for Alibaba are released tomorrow and they’re expected to report a quarterly rise in revenue. According to Reuters the mean analyst estimate for revenue is 6.3% (CNY 199.256 billion), and earnings are forecast for CNY 7.39 per share, down from 10.32 in the same quarter last year. Of the analysts polled, 44 have a “buy” signal, 38 of which are a “string buy”, compared to just 3 “sell” recommendations.

Alibaba Company Profile

We can see on the daily chart the stock remains in an established downtrend, and it both reached and exceeded our downside target of 82.42, which was projected from the head and shoulders top pattern. Two lower highs have since formed and prices are now hovering above the April low ahead of tomorrow’s earnings report.

The support zone around 80.0 is likely to be a pivotal level over the coming week. Take note that a bullish divergence has formed with RSI so a strong earnings report could tempt bulls to drive prices back towards 100. However, a break beneath 81.80 brings the 73.28 low into focus, a break of which confirms the dominant bearish trend has resumed.

The support zone around 80.0 is likely to be a pivotal level over the coming week. Take note that a bullish divergence has formed with RSI so a strong earnings report could tempt bulls to drive prices back towards 100. However, a break beneath 81.80 brings the 73.28 low into focus, a break of which confirms the dominant bearish trend has resumed.

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade