The Bank of Canada hiked rates by 25bps today, as expected, to bring the overnight rate to 4.50%. In addition, it said that the “Governing Council expects to hold the policy rate at current levels while it assesses the impact of the cumulative interest rate increase”. However, the BoC also said that it is prepared to raise the policy rate if necessary to return inflation to the 2% target. The BoC will also continue with its Quantitative Tightening. In Governor Macklem’s press conference which followed, the head of the BoC reiterated the statement, saying that the central bank has raised rates rapidly and now is the time pause and assess whether monetary policy is sufficiently restrictive. However, he also left the door open for future rate hikes, noting that if the BoC needs to do more to get inflation to its 2% target, then it will!

Everything you need to know about the Bank of Canada

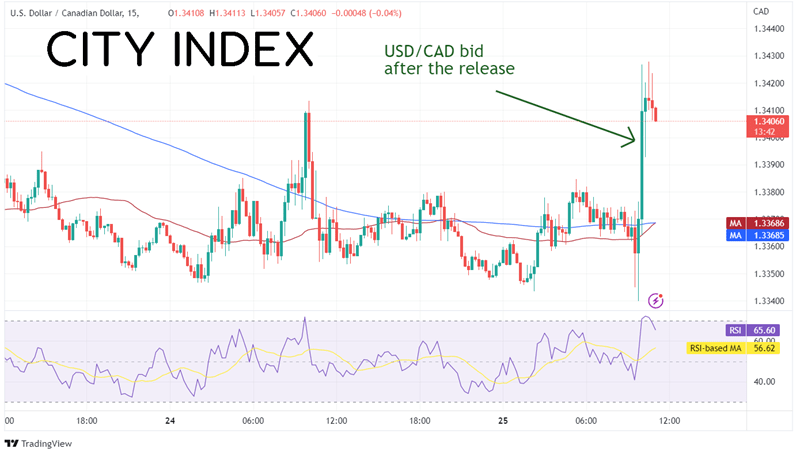

USD/CAD immediately went bid upon the release of the rate hike as traders were more focused on the rate hike pause than the actual 25bps increase to 4.50%. The pair moved from 1.3364 to 1.3427 as traders digested the dovish statement.

Source: Tradingview, Stone X

Trade USD/CAD now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

Although USD/CAD may have jumped 60 pips on the release of the statement, in the larger picture, price has been relatively subdued. On a 240-minute timeframe, price couldn’t even bounce to resistance at the January 19th lows of 1.3448. If price does break above there, USD/CAD can move to the highs from January 18th at 1.3521. This would open the door for a larger move to the highs from December 16th, 2022, at 1.3705. For guidance, this is also near the 61.8% Fibonacci retracement level from the highs of October 13th, 2022, to the lows of November 15th, 2022. First support crosses at today’s lows of 1.3340. Below there, price can fall to the lows of November 15th, 2022, at 1.3224. A break under this level would open the door for a move down the psychological round number support level at 1.3000.

Source: Tradingview, Stone X

Will USD/CAD continue its recent trend lower despite a dovish BoC? If guidance from the BoC monetary policy decision can’t get the pair to move, then USD/CAD may be in “wait and see mode” until the FOMC meets on February 1st!

Learn more about forex trading opportunities.