Aside from the commonly cited reasons behind last week's falls, including growth concerns, reduced central bank stimulus, and the delta variant spread, there are other considerations causing investors to pause for thought.

These include the expiration of enhanced unemployment benefits, the deadline for the budget draft deadline (September 15th), the FOMC meeting (September 22nd), the infrastructure deadline (September 27th) as well as the debt ceiling expiration (September 30th).

Locally, this week's main events are RBA Governor Lowes speech at the Anika Foundation on Tuesday. The Governor is expected to elaborate on the reasons behind the RBA's decision to taper and deliver an optimistic assessment of the economy, followed by August labour force data on Thursday.

Lockdowns in NSW and Victoria, two states that account for almost 60% of total employment in Australia, are expected to see the unemployment rate rise from 4.6% to 5.0%. Employment is expected to fall 110k, along with a sharp decline in the participation rate from 66% to 65.5%. The range of forecasts is extreme. For example, estimates for the unemployment rate vary from 4.8% to 5.5%!

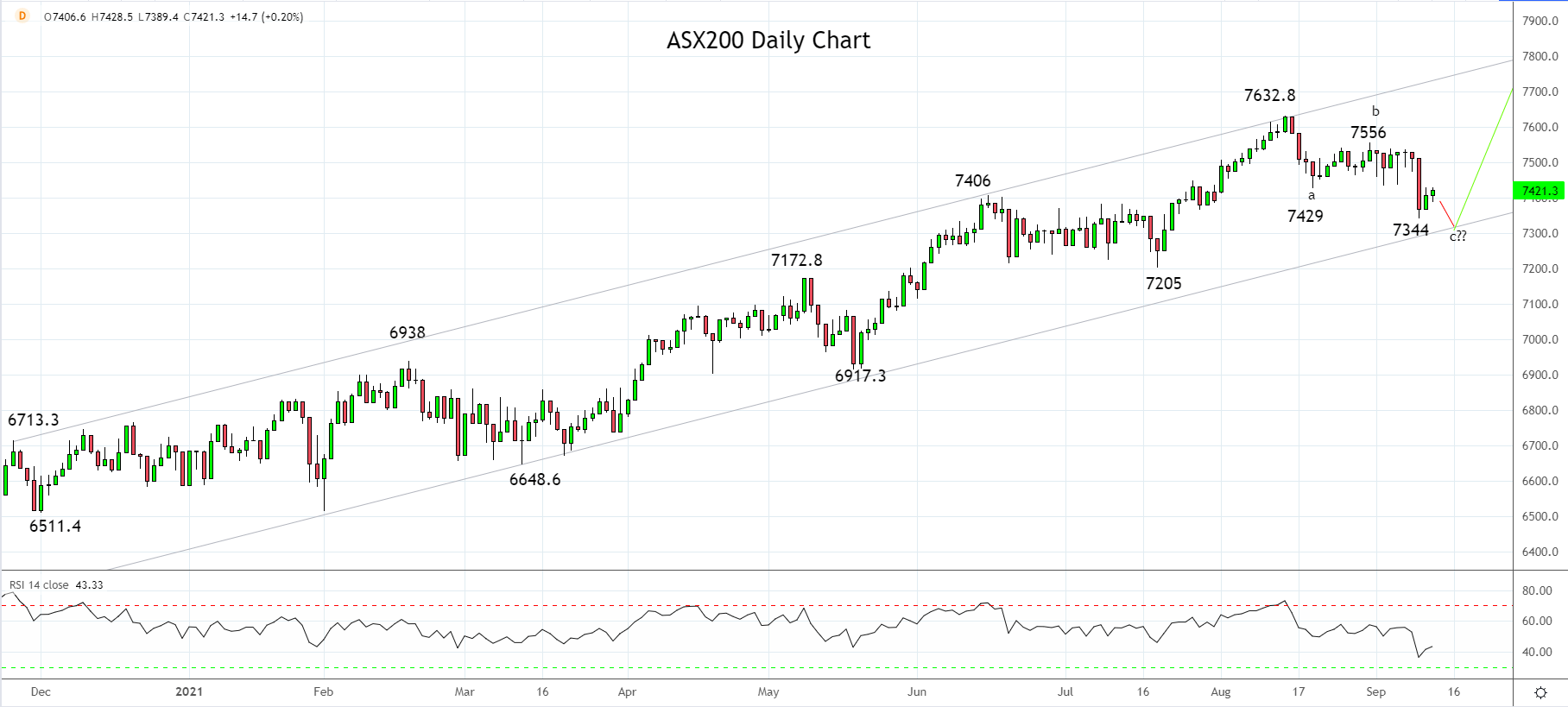

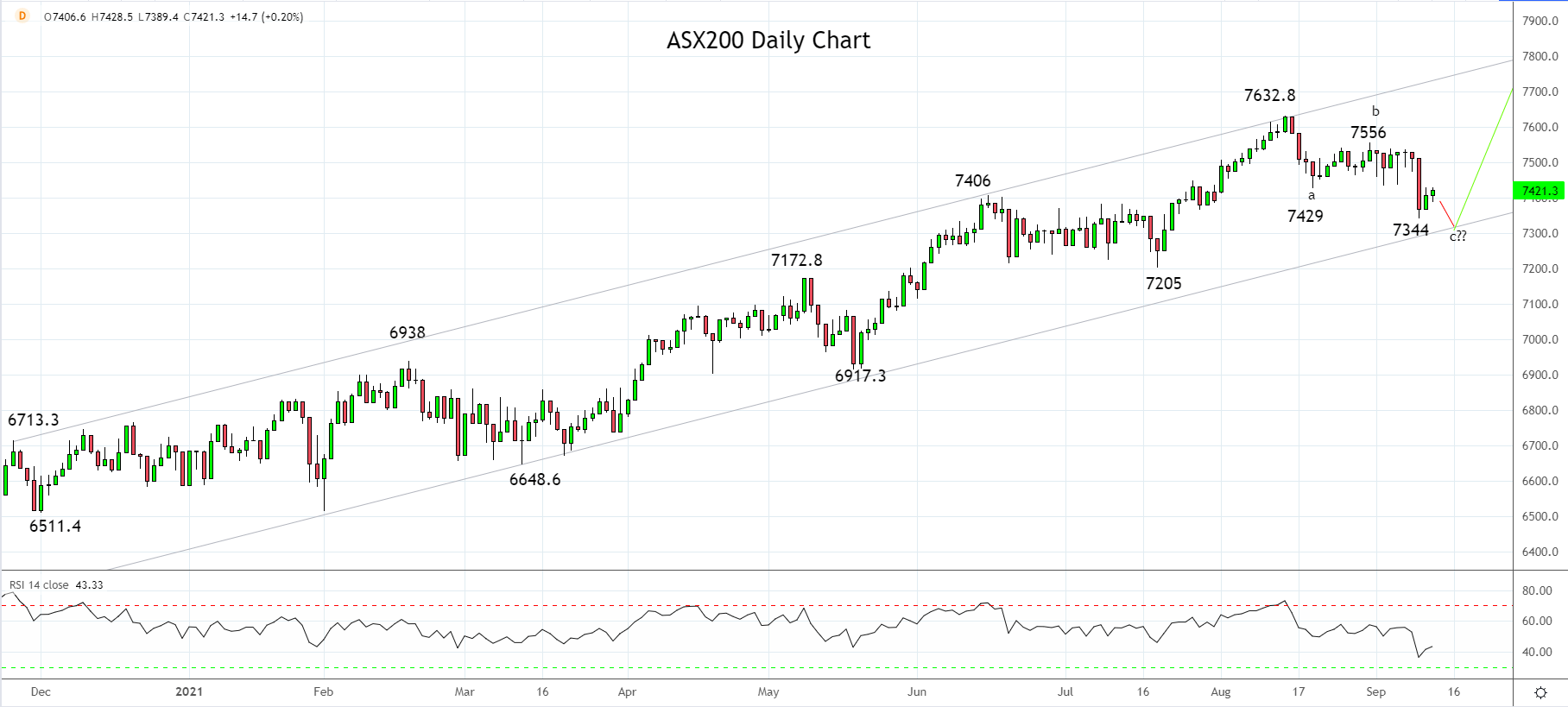

Last week the ASX200 traded towards our long-standing pullback target ahead of 7300 coming from trend channel support. However, given the event risk outlined above, it's too early to proclaim the correction is complete, despite an impressive bounce this morning.

Instead, continue to look for signs of basing/stabilisation ahead of the trend channel support 7340/00 area as in initial indication the correction is complete, followed by a break and close above resistance at 7450ish to confirm the resumption of the uptrend.

Aware that should this fail to materialise, and the ASX200 breaks and closes below 7300, further falls towards the next area of support at 7200 are likely underway.

Source Tradingview. The figures stated areas of September 13th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Latest market news

Yesterday 10:48 PM

Yesterday 02:00 PM

Yesterday 01:14 PM

Yesterday 12:00 PM