The suspension “was unlawful”. Now what?

To the extent that certainty has increased rather than decreased, the ruling from the United Kingdom’s Supreme Court that Prime Minister Boris Johnson’s suspension of Parliament “was unlawful” was not as positive for sterling as it first appeared. The finely tuned judgement, read out by The President of the Supreme Court, Brenda Hale, saw the pound extend the day’s gains by some 40 pips in a matter of minutes. But it wiped those out just as briskly before a partially successful return to $1.2489 highs of the day. In short sterling has been more volatile than sure-footed.

To be clear, the judgement strengthens the hands of both houses of Parliament in an unprecedented constitutional moment that by definition suggests that there will be no ‘come back’ of any kind from the government. The PM has indicated that the government would abide by the court’s decision. Still there has been widespread suspicion that Johnson could, perhaps at the behest of key advisors, attempt to wriggle out of any stipulations. Those stipulations are much narrower and constricting now, given that the Supreme Court’s ruling that the decision to prorogue parliament was unlawful, void and had no effect. Objectively, MPs opposed to leaving the EU without a deal have been handed fresh legs to stand on, whilst the government’s position has been hobbled.

But we are all well acquainted with what happens when then government’s wishes collide with the prevailing view of the Commons. Parliament may no that it doesn’t want no-deal and therefore must seek a delay, but so far has signally failed to converge on the type of deal it does want. Nor can the PM seek to break the impasse by his choice of general election date. (The opposition has called for Johnson’s resignation though it’s not clear whether he will choose that course action). As it stands, the earliest an election can be held is towards the end of November, but an even later date—possibly even next year—cannot be ruled out.

There is some measure of uncertainty that will clear shortly. The court noted that in its view, “immediate steps to enable each House to meet as soon as possible" should be taken. The Speaker of the House of Commons, John Bercow duly announced that Parliament would resume on Wednesday 11.30 BST. The easiest theme to predict that will dominate proceedings immediately afterwards are calls for Johnson to resign, even though PMQs are off the cards. Beyond that, whilst the Supreme Court has somewhat reduced the risk of a no-deal Brexit by ensuring Parliament can make its voice heard in the final weeks to the Brexit deadline, beyond that, the ruling has not reduced uncertainty very much. It is a truism combined with a cliché that markets don’t like uncertainty.

That is why sterling and other markets particularly exposed to the UK, appear to brace for a further protracted period of flux that could deepen Britain’s economic malaise.

Chart thoughts

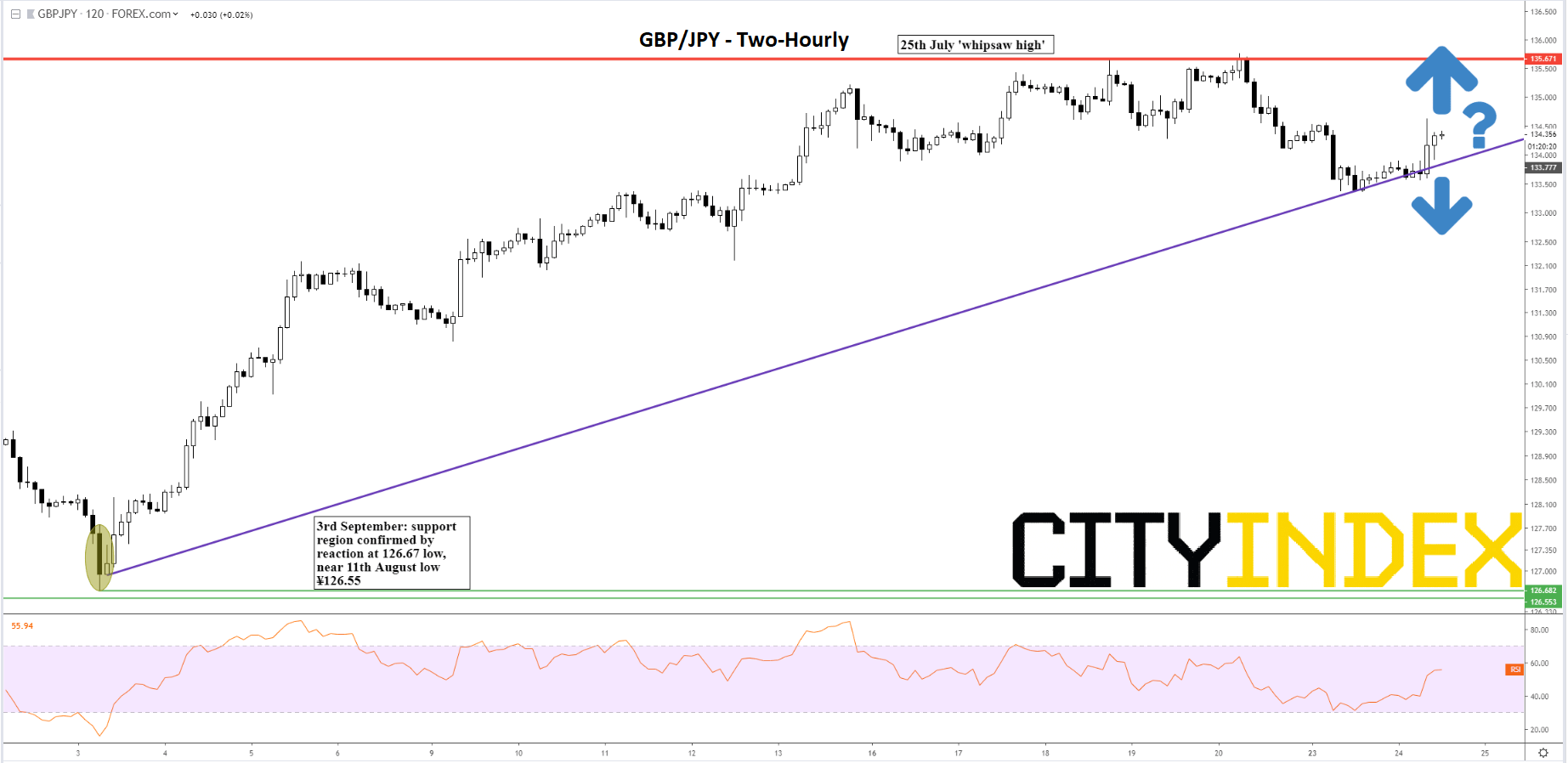

Boris Johnson’s latest and greatest defeat tops a month of gains for sterling that are particularly well defined against the yen. The snapshot below shows a beautiful up leg since support was created by the emphatic rejection of prices below ¥126.7 on 3rd September. But sterling’s whipsaw vs. yen (and other majors) late in July is coming back to haunt it. The cap of that move was around ¥135-¥135.67. The rate mostly plummeted thereafter before basing at ¥126.55 on 11th August. The echo with this month’s low is obvious, though that won’t be of much immediate help for the pound. Sterling has already ricocheted off ¥126s twice in recent sessions, yet short term rising trend line support is directing it towards another test. Typically, when two key technical structures are close enough to be breached in fairly quick succession, if they both are, the notion of ‘breakdown’ should apply. Sterling can be expected to head towards September lows in that event. Only an implausible looking break higher in the near term could avoid that fate.

GBP/JPY – two-hourly [24/09/2019 13:40:00]

Source: City Index