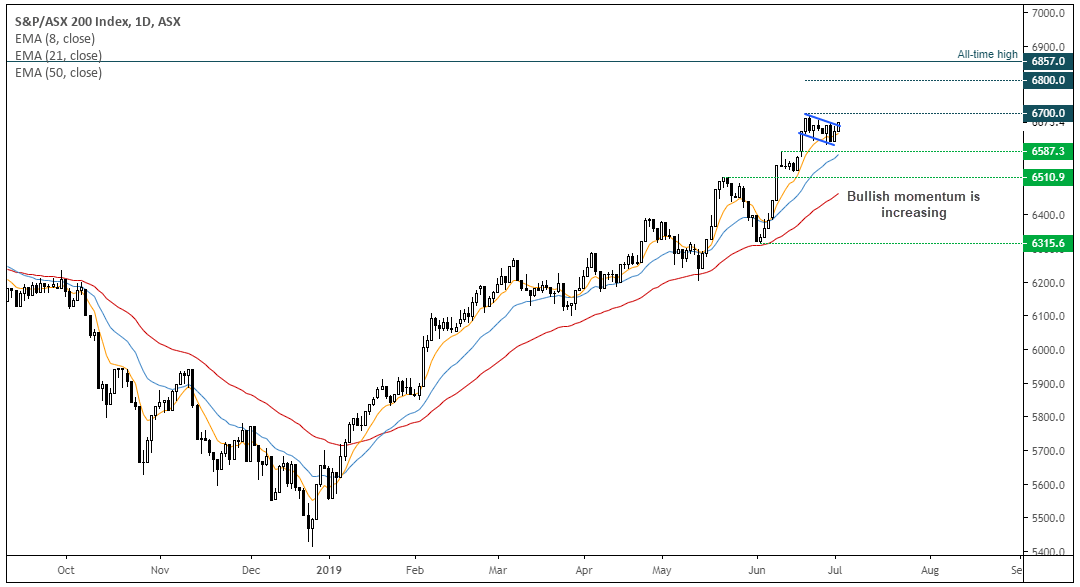

The ASX200 is trading in a tight consolidation pattern ahead of today’s RBA meeting. If they deliver with a dovish cut (or comments from the governor) we’d expect it to break to new highs.

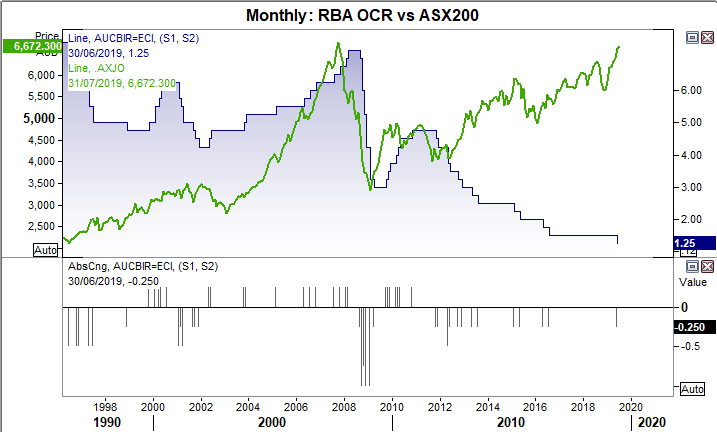

Since the GFC, the ASX200 has followed the global trend of rallying in a low interest environment. However, unlike its US counterpart, the ASX200 has not yet broken above its pre-crash highs but it is indeed getting close to this milestone level. If further cuts are signalled today, we’d expect the index to break to a new cycle high.

Markets are pricing in a 78% chance of a rate cut today, and that we see the ASX200 resisting any temptation to break higher ahead of the decision suggests we likely need a dovish cut for bulls to extend the rally.

We can see on the daily chart that the index is trading within a potential bullish flag formation, just off its highs. Price action is bouncing along the short-term moving averages to show a pick-up of momentum, and now trades just 2.78% from its all-time high.

- A break above 6,700 assumes trend continuation and for a run for 6,800 and the all-time high

- However, such a milestone level is an obvious area to book profits so we’d expect a price reaction around here

- If RBA surprise with a natural cut, we could see prices correct before heading higher.

- However, the dominant trend remains bullish above 6,315, so we’d reconsider bullish setups if a new level of support is found above this low.

Related analysis:

RBA Preview: AUD/USD Holds Above 70c Ahead Of Expected Rate Cut

Featured Trade: Bullish exhaustion seen in AUDJPY ahead of RBA