Thursday US cash market close:

- The Dow Jones Industrial rose 92.07 points (0.28%) to close at 33,223.83

- The S&P 500 index rose 63.2 points (1.5%) to close at 4,288.70

- The Nasdaq 100 index rose 465.235 points (3.44%) to close at 13,974.67

Asian futures:

- Australia's ASX 200 futures are down 0 points (-1.1%), the cash market is currently estimated to open at 6,990.60

- Japan's Nikkei 225 futures are up 330 points (1.27%), the cash market is currently estimated to open at 26,300.82

- Hong Kong's Hang Seng futures are down -135 points (-0.59%), the cash market is currently estimated to open at 22,766.56

- China's A50 Index futures are up 58 points (0.4%), the cash market is currently estimated to open at 14,649.85

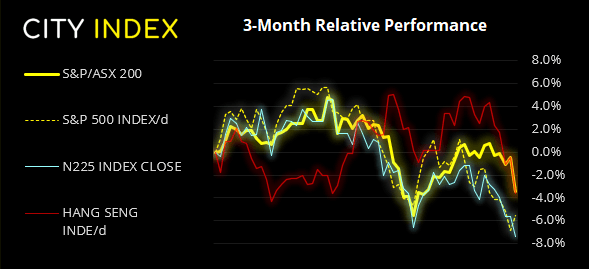

We can slip past the obvious as to why Wall Street was initially broadly lower yesterday, but US markets did post a turnaround after the Biden administration announced far more severe sanctions for Russia. The S&P 500 rebounded from its 17-month low of 4120 and close 1.5% higher, the Nasdaq rose 3.4%. There is a case to be made for “buying the invasion” and perhaps the lows are in. Yet it does not escape the fact that the Fed are about to embark on multiple rate hikes and investors are concerned with growth, so we’re not convinced this that if prices continue higher it will simply break to new high – as it could still be part of a bear-market rally.

Worst day for the ASX 200 in 17-months

With all 11 sectors in the red, 89% of stocks lower and over $70 bn wiped off the ASX, it was not a good day to be long. And to add insult to injury, it was its worst day since Sep 2020. Another turbulent session on Wall Street overnight should have investors on edge today, even if indices recovered into the close. The ASX is expected to open around 7,000 but, after such a volatile day, we doubt it will be skipping into the weekend sunset. Trading flat today might be seen as a small victory.

ASX 200: 6990.6 (-2.99%), 24 February 2022

- Utilities (-0.84%) was the strongest sector and Information Technology (-6.4%) was the weakest

- 11 out of the 11 sectors closed lower

- 8 out of the 11 sectors outperformed the index

- 15 (7.50%) stocks advanced, 178 (89.00%) stocks declined

Outperformers:

- +33.41% - CIMIC Group Ltd (CIM.AX)

- +5.9% - Northern Star Resources Ltd (NST.AX)

- +4.77% - Evolution Mining Ltd (EVN.AX)

Underperformers:

- -15.38% - Imugene Ltd (IMU.AX)

- -10.34% - Zip Co Ltd (Z1P.AX)

- -10.19% - AVZ Minerals Ltd (AVZ.AX)

Widespread volatility for currency markets

19 of the 28 currency pairs we tracked met, or (far) exceeded their average ranges yesterday, with USD rising against all its peers and GBP and NZD taking the biggest hits during risk-off trade. But with headlines from Russia’s invasion pouring in then it is to be expected. Famous last words of course, but… we do not expect the same level of volatility today as the shock has already hit the system. And as we are heading into the weekend it appears more likely traders may want to square up positions and that prices trade well within yesterday’s ranges. Unless we see a new catalyst that reverse yesterday’s sentiment.

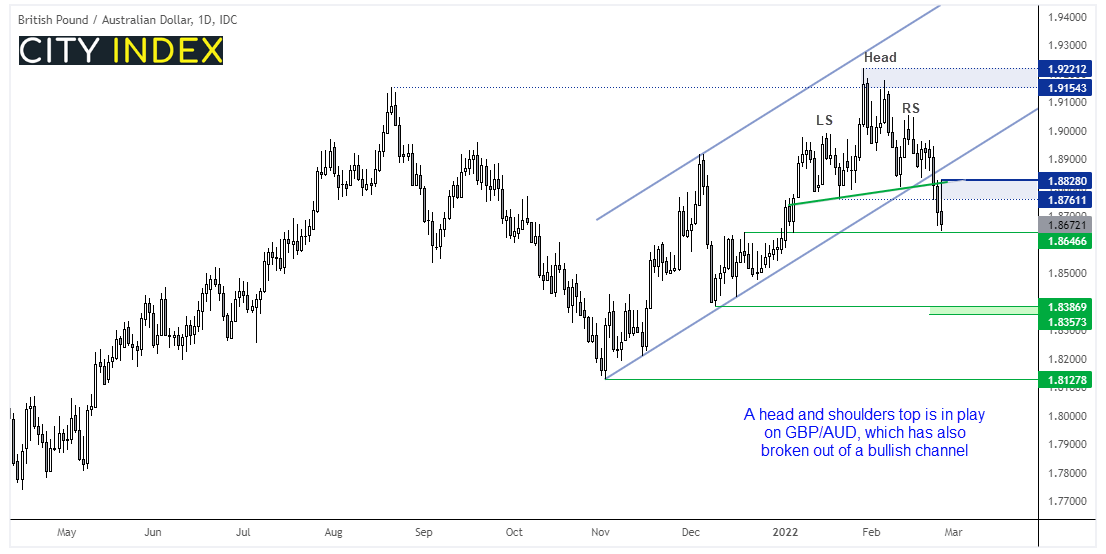

Head and shoulders top in play on GBP/AUD

An appealing feature of a cross such as GBP/AUD right now is that it is mostly detached from the Russian invasion theme. Both are risk-assets so less vulnerable to the switch between risk-on and risk-off.

The daily chart shows that it broke to the downside of its bullish channel on Tuesday, before accelerating lower on Wednesday to confirm a breakout of a head and shoulders top. Whilst a trendline break targets the lows at 1.8130 the H&S top targets 1.8360.

However, support has been found at 1.8646 and we have already seen a decent downside move. So, we’re hoping for prices to stabilise before breaking lower next week. For the H&S to remain in play prices need to remain below yesterday’s high of 1.8828.

Gold

Gold seemingly flew too close to the sun, no sooner had it reached a 16-month high, prices came crashing down like Icarus. At over 5%, gold’s daily range yesterday was large enough to park a large plane in. And that it ended up closing around -0.6% lower with a high to low difference of around $100 means there was a whole lot of confusion, stops being triggered and margin calls.

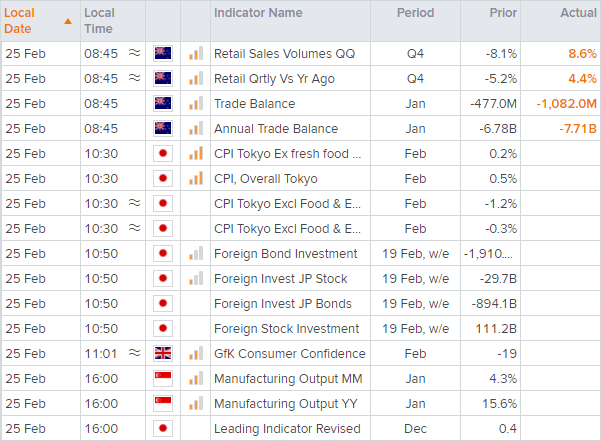

Up Next (Times in AEDT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade