Asian Futures:

- Australia's ASX 200 futures are up 13 points (0.18%), the cash market is currently estimated to open at 7,501.30

- Japan's Nikkei 225 futures are up 220 points (0.8%), the cash market is currently estimated to open at 27,861.14

- Hong Kong's Hang Seng futures are up 59 points (0.23%), the cash market is currently estimated to open at 25,466.89

UK and Europe:

- UK's FTSE 100 index rose 23.03 points (0.32%) to close at 7,148.01

- Europe's Euro STOXX 50 index rose 21.11 points (0.51%) to close at 4,190.98

- Germany's DAX index rose 58.13 points (0.37%) to close at 15,851.75

- France's CAC 40 index rose 15.89 points (0.24%) to close at 6,681.92

Friday US Close:

- The Dow Jones Industrial rose 192.38 points (0.54%) to close at 35,455.80

- The S&P 500 index rose 39.37 points (0.89%) to close at 4,509.37

- The Nasdaq 100 index rose 154.432 points (1.01%) to close at 15,432.95

Learn how to trade indices

Indices lap up Powell’s speech

Equity markets were pleased with Jerome Powell’s speech on Friday. Whilst keeping open the potential to taper this year, no firm plan or suggestion of timeline was offered, meaning the party of easy money has been extended, even if only temporarily.

The Nasdaq 100 and S&P 500 closed to new record highs, the Dow Jones trades less than -0.5% beneath its own record high and the Russell 2000 outperformed with its most bullish session in 1-month.

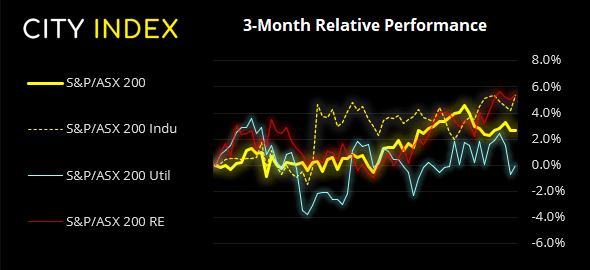

The ASX 200 is expected to open slightly higher today, and the positive sentiment on Wall Street makes our bearish bias outlined on Friday a lower probability bet. However, it should be remembered that the prior week’s candle was a bearish engulfing week from its record high. So, should any rally falter at or below last week’s high then a bearish scenario is one to reconsider. And how prices trade today could provide an early indication of how much positivity the ASX has taken from Powell’s (somewhat disappointing) speech.

ASX 200 Market Internals:

ASX 200: 7488.3 (-0.04%), 28 August 2021

- Industrials (1.07%) was the strongest sector and Consumer Discretionary (-1.6%) was the weakest

- 5 out of the 11 sectors closed higher

- 68.5% of stocks closed above their 200-day average

- 61.5% of stocks closed above their 50-day average

- 53% of stocks closed above their 20-day average

Outperformers:

- + 17.9% - Clinuvel Pharmaceuticals Ltd (CUV.AX)

- + 6.83% - Atlas Arteria Group (ALX.AX)

- + 6.42% - Blackmores Ltd (BKL.AX)

Underperformers:

- -6.55% - Pilbara Minerals Ltd (PLS.AX)

- -6.08% - Appen Ltd (APX.AX)

- -5.42% - NEXTDC Ltd (NXT.AX)

Forex: Dollar falls from the March high

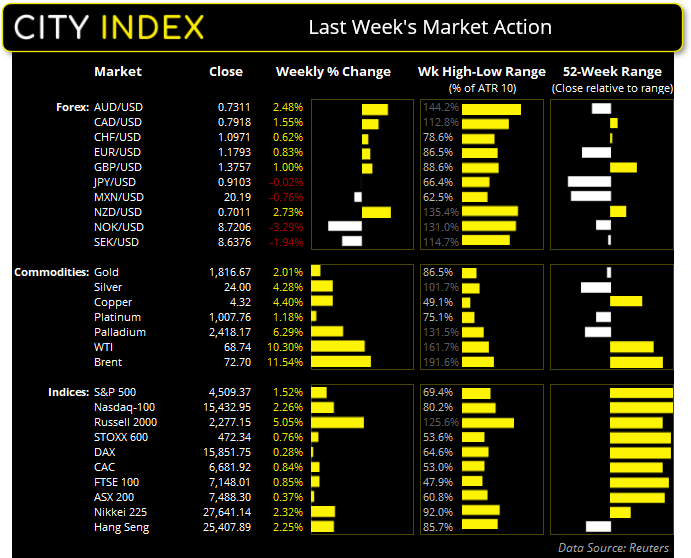

Commodity currencies were the dominant force last week, with NZD and AUD rallying around 2.5% and CAD rising 1.7%. USD and JPY were the weakest major last week, yet the USD dollar and NZD are the strongest in August.

The US dollar was weaker following Jackson Hole due to lack of commitment to tapering. The US dollar index (DXY) printed a bearish outside candle on Friday, despite a strong core PCE print. A dark cloud cover reversal formed on the weekly chart from the March high to underscore the significance of the resistance level, and a break beneath 92.47 support suggests a deeper bearish move is underway.

USD/CAD is reconsidering a break beneath trend support (projected from the June low), although we’d want to see a break beneath 1.2578 support before assuming a reversal.

AUD/USD closed above trend support to warn of another leg higher of its countertrend move. A break above Friday’s high brings the 0.7400 handle into focus and the bias would remain bullish above Friday’s low.

Today is a bank holiday in the UK, so volumes will be lower during the European and US sessions.

Learn how to trade forex

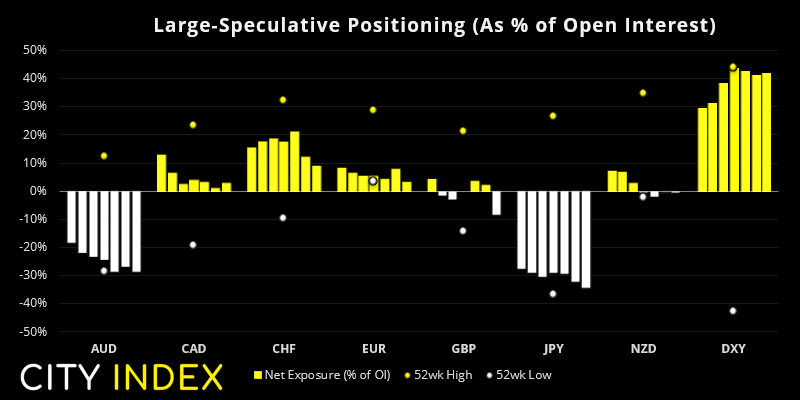

From the Weekly COT Report (Commitment of Traders)

From Tuesday 24th 2021:

- According to data compiled by IMM, traders were their most bullish on the US dollar since March 2020. They’re currently net-long US $8.4 billion overall, or $8.5 billion against G10 currencies and net-short by just -$0.1 billion.

- Net-long exposure to euro futures fell by -33k contract ahead of the Jackson Hole symposium. Long bets reduced by -39.4k contract and shorts reduced by 6.4k contracts.

- Traders were their most bearish on yen futures in 7-weeks, with net-short exposure near 2-year lows.

- Large speculators were their most bearish on AUD futures in nearly 3-years.

- British pound futures flipped to net-short exposure and traders are their most bearish on the pound since December.

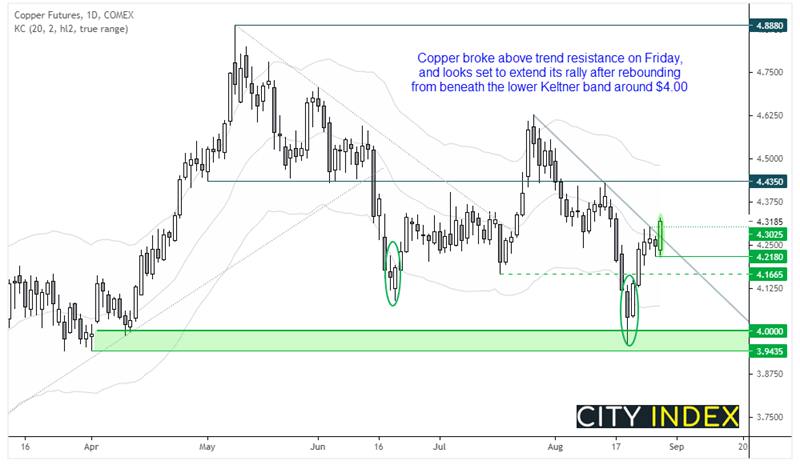

- Net-long exposure to coper futures fell to an 8-week low, and now near its least bullish exposure level since June 2020.

Commodities: Metals rebound thanks to a weaker dollar

Copper futures closed to an 8-day high on Friday and cleared a couple of technical level to suggest it’s ready for its next leg higher. Since its rally from $4.00 where bears failed to force a daily close beneath the 200-day eMA, we saw a minor pause on Wednesday and Thursday ahead of Jackson Hole as prices held below trend resistance. Yet Friday’s close has cleared this level and suggest a corrective low has formed at 4.218. A bullish engulfing candle formed on Friday, so a break of its high assumes bullish continuation with 4.435 in focus for bulls.

Gold closed to a 3-week high and above a cluster of resistance levels, including the monthly pivot, 200-day eMA and trend resistance. Our bias remains bullish above 1800 and for a move towards 1834 / weekly R1.

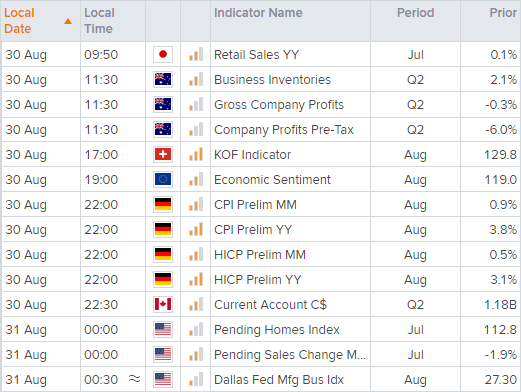

Up Next (Times in AEST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.